The severance payment is an important term at the end of an employment relationship, particularly at the time of retirement. As a worker in Spain, it is essential to know what you are entitled to when calculating your severance pay in this situation. From outstanding salary to overtime, each item plays a crucial role in this process. Make sure you get a fair transition and be aware of your rights, read more here!

What do you receive in your full retirement settlement?

Retirement is a time longed for by many. Basically, because we stop working and enjoy our pension in our later years. However, before we completely disengage, the company must settle all outstanding accounts in the form of the popular “iniquity” (severance pay).

When an employment relationship is terminated due to the employee’s retirement, the question arises: what will be paid as severance pay in this particular situation? It is important to note that the answer is identical to cases of voluntary termination or any type of contract termination.

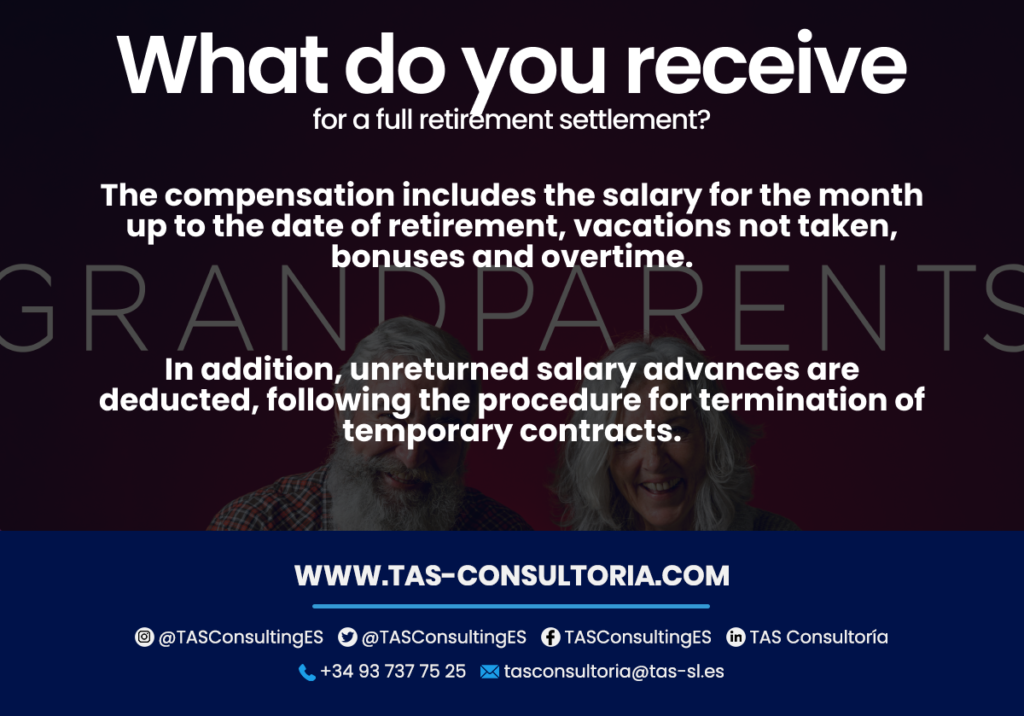

The worker, at the time of retirement, will receive a compensation that includes:

- The salary corresponding to the month up to the date of termination of the labor relationship due to retirement. In addition, vacations not taken during the work period will be included.

- The proportional part of bonuses and special payments that the employee is entitled to receive.

- Also, if the employee has worked overtime that has not yet been paid, it must be included.

- Payroll advances will also be deducted. Those that were granted by the company and that the employee may not have returned to the time of the end of the contract. This also occurs in the case of the termination of a temporary contract.

In summary, this type of settlement includes:

You may also be interested in: From the MOSS regime to the OSS regime: what is it all about?

How is the retirement severance pay calculated?

Calculating the retirement severance payment involves an important number of factors that should not be overlooked. It includes all the remunerations generated by the worker that have not yet been collected at the time of termination of the contract. Previously, we have mentioned the main considerations.

Below, we specify a little more about each component of the retirement severance payment:

Salary

You calculate by dividing the monthly salary by 30 and multiply by the days worked in the month of retirement. This is the basis for the severance payment.

2. Extra pay

These are the overtime hours worked during working time. They must include the outstanding proportional part, whether prorated, semi-annual or annual.

3. Unused vacation time

They have to count the days paid but not taken. Considering 2.5 days per month from the first day of the year until the end of the contract.

4. Special Events

Whether they are collective bargaining agreements, bonuses, objectives, etc., they may be applied as appropriate. They are also included as salary supplements.

Are there any severance pay entitlements in case of early retirement?

Indeed, the right to severance pay applies in all situations of termination of professional activity, including early retirement.

In the case of a retirement, the worker is entitled to receive compensation, the amount of which will vary depending on several factors. As mentioned above.

But in addition to what is legally stipulated, in some cases, both collective bargaining agreements and companies may offer additional compensation. Also, some incentives for employees who opt for early retirement.

These conditions may differ in each case and must be evaluated individually to determine the amount of the severance payment. But it is possible.

You may also be interested in: How can you register for Social Security?

Is there a severance payment for the employee at the end of his or her employment contract upon retirement?

When an employee reaches retirement age and meets all the requirements, he/she will not be entitled to receive an indemnity. Specifically, for the termination of his employment contract. As stipulated in the current legal regulations.

Retirement, in this context, is considered a reason for termination of the employment contract that does not generate additional economic compensation.

However, in some cases, the collective bargaining agreement applicable to the company or sector may contemplate different and specific conditions. It is important to note that severance pay is not synonymous with compensation.

What happens in these cases?

In situations where the contract terminates due to retirement, such agreement may provide for several things. That is, they may grant you an indemnity or a certain amount in recognition of years of service.

This is a measure that acts as an incentive for workers moving into retirement. These provisions tend to be more common in the case of early retirements.

However, in the absence of such a provision in the agreement, the employee who is about to retire will receive his severance payment. Only without the right to an indemnity for the termination of the employment contract.

It should be noted that any indemnity, if any, will be subject to the terms and conditions specified in the collective bargaining agreement in force. We share with you the list of the most important points regarding this frequent doubt:

You may also be interested in: What is the new Insolvency Law about?

Understanding what you are entitled to as an employee when calculating your retirement severance pay is essential. Especially to ensure a smooth and fair transition of employment. From outstanding salary to accrued benefits, every detail counts.

If you have any questions or need advice on how to calculate your retirement settlement, do not hesitate to contact us at tasconsultoria@tas-sl.es. Our team of social management experts will be happy to help you through this process and provide you with the necessary assistance. Contact us today and ensure a fair and satisfactory termination!

Your email address will not be published .

Required fields are marked with *