Are you involved in the transfer of a property in Spain and you are a non-resident for tax purposes in this country? You have come to the right place! First, it is essential to know how to approach the declaration before the Non-Resident Income Tax or IRNR law. This process may seem complex, but with the right information and approach, it becomes clearer and more manageable. Meet your tax obligations without a problem!

What is Non-Resident Income Tax and how does it apply to the transfer of real estate?

The Non-Resident Income Tax (IRNR) seeks to tax specific income: income generated in Spanish territory by individuals or entities that are not resident in Spain.

The IRNR law covers various areas such as income from work, movable capital or real estate. Also, economic activities, among other financial aspects. It is a measure that contributes to the support and operation of public services and social programs in the country.

The declaration and payment under the IRNR law is made using forms 210, 211 and 216, depending on the particular situation. In this context, the deadline for filing the return varies according to the nature of the income and its origin. Generally speaking, this deadline may be quarterly or annual, except in exceptional cases.

It should be noted that this tax is complex in nature. So it requires a good understanding of both the Spanish regulations and the tax regulations of the countries of origin. In addition, the residence status of the taxpayers.

Therefore, you should seek the guidance of a specialized advisor. Especially before carrying out any transaction that generates income subject to the IRNR law.

You may also be interested in: Reform of the Alien Law: new developments 2022

How to declare the transfer of a real estate property under the IRNR law?

