Are you a non-resident renting an apartment in Spain? Then, you should know that you have to pay the Non-Resident Income Tax (IRNR). This is applied on the income obtained in Spanish territory by individuals or legal entities without habitual residence in Spain. If you want to know how to pay this tax and which other taxes you have to pay, this article is for you. Join us!

What taxes do you have to pay if you are a non-resident and rent an apartment in Spain?

In Spain, non-residents renting an apartment are subject to various taxes and fiscal obligations.

The first tax is the Non-Resident Income Tax (IRNR). This tax is levied on income generated in Spain by non-residents. In the case of renting a house, a tax rate of 24% is applied on the gross income obtained. That is, the total amount of the rent without deducting any expenses.

In addition, they must also pay Value Added Tax (VAT) if the owner is a company or professional. The general VAT rate for residential rentals is 10% on the total amount of the rental.

Under international treaties to avoid double taxation, the lessee’s country of residence may also be entitled to tax this income. In this case, the corresponding deduction or exemption may be applied in the country of origin.

Additionally, the lessor is obliged to withhold a percentage of the rent as payment on account of the IRNR. Thus, the withholding is 19% of the total amount of the rent. However, it may vary depending on the tax regulations in force at the time of payment.

It is essential that the non-resident complies with its tax obligations and files the corresponding tax returns. In addition, it is advisable to have the advice of a professional specialized in tax matters to ensure proper compliance with tax obligations.

You may also be interested in: VAT rates in Spain: updates 2022

But what is IRNR?

The Non-Resident Income Tax or popularly known by its acronym IRNR. This tax is levied on income obtained in Spain by individuals or legal entities without tax residence in Spain.

This tax applies both to income obtained directly (earned income, interest, dividends, etc.) and to income obtained indirectly (through the sale of real estate located in Spain). In this sense, the IRNR has two modalities:

- The general regime. Characterized by the separate taxation of each income obtained, applying a fixed rate of 24%. It may be 19% if the taxpayer resides in a country of the European Union or the European Economic Area.

- The special regime. It applies to income obtained by entities or permanent establishments of non-residents. It is characterized by the joint taxation of all the income obtained, applying a variable rate according to the nature and amount thereof.

The IRNR is managed through the filing of periodic or annual returns, depending on the type of income and the applicable regime. Taxpayers may request a refund of the excess withholdings or payments on account that they have paid, provided that they meet the established requirements.

Also, taxpayers can benefit from reductions, exemptions and agreements. This is to avoid double taxation between Spain and their country of residence.

2 Types of income subject to IRNR

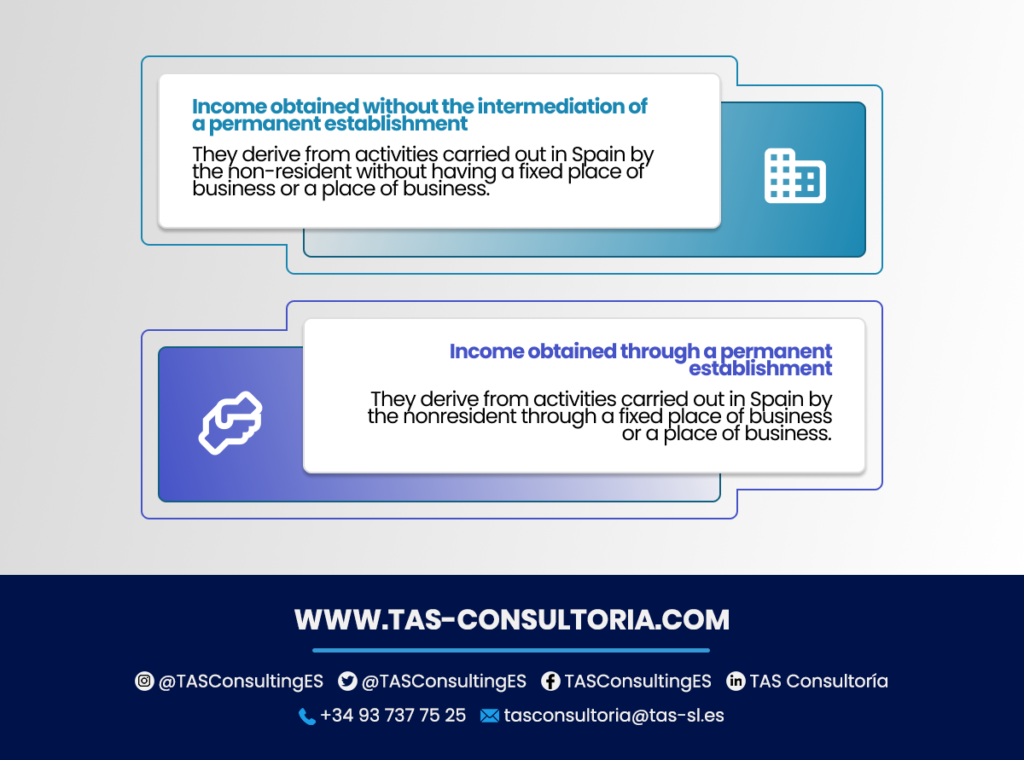

According to current Spanish legislation, there are two types of income that are subject to IRNR:

Each type of income has a different tax regime that depends on several factors, such as the taxpayer’s tax residence, the existence or not of double taxation treaties, the type of activity or the source of the income.

