Do you work with cryptocurrencies and don’t know the implications of the new tax models? Find out how the authorities are approaching this issue and how it can affect your financial situation. Keep reading to stay informed and make informed decisions on your cryptocurrency investments! Keep reading and don’t miss the details!

Form 172: Information return on balances in virtual currencies

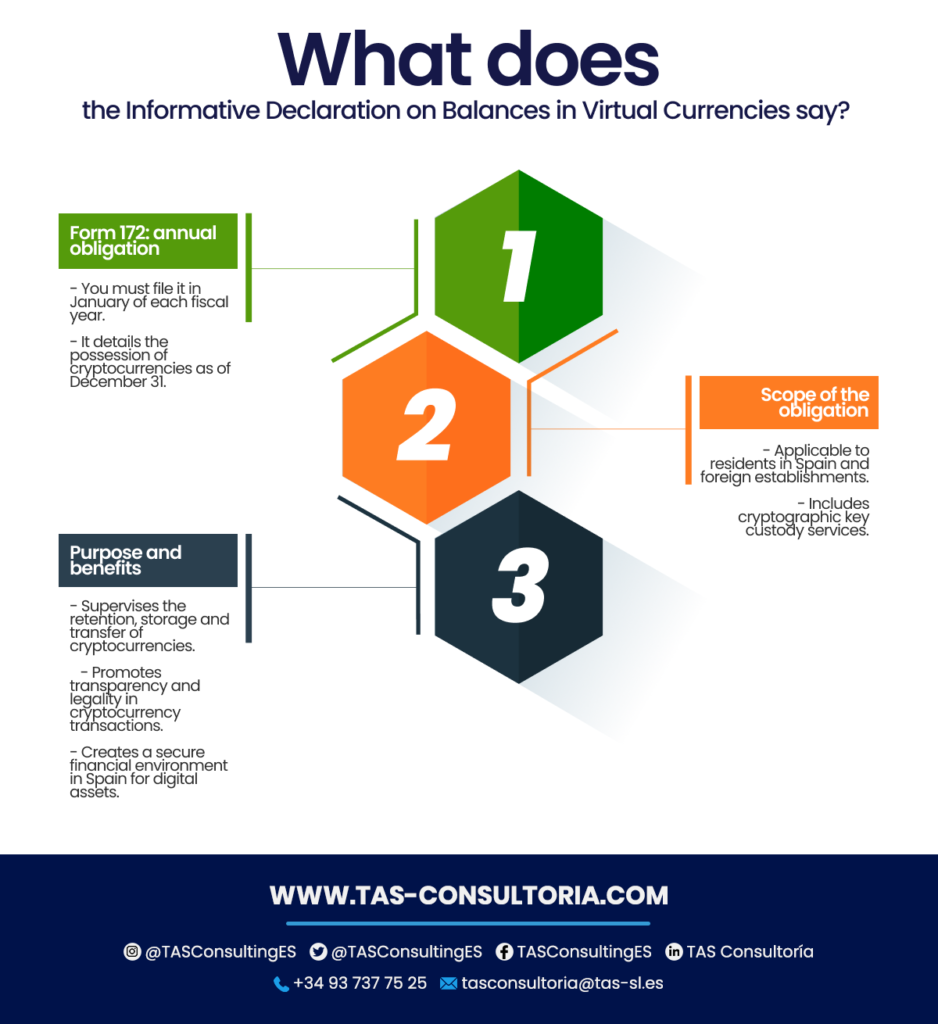

Within the framework of the tax legislation in Spain, it is established the need to file the Form 172 once a year. Specifically, during the month of January of each fiscal year. This is one of the most important models, since it requires a detailed description of the possession of cryptocurrencies at the close of the fiscal year. That is, as of December 31 of each year.

The responsibility to comply with this obligation falls on individuals and entities with residence in Spain. It also includes establishments in Spanish territory belonging to foreign individuals. Especially for those offering services for the custody of private cryptographic keys on behalf of third parties.

The fundamental purpose of this obligation and its fiscal models is to effectively monitor and regulate the retention, storage, and transfer of virtual currencies.

By complying with these regulations in due time and form, we seek to:

- Promote transparency and ensure compliance with laws related to transactions involving cryptocurrencies.

- Promote the creation of a stable and secure financial environment. Especially for all actors involved in the management and transactions of digital assets within the Spanish territory.

Keep this summary of one of the tax models and its declaration at hand:

You may also be interested in: VAT rates in Spain: updates 2022

Form 173: Annual tax return on transactions with virtual currencies

Of all the tax forms, this one represents a key piece in the Spanish tax regulations. This form must be filed annually. This involves a data collection process that spans the entire tax year.

The information required to complete this model focuses on detailing the transactions carried out with virtual currencies, as mentioned above.

This declaration is mandatory for individuals or legal entities resident in Spain. It is for all those who carry out operations with cryptocurrencies, such as Bitcoin, Ethereum or other virtual currencies.

As in any of the tax forms, you must provide information about:

- Operations performed

- The type of cryptocurrency used

- The number of units transferred or acquired

- The date and amount of each transaction

- The tax identification of both the issuer and the recipient of the cryptocurrency should also be indicated, when possible.

Not all cryptocurrency transactions are subject to this declaration. There is a threshold that determines when a transaction must be declared. In the case of Form 173, you must declare transactions whose aggregate amount in the year exceeds €50,000.

You may also be interested in: VAT exempt activities: in which cases does it apply?

Form 721: Annual declaration of virtual currencies abroad

It is intended for tax residents of Spain who keep their cryptocurrencies in custody abroad.

This declaration is a little more extensive. It covers a period from January 1 to March 31 of the year following the year to which it corresponds to declare. The relevant information to complete this model must detail the amount and nature of the cryptocurrencies. Specifically those that they have in possession at the close of the fiscal year, that is, at December 31.

The aggregate value of virtual currencies held abroad must exceed €50,000 at any time during the year. Even if the value falls below this threshold later, the obligation to file the declaration remains in force.

The Form 721 may require additional information, such as the country where the wallet is located or the exchange platform. It is important to collect all the necessary information before filing the return.

The responsibility to file Form 721 also falls on both individuals and legal entities with residence in Spain. In addition, it includes permanent establishments in Spain of persons and entities that do not have tax residence in the country. But, they maintain virtual currencies abroad of which they are beneficial or beneficial owners.

What is the procedure for declaring cryptocurrencies according to tax models?

As stated above, there are three annual tax forms that must be submitted in January of the year following the year to which the information corresponds. In these forms, you are asked to detail the cryptocurrencies held as of December 31. These data must be sent electronically to the Tax Agency.

Within these declarations, it is necessary to include your name, surname, ID number, address and other details that we will describe below:

You may also be interested in: What is the Financial Transaction Tax?

If you are looking for personalized guidance on these tax models and how they affect your crypto income statements: we encourage you to request a specialized consultation!

Our experts are ready to answer your questions and help you navigate this constantly evolving aspect. Don’t hesitate to request your personalized consultation through tasconsultoria@tas-sl.es and take control of your tax affairs in the world of cryptocurrencies!

Your email address will not be published .

Required fields are marked with *