Discover the latest news on Social Security bonuses in Spain for the conversion of temporary contracts to permanent contracts. These bonuses represent a valuable opportunity for employers and workers in search of job stability. If you want to know in detail the implications and advantages of these new measures, read on!

What are the new Social Security bonuses for converting temporary contracts to permanent contracts about?

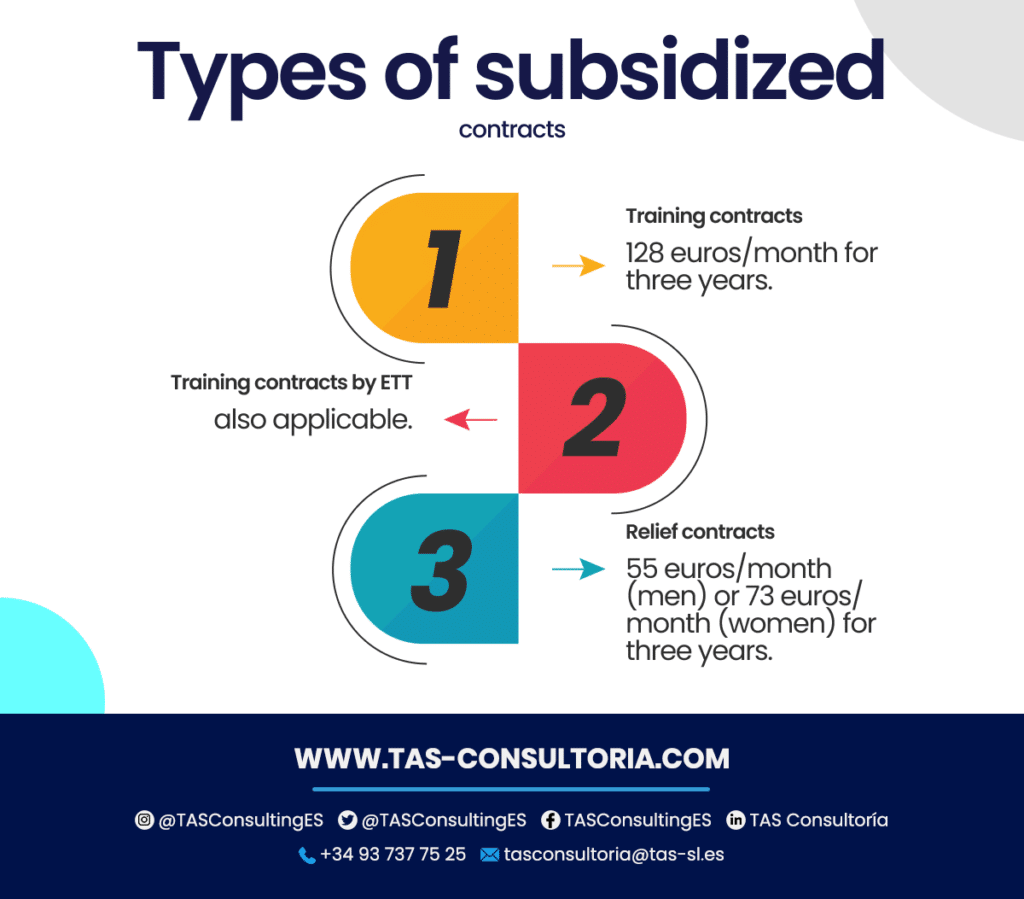

Since September 1, 2023, new bonus policies have been implemented in the Spanish labor market. More specifically, related to the conversion of temporary training and relief contracts into permanent contracts.

These bonuses represent a significant step in the promotion of labor stability. As well as the incentive of indefinite hiring in the labor market. In line with these changes you will be able to receive considerable benefits in terms of reduced contributions. Either at the end of the initial duration of the contract or with its extension.

This financial stimulus provides a tangible incentive for both employers and workers. In short, they will receive the sum of 128 euros per month for a period of three years.

Additionally, provisions are established for relief contracts with differentiated bonuses for men and women. This series of measures aims to promote gender equality in the workplace. All this by providing economic incentives for the transformation of temporary contracts into permanent contracts.

This will strengthen job security and protection for all workers.

However, how have the bonuses for converting training or relief contracts to indefinite-term contracts changed? Here are the details:

You may also be interested in: What is a patent and how to obtain it in Spain?

Who benefits from contract bonuses?

According to Royal Decree-Law 1/2023, persons considered vulnerable are eligible for bonuses for indefinite-term contracts. This measure seeks to provide additional support and opportunities to the vulnerable in the labor field. Being so, among these groups are:

- Priority attention people.

- People with disabilities.

- People with disabilities and greater labor difficulties: cerebral palsy, mental health disorders, intellectual disability or autism. Also those with more than 33% disability; and physical or sensory, with more than 65% disability.

- People at risk of social exclusion.

- Women victims of gender violence.

- Women victims of trafficking, sexual or labor exploitation, and in contexts of prostitution.

- Victims of terrorism.

On the other hand, the contribution bonuses and benefits are extended to various beneficiaries. These include companies, self-employed workers, cooperatives and non-profit entities. In this context, the incentives are conditioned on the fulfillment of specific requirements.

You may also be interested in: How can you register for Social Security?

What do you need to get your bonus?