You may also be interested in: Nationality agreement between Spain and France

How is the IRNR calculated?

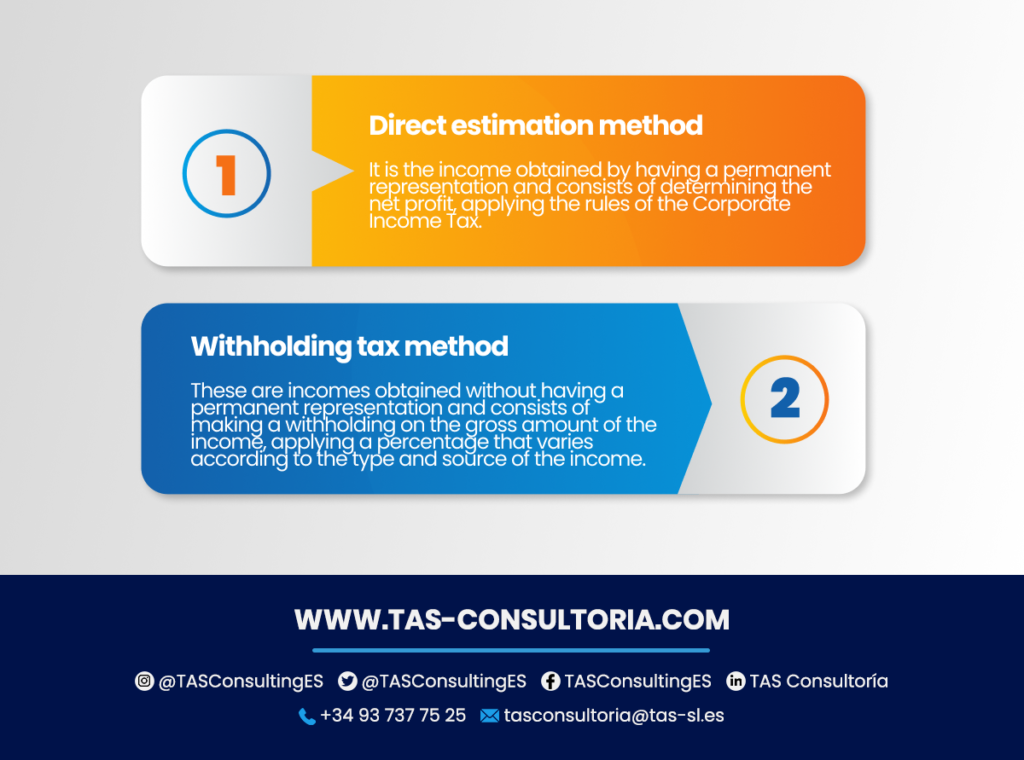

The calculation of the IRNR varies according to the type of income and the applicable tax regime. In general, two methods are distinguished:

In some cases, the taxpayer may choose to be taxed by the direct estimation method instead of the withholding tax method. Of course, as long as the requirements established by law are met.

What is VAT?

VAT is an indirect tax levied on the consumption of goods and services in Spain. It applies to each stage of the production and distribution chain, from the producer to the final consumer.

VAT is calculated on the sales price of goods and services and is paid to the State by the seller or service provider. VAT has different rates or percentages depending on the nature of the goods and services consumed. In Spain, the VAT rates in force are:

- The general rate is 21% and applies to most goods and services.

- The reduced rate is 10% and applies to certain food products, passenger transportation, cultural, health and educational services, among others.

- The super-reduced rate of 4% applies to basic necessities such as bread, milk, eggs, books, newspapers and magazines.

It is worth mentioning that this is a tax that falls on the final consumer. Since it is he who bears the cost of the tax in the final price of the product or service.

However, businessmen and professionals who carry out activities subject to VAT are obliged to charge VAT on their invoices and to declare and pay it periodically to the tax authorities. To do so, they can deduct the VAT on their purchases and expenses related to their economic activity.

However, each country sets its own VAT rates within certain limits. The minimum VAT rate in the EU is 15%. However, some countries apply lower rates for certain products or services.

You may also be interested in: Taxes in Spain for Foreigners

Conclusion

Do you want to pay your IRNR and VAT taxes to be able to rent an apartment as a non-citizen without difficulties? Contact us through tasconsultoria@tas-sl.es we can advise you on everything related to real estate, Spanish taxation, legality and much more, contact us and schedule your personalized advice!

Your email address will not be published .

Required fields are marked with *