The self-employed and SMEs have a great importance within the Spanish business world, as they have become one of the main engines of the Spanish economy for its ability to generate employment and value. For this reason, the state has focused on providing aid for the self-employed and SMEs that contribute to growth. Do you want to know more about aids for the self-employed in Spain? In this article we tell you about them, join us!

What is the self-employment promotion program?

This is a nationwide program regulated by order tas/1622/2007 of June 5, 2007 and aimed at unemployed people. It is managed by the Autonomous Communities, through their employment departments and by their public employment services.

The purpose of this program is to promote and provide financial assistance to projects developed by unemployed persons who are registered at the employment offices and who wish to become self-employed.

The method used to provide this assistance to the self-employed is through the establishment of extensions, reductions or bonuses on social security contributions.

You may also be interested in: Profitable business in Spain 2022

What aid is available for the self-employed?

The support program for self-employment includes four types of aids for the self-employed, which are adapted to each Autonomous Community. Each one of them is dedicated to specific sectors, among these aids we highlight:

Subsidy for the establishment as self-employed or self-employed up to a maximum of €10,000

The amount of this aids for the self-employed is determined by each autonomous community, the important thing is that those who opt for it are:

- Unemployed in general.

- Young people 30 years of age or younger who are unemployed.

- Unemployed women.

- Unemployed people with disabilities.

- Women with disabilities who are unemployed.

It should be noted that in the case of women who are victims of gender violence, the amounts are increased by 10%.

This aids for the self-employed is usually conditional on the beneficiary making an investment in fixed assets. This must be at least 5,000 euros excluding taxes, provided that they are subject to recovery or compensation.

The granting of aid usually takes place within a period of time ranging from 3 months prior to the start of the activity to 6 months after the start of the activity.

In addition, these subsidies require a commitment to remain self-employed for 2 to 3 years, otherwise they will have to be returned.

Financial subsidy

The financial subsidy is the equivalent of a reduction of up to 4 points of the interest fixed by the public or private credit institution that generates the loan. It will have a subsidy limit of a maximum of €10,000.

Of this loan, at least 75% must be used to finance fixed asset investments. The other 25% may be used to finance current assets.

This means that the beneficiary must make an investment in fixed assets for a value of not less than 5,000 euros.

Technical assistance grant

In the subsidies for the self-employed we also find the subsidy for technical assistance, where the amount is 75% of the cost of the services rendered of this subsidy, with a maximum of 2,000 euros.

Training grant

The amount of this grant reaches 75% of the cost of the courses received by the aid. The ceiling is 3,000 euros.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

What are the incentives for the self-employed?

As a measure of aids for the self-employed, public administrations have been dedicated to promoting and facilitating entrepreneurship. Especially in what is known as the current economic situation.

For this reason, we are working to establish an environment that promotes an entrepreneurial culture, as well as the creation and development of business projects that generate employment and added value. The incentives proposed as a promotional measure are:

Social Security reductions and allowances

One of the aids to which the self-employed will have access, are the reductions and bonuses to the Social Security, as it is established according to the Law 20/2007, of July 11, of the statute of the self-employed. This, in turn, was amended by Royal Decree Law 13/2022, of July 26.

This Royal Decree Law 13/2022, of July 26, 2002, established a new contribution system for self-employed workers and improved protection for termination of activity.

In the case of subsidies, in the Royal Decree Law of 14/2022, of August 1. New economic sustainability measures were presented in the field of transport, in the area of scholarships and study grants, as well as measures for energy saving, energy efficiency and reduction of energy dependence on natural gas.

Bonus for self-employed workers or freelancers for reconciliation of professional and family life linked to recruitment

With this aid, Article 30 of Law 20/2007, of July 11, 2007 on the Statute of Self-Employment is amended. In order to subsidize the self-employed for the reconciliation of professional and family life linked to hiring.

For this reason, self-employed workers were given the right, for a period of up to 12 months, to a 100% rebate of the self-employed contribution for common contingencies such as:

- Care of children under 12 years of age.

- To have a dependent relative by blood or affinity up to the second degree, in a duly accredited situation of dependency.

- A dependent relative by consanguinity or affinity up to the second degree, with cerebral palsy, mental illness or intellectual disability, with a recognized degree of disability equal to or greater than 33% or a recognized physical or sensory disability equal to or greater than 65%.

ICO Grants

ICO offers a catalog of research lines available to finance both investment projects and liquidity needs of self-employed and companies. To distribute these products, ICO acts in collaboration with the credit institutions that are adhered to each of the lines.

In addition, it is the ICO that provides the funds and it is the entities that are responsible for the processing, studies and approval of the operations under the conditions established in the lines.

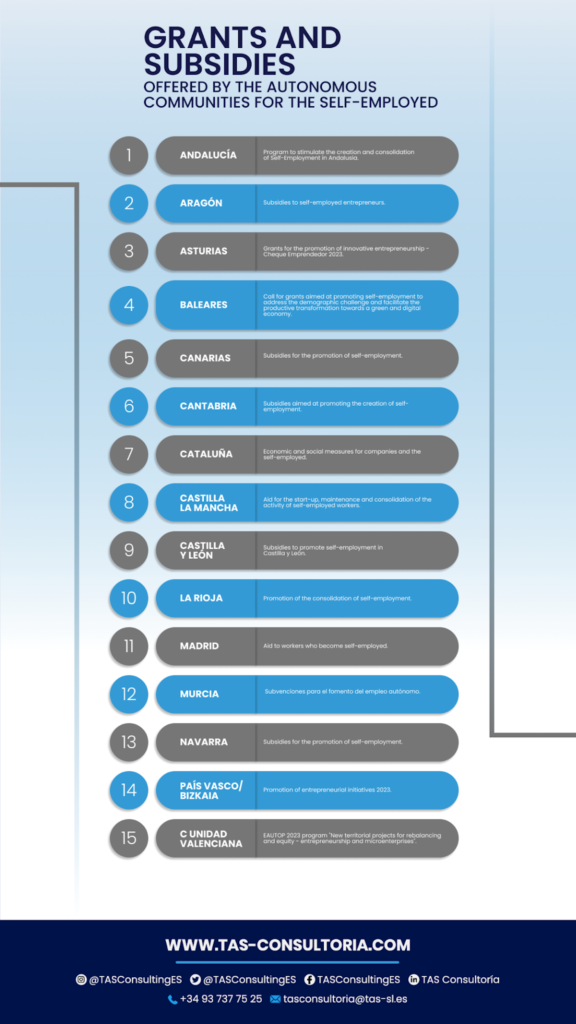

Grants and subsidies for autonomous communities

For each autonomous community there is a subsidy for 2023, this individual subsidy is updated periodically as changes or new developments occur. See what they are below!

You may also be interested in: How to register a trade name in Spain?

To learn more about grants for freelancers, I invite you to contact us through our email tasconsultoria@tas-sl.es. Our team of professionals can provide you with all the information you need and much more. Just contact us and get a totally personalized and free advice to take your business to another level.

Your email address will not be published .

Required fields are marked with *