Tax residence in Spain is a key concept to determine your tax obligations in this country. Therefore, one of the fundamental aspects to be considered a tax resident is the time you spend in its territory. Here we explain how to calculate the 183 days of residence that can determine your tax status in Spain. Read on and keep your tax situation in order!

What is tax residency in Spain?

To understand tax residence in Spain, you must differentiate it from residence for the purposes of foreigners or residence permits.

Tax residence refers to the condition established by the Tax Agency for foreigners who reside in Spain for an extended period of time. Or have economic interests in the country. This condition entails the obligation to pay taxes and pay tax at specific rates.

Tax resident status in Spain has significant tax implications. In many cases, tax residents enjoy advantages. That is, they pay less tax and lower rates than those who do not have this status. This makes tax residency an attractive option for many foreigners setting up in the country.

You may also be interested in: Types of taxation in Spain: direct and indirect taxes

How are the 183 days of residence calculated in order to be considered a tax resident?

Determining your tax residence in Spain involves carefully assessing the length of time you have been in the country. Below, we explain how Hacienda carries out this calculation:

Tax residency rules

The Inland Revenue considers a person to be a tax resident in Spain if he or she has met certain circumstances, which include the following:

- The stay in the country for more than 183 days in a calendar year.

- If your minor children and spouse reside in Spain, they presume your tax residence here. Unless you can prove otherwise.

- They also take into account whether the main core of your economic interests are in Spain. This means that the majority of your investments, business and income are generated in the country.

2. Calculation of days as tax resident

To determine whether a person has spent more than 183 days in Spain, the tax authorities apply specific rules.

They add up the days of certified presence. That is, those for which presence in the country can be demonstrated with irrefutable evidence. Such as, for example, traffic fines, hotel stays, medical procedures and credit card payments. Also appearances before notaries and public agencies.

3. Presumptive and sporadic days

Days as a tax resident also include those between two days of certified presence. Provided there is no evidence to the contrary.

For example, if you prove that a person was in Spain on April 2 and July 5. The days between these dates are considered days of residence, unless you can prove otherwise.

In addition, they take into account the days of sporadic absence. These correspond to temporary absences in which the person traveled to another country. Unless he/she can prove his/her tax residence elsewhere.

4. Travel days as a tax resident

It is important to note that travel days are counted in their entirety, without requiring a minimum number of hours. This means that the days of travel from Spain to the foreign country or back are considered as full days of residence in Spain.

How to obtain a tax residency certificate from your home country?

In order not to be considered a tax resident in Spain and, consequently, avoid tax obligations in the country: you can obtain a tax residence certificate from your country of origin.

This document is issued by the nation where you primarily concentrate your economic interests. And it serves as proof of your status as a genuine resident in that place. Here are the steps to obtain it:

By obtaining a tax residence certificate from your home country, you will be able to prove your status as a genuine resident there. Thus, you avoid tax liability as a resident in Spain.

However, it is essential to understand that interpretation and specific requirements may vary depending on your country of origin. It is therefore essential to be aware of the regulations in force.

You may also be interested in: Requirements for requesting a letter of invitation to Spain

Tax obligations as a tax resident in Spain

For tax residents in Spain, the tax burden becomes less advantageous. They have to pay income tax on all income generated globally. This implies a substantially higher total tax burden in Spanish territory. This tax is levied on most of the activities and income.

The exact percentage varies according to each situation, being a progressive tax with rates between 17% and 47%.

A possible exception is the Beckham Law if you are a tax resident. This allows foreigners to pay a flat 24% if they have not been resident in Spain for the last 10 years. In addition, wealth tax is still applicable for residents. With a minimum threshold of 500,000 euros in Catalonia.

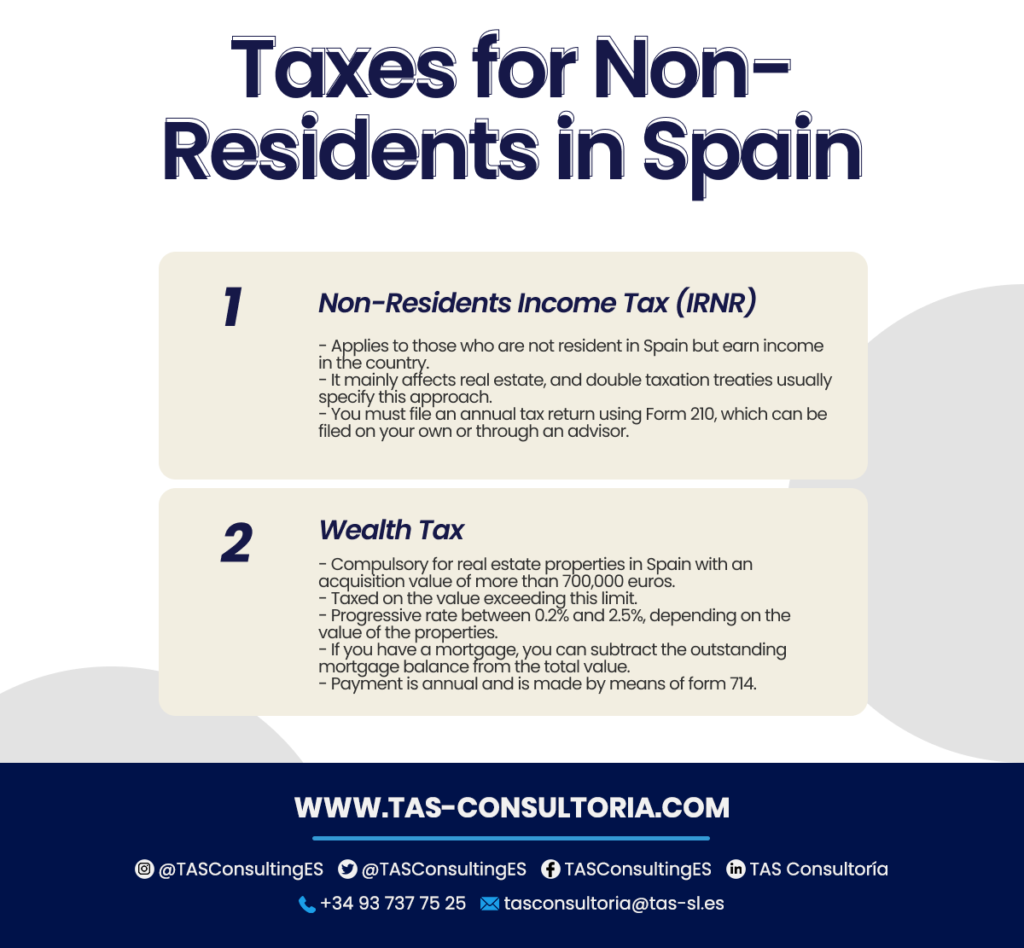

What taxes do non-residents have to pay?

Both foreigners and recognized non-residents in Spain are responsible for two main taxes:

The way in which the 183 days of residence is calculated is an essential aspect of your tax status in Spain. The correct determination of your status as a tax resident or non-resident can significantly impact your tax obligations.

You may also be interested in: All about the residence permit for investors

Do you want to make sure you comply with the regulations and get the necessary advice to optimize your stay in Spain? We invite you to calculate your days of residence with the help of our experts.

Don’t hesitate to schedule a consultation with us at tasconsultoria@tas-sl.es! Get the guidance you need to keep your tax affairs in order during your time in Spain.

Your email address will not be published .

Required fields are marked with *