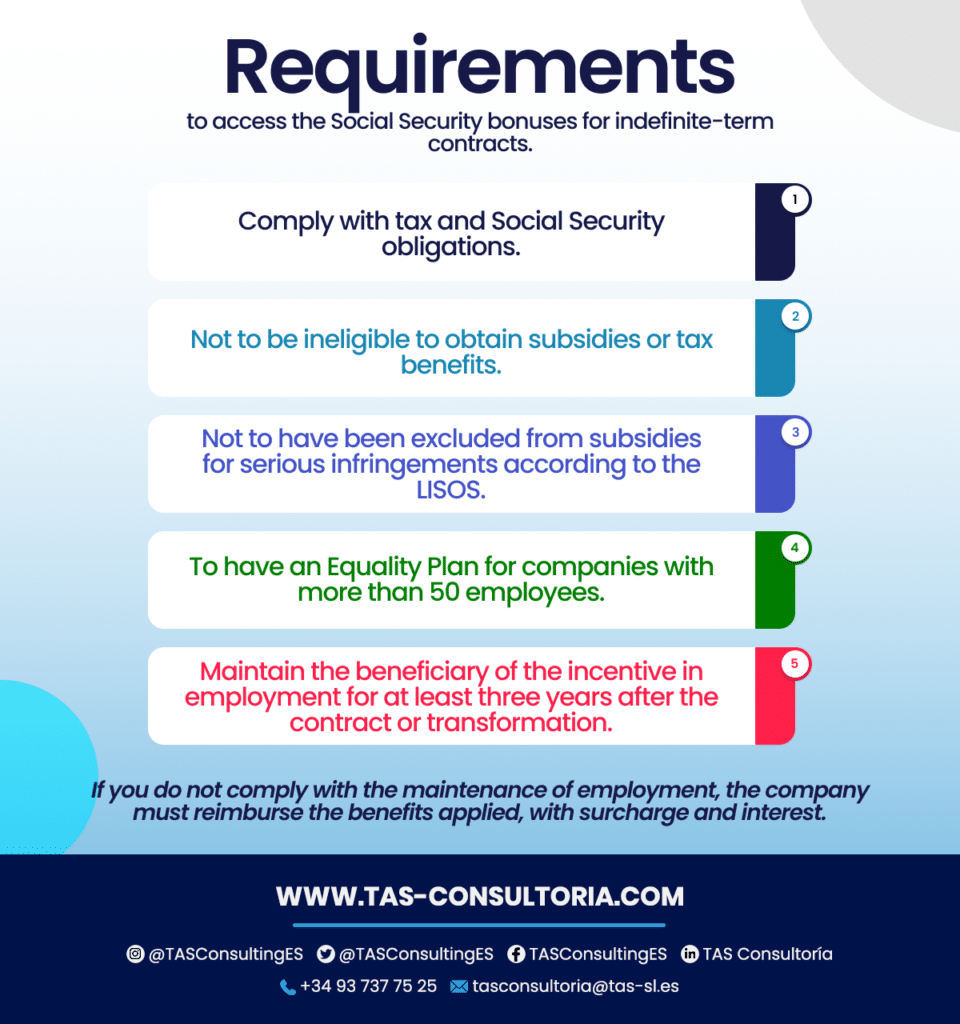

In order to guarantee access to hiring bonuses and incentives, it is vital to comply with a series of key requirements. These aspects are crucial to ensure the effectiveness and adequacy of the incentives offered to companies and beneficiaries.

- First of all, it is necessary to fully comply with tax obligations. Ensuring a correct compliance with the fiscal aspects. Likewise, maintaining proper compliance with Social Security obligations is another essential pillar for accessing these bonuses for indefinite contracts.

- In addition, they impose the condition of not having been previously disqualified from obtaining: subsidies, public aid or enjoying tax or Social Security benefits and incentives. This measure seeks to ensure that the bonuses reach those who fully comply with their responsibilities and legal commitments.

- In parallel, you must have an Equality Plan in case the company has more than 50 employees. This requirement reflects the commitment to equal opportunities in the workplace, a fundamental piece in today’s world.

- Finally, as a beneficiary, you must maintain the incentive in employment for at least three years. Exactly, from the start date of the contract or its transformation. However, certain exceptions are established for specific events, ensuring a fair assessment of the maintenance of employment.

In the event of non-compliance with the condition of maintaining employment, the company must reimburse all the benefits applied in the installments. Including surcharges and interest. These provisions encourage compliance and responsibility in the use of labor bonuses.

We share with you a list of the requirements:

6 exception cases you should know about

There are situations in which the bonuses cannot be applied to indefinite-term contracts. These cases include:

1. Special labor relations (not subject to common labor regulations).

2. Hiring of close relatives of the employer or with control over the company.

3. Persons who have worked in the same company in the last twelve months under a permanent contract or in the last six months under a temporary contract.

4. Persons who have had an indefinite-term contract and have terminated it in the three months prior to the subsidized hiring.

5. Employers who have carried out recognized or declared unfair dismissals and incentive contracts in the last twelve months.

6. Part-time hires with a working day of less than 50%.

7. Companies that transfer their activity to countries outside the European Union must reimburse the bonuses.

You may also be interested in: What is the new Insolvency Law about?

These Social Security bonuses have opened up a promising outlook for the labor market in Spain. If you would like to explore how to make the most of these opportunities and get personalized advice on the tax benefits you could obtain: do not hesitate to schedule a specialized consultation through tasconsultoria@tas-sl.es!

Passing up the opportunity to strengthen your company and provide security to your employees? Not with our consulting services. Request your consultation now and take the first step towards a more stable and beneficial hiring.

Your email address will not be published .

Required fields are marked with *