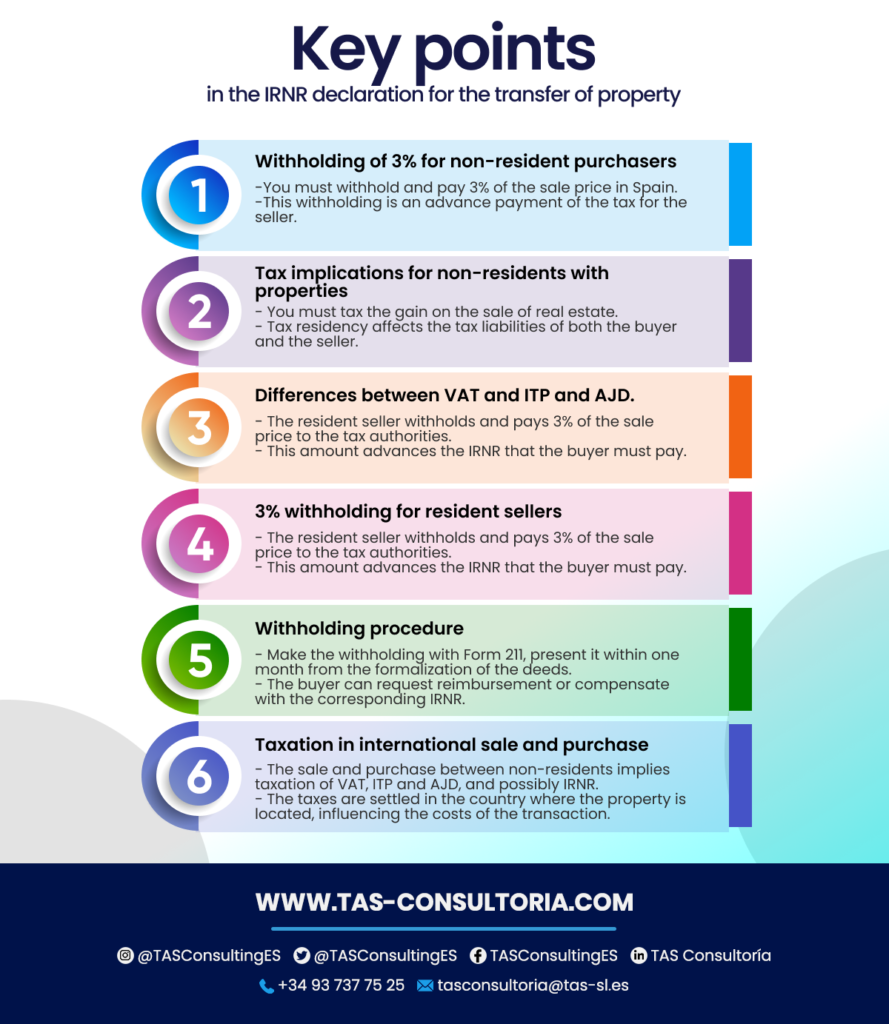

The buyer does not have a residence in the country? He must withhold and pay to the Public Treasury 3% of the agreed consideration. This withholding is considered as a payment on account of the tax for the seller. That said, it is important to remember that this tax corresponds to the gain obtained by the transfer.

In addition, if the person involved in the transaction is not resident in Spain and owns real estate, he/she will be subject to the IRNR law. Consequently, the gain derived from the sale of a real estate property becomes a taxable income.

The sale and purchase of property involves tax liabilities for both the seller and the buyer. These obligations vary depending on the tax residency of the parties involved.

Therefore, it is essential to differentiate between VAT and Transfer Tax and Stamp Duty (ITP and AJD). Remember that VAT is a direct tax on the consumption of goods and services. While the ITP and AJD are direct taxes levied on the transfer of goods and rights.

Other key factors of the IRNR law

If you are a non-resident buyer, you should be aware of the following particularities:

- If the seller is resident in Spain, he is subject to withhold and pay 3% of the sale price to the tax authorities. This amount will constitute an advance payment of the non-resident income tax that the buyer will have to pay.

- This withholding must be made by means of Form 211 according to the IRNR law. Also, you have to present it within one month from the date of formalization of the public deeds. If the buyer is dissatisfied with the withholding made, he can request its reimbursement or use it to offset the corresponding IRNR.

Consequently, the sale and purchase of a property between persons who do not reside in Spain entails the taxation of both VAT and ITP and AJD. As well as the contributions of the IRNR law as applicable. These taxes will be settled in the country where the property is located. Consider this when calculating the costs and benefits of the transaction.

We share with you a precise summary of this process:

You may also be interested in: Taxes in Spain for foreigners

Tips for a successful IRNR declaration: transfer of property

Successfully filing a tax return when selling property under the IRNR law requires understanding the tax obligations and deadlines:

Knows the tax regulations

Familiarize yourself with the Spanish legislation on the IRNR law. Understand the specific rules that apply to the transfer of property for non-residents.

Consult a professional

Seek the help of a tax advisor specialized in IRNR law issues. A professional can provide personalized guidance and ensure that the return complies with current regulations.

Understands retention

It includes the obligation to withhold and pay to the tax authorities 3% of the sale price if the seller is a Spanish resident. This is an advance of the IRNR to be paid by the buyer.

Meets deadlines

Be sure to file the declaration using Form 211 within one month. Always from the date of formalization of the public deeds.

Retains relevant documentation

Keep in order and at hand all the documents related to the transfer operation and declaration according to the IRNR law. Including deeds, payment and withholding receipts, among others.

Verify the correctness of the data

Carefully review the data provided in the return before filing it to avoid errors that may cause problems in the future.

Request adjustments if necessary

If you consider that the withholding tax withheld is not accurate, seek advice to request a refund or compensation of the tax.

Calculate costs and benefits

Evaluates the fiscal impact of the real estate transaction to understand the net costs and benefits involved.

Keep abreast of legislative changes

Stay updated on possible changes in tax regulations within the IRNR law. Those that may affect your tax obligations as a non-resident.

Preliminary tax planning

If possible, plan the real estate transaction considering the most efficient tax structure. Consult with a specialist in international tax planning.

You may also be interested in: Learn about the new housing price forecast 2023

If you need personalized advice for your particular situation, our team of tax experts is here to help you. Do not hesitate to contact us at tasconsultoria@tas-sl.es and request a tax consultation.

We are ready to provide you with the necessary guidance to ensure a smooth IRNR tax process. Don’t put off your doubts, act now and ensure a flawless return!

Your email address will not be published .

Required fields are marked with *