Digital payments have become a fundamental tool for the financial management of any business. More and more companies are choosing to integrate digital solutions to collect and receive payments, allowing them to offer a more convenient and secure shopping experience to their customers. We share with you the key information to encourage you to integrate them into your business, let’s go!

What are digital payments?

When you digitize a business, your main goal is to ensure customer satisfaction. That’s when digital payments become a key piece to achieve this goal. No one likes to waste time on unnecessary paperwork or worry about the security of their money.

Digital payments are a set of payment methods that are made through electronic devices, such as smartphones, tablets, computers, point-of-sale terminals (POS), card readers, among others.

These methods include bank transfers, electronic wallets and credit or debit cards, always avoiding the use of cash.

For these and many more reasons that we will detail throughout this post, digital payments are essential for e-commerce and any online business.

You may also be interested in: Impact of health tech today

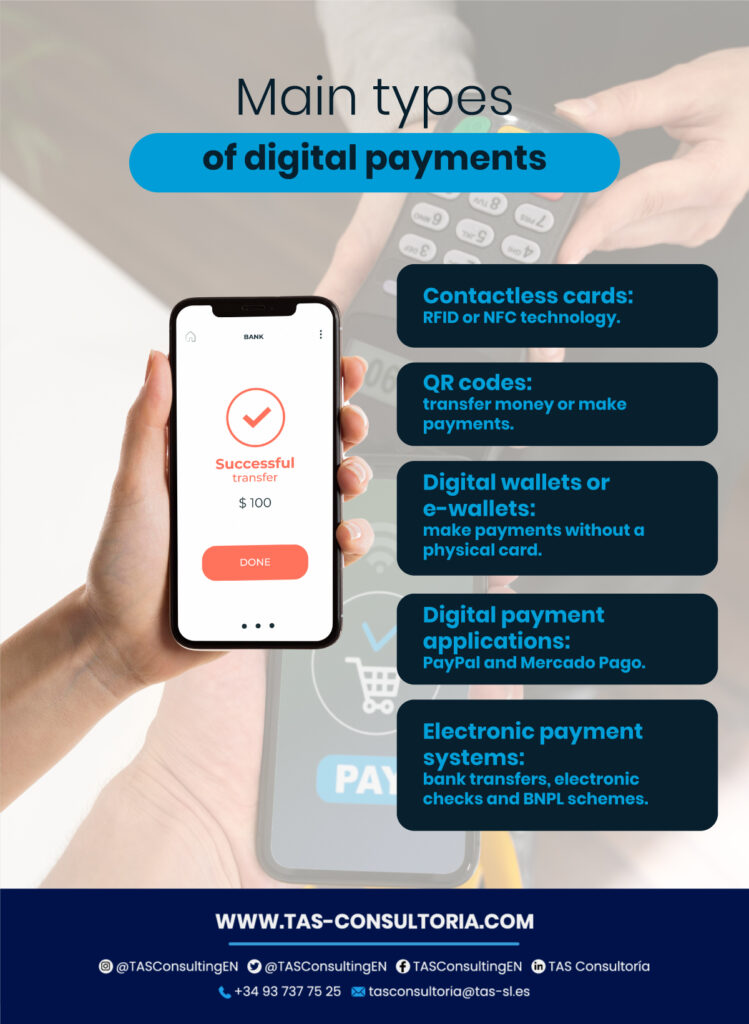

What are the most common types of electronic payments?

Nowadays, there are several ways to make digital payments that are gaining more and more popularity due to their speed and convenience.

One of the most widely used options is the contactless card, which, as its name suggests, allows contactless data transfer. For more details, this tool is based on two technologies:

- Radio Frequency Identification (RFD): one of the earliest forms of data exchange used in transportation cards and some security systems to open doors.

- Near Field Communication (NFC): short-range wireless technology used for data exchange, access control, contactless transactions and automatic configuration of communication systems.

Both allow you to make payments without having to enter a security pin or swipe your card at a payment terminal.

However, they are not the only ones that exist, see below the most popular digital payments:

You may also be interested in: B Corp: what is it and how to become one?

5 Unmissable advantages of digital payments

Digital payments are one of the most important digital transformation tools for companies.

On the one hand, we have the competitive advantage they provide to businesses, since they allow diversifying payment methods and reaching a larger number of users, especially those who prefer to make transactions without physical contact.

In this sense, the implementation of these payment solutions has become crucial, because more and more consumers are opting for this payment method.

An example of this is the volume of payments processed by Mercado Pago in Argentina. In the first quarter of 2021 alone, it reached USD 14.7 billion.

To give you a broader idea, here are the 5 unmissable advantages of digital payments:

1. Increased safety

Digital payments have the ability to reduce theft and fraud, which significantly benefits both users and merchants.

2. Effective online marketing and communication

Through QR codes, companies can register much more easily and quickly the different payments you receive. You can verify them through QR, payment links or transfers, this will allow you to have an effective sales channel through the Internet.

3. Control of operations and expenses

Users can access transaction history and schedule payments, giving them more effective control over their transactions and expenses.

4. Speed and agility in physical purchases

Think about it, you would gain dynamism and fluidity in each of your operations and would significantly reduce queues in stores.

5. Safety and health

This will help to maintain a safe environment even after the pandemic.

How can your business adapt to this new digital payment method?

If you want your company to start receiving digital payments as soon as possible, you need to have an adequate and secure financial structure. Here are the 5 steps you need to take to integrate digital payments in your company:

You may also be interested in: Digital Spain 2025: basic guide

If you have not yet incorporated this tool in your business, do not wait any longer and ask for an administrative consultancy to include digital payments in your company this 2023. Don’t get left behind and start taking advantage of all the benefits that this technology can offer you, contact us at tasconsultoria@tas-sl.es!

Your email address will not be published .

Required fields are marked with *