In Spain’s tax landscape, the Real Estate Tax (IBI) undergoes changes and updates every year. If you’re looking for the tax news that will affect your property in 2023, you’ve come to the right place. Here are the latest IBI developments and how they could impact your tax obligations – read on!

Guide 2023: IBI calculation and payment responsibility

The Real Estate Tax (IBI) is a crucial tax in the fiscal field. Being applied in a generalized way to diverse properties ranging from homes and commercial premises to offices and land.

Throughout the year, it is established as a financial commitment. Although it is possible to find certain municipalities that grant the option of defraying the amount owed through periodic installments.

The amount of the Real Estate Tax is established individually by each municipal entity. And the procedure to calculate it is based on the cadastral value of the real estate. In this, you must reflect an integral evaluation that contemplates: the intrinsic value of the land as well as that of the buildings erected on it.

This cadastral value becomes the starting point for the tax calculation. To do so, you must apply a coefficient that varies significantly within a range between 0.4% and 1.3%. It is worth mentioning that this variability applies specifically to properties located in urban environments.

Determining the amount to be paid for Real Estate Tax is a meticulous process. Multiple elements interact in this process, such as the valuation of the land and the consideration of the structures erected. This together with the fiscal particularities established by each municipality.

Through this valuation system, equity is sought in the tax contribution of citizens. Thus allowing the sustenance of initiatives and public services that the community requires for its welfare and continuous development.

You may also be interested in: Renting a commercial property in Spain

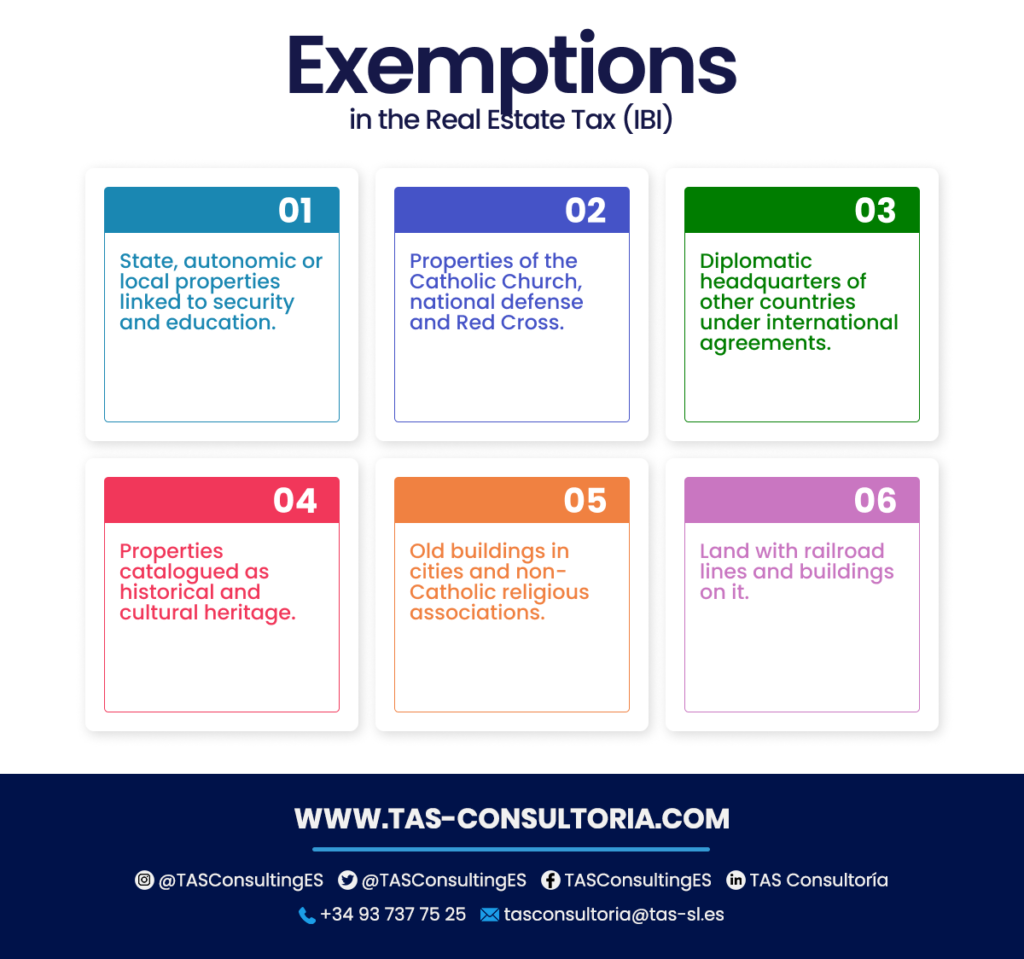

Which properties are exempt from payment of Real Estate Tax (IBI)?

The legal regulations provide for a series of cases. Many of them are exempt from the obligation to pay the Real Estate Tax (IBI). These specific cases encompass a wide variety of properties. Below, we break down each of them in detail:

- In the first place, properties owned by the State are exempt from payment of IBI. Whether they belong to the autonomous communities or under the jurisdiction of local entities. As long as they are directly linked to public safety issues or educational services. This includes facilities such as police stations, penitentiary centers and educational establishments.

- Likewise, real estate owned by the Catholic Church is also exempt from Real Estate Tax; as well as state-owned real estate used for national defense. Those owned by the Red Cross fall into this exemption category.

- Diplomatic headquarters of other countries established in the territory are also exempted from paying IBI. This by virtue of international agreements that recognize their tax immunity.

- In another category, properties that have been catalogued as historical heritage because of their cultural and architectural value are exempt.

- Other properties that are exempt from Real Estate Tax are the old ones located in the main cities. Also those belonging to legally recognized non-Catholic religious associations.

- Finally, land occupied by railroad lines is also exempt from IBI tax. Along with the buildings constructed on this land.

You can see the summary of the points below:

You may also be interested in: The lease of commercial premises in Spain

OCU guidelines for the management of tax obligations

The Organization of Consumers and Users (OCU), in its vast experience, has designed a cost distribution model. It is associated with real estate in lease agreements where the Real Estate Tax is included. According to the organization, it seems to be the most adopted approach.

This sharing structure is designed to ensure fairness and transparency in the financial responsibilities of both parties:

- In the case of the owners, they are responsible for the obligations related to the Real Estate Tax (IBI). That is to say, the expenses inherent to the community of owners, the insurances and the waste collection fee. Usually, the owner assumes the payment of the IBI tax. However, in situations where the contract so provides, this responsibility may fall on the tenant.

- On the other hand, tenants assume the costs related to services that are measured through individual meters. Such as water, gas, electricity, among others.

This distribution proposed by the OCU is based on a fairness perspective. Where expenses are allocated according to their nature and the way in which they impact on each of the parties.

By opting for this structure of sharing expenses related to Real Estate Tax, you establish a solid relationship. It is important to maintain a harmonious and well-informed relationship between landlords and tenants.

You may also be interested in: Learn about the new housing price forecast 2023

Conclusion?

Stay informed and prepared for the changes that may arise. If you need expert, personalized advice to better understand how these developments affect your real estate and your finances, contact us at tasconsultoria@tas-sl.es!

Our team of tax consultants is ready to provide you with the guidance you need. Request your updated tax consultancy and ensure an efficient management of your properties and Real Estate Tax.

Your email address will not be published .

Required fields are marked with *