If you have changed your address or made any changes to your property, it is important that you update your cadastral data. Although it may seem a complicated process, following the proper steps will make this procedure a simple and quick process. In this article we will show you the steps you must follow to change your cadastral data, from gathering information to submitting the necessary documentation. Read on!

Why is it important to keep your cadastre data up to date?

The Cadastre is an administrative registry whose purpose is to identify and value urban and rural real estate located in Spain.

Cadastral data includes relevant information on the ownership of real estate such as location, surface area, use and destination, ownership, cadastral value, among others.

In addition, the Cadastre is a fundamental entity for the management of taxes and fees, since it is used to determine the taxable base of some taxes. For example, the Real Estate Tax (IBI) and the Transfer Tax and Stamp Duty (ITP-AJD).

In this sense, it is important to keep the cadastral data of the properties updated in order to avoid penalties and errors in taxation.

So, what may be the reasons why there may be changes in your cadastral data? The main ones include:

- Construction of new buildings

- Modification of the ownership of the property

- Segregation or grouping of plots

It is essential to keep the cadastral information of a property up to date to ensure proper management and taxation of taxes.

In addition, cadastral data are essential for public administrations to carry out territorial planning and the development of public policies in an efficient manner.

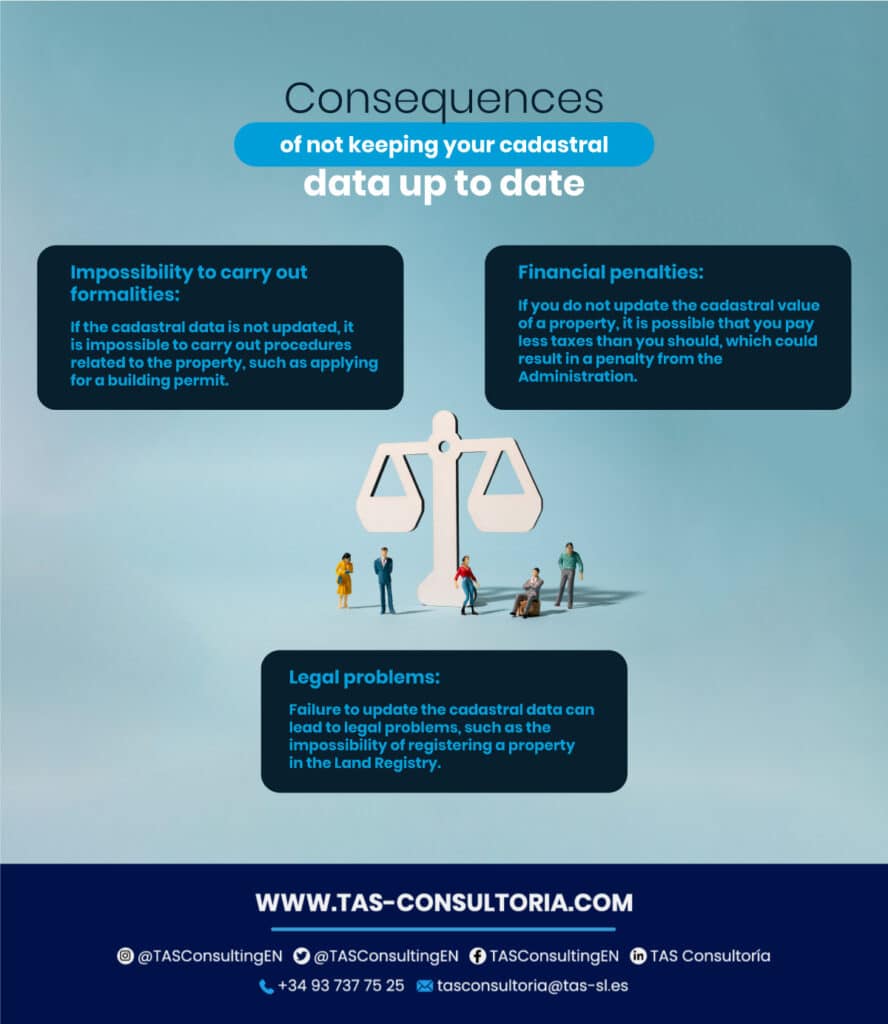

Now, what are the scenarios that can result from not changing and updating your marriage data? Here are the consequences:

You may also be interested in: The lease contract for commercial premises in Spain

How to consult your land registry data?

Consulting the cadastral data of a property is an important process to know the details about your property, its location and its characteristics.

In addition, it can be useful for administrative procedures, such as applying for grants or subsidies, or to obtain information for decision making in the real estate field.

Fortunately, there are different ways to consult this information, either through the electronic headquarters of the Cadastre or in a physical office.

For this, you will need the cadastral reference of the property, which can be found in the receipt of the Real Estate Tax (IBI) or in the Land Registry. In the electronic headquarters you will be able to obtain detailed information, such as the description of the property, surface, use, cadastral value, ownership and charges.

If you prefer to go to a Cadastre office, you must present the cadastral reference of the property and a document proving your identity. In the offices you will be able to obtain the same detailed information as in the electronic office.

The information that can be obtained in the cadastral consultation includes, among other data:

- The cadastral reference of the property.

- The description of the property (type of construction, age, surface, etc.)

- The use of the property (residential, commercial, industrial, etc.)

- The ownership of the property

- Encumbrances and encumbrances on the property

- The cadastral value of the property

- Possible discrepancies between the cadastral description and the reality of the property.

It is also important to remember that the cadastral information is of a public nature and its consultation is free of charge. Therefore, it is advisable to review it periodically to ensure that it is up to date and that there are no errors in the information of the property.

Know the steps to change and update your cadastral data

Before carrying out any procedure, it is necessary to have the documents that prove the ownership or the right to use the property, such as the property deed or the lease contract. In addition, it is advisable to consult a notary to ensure the correct fulfillment of all the necessary requirements and procedures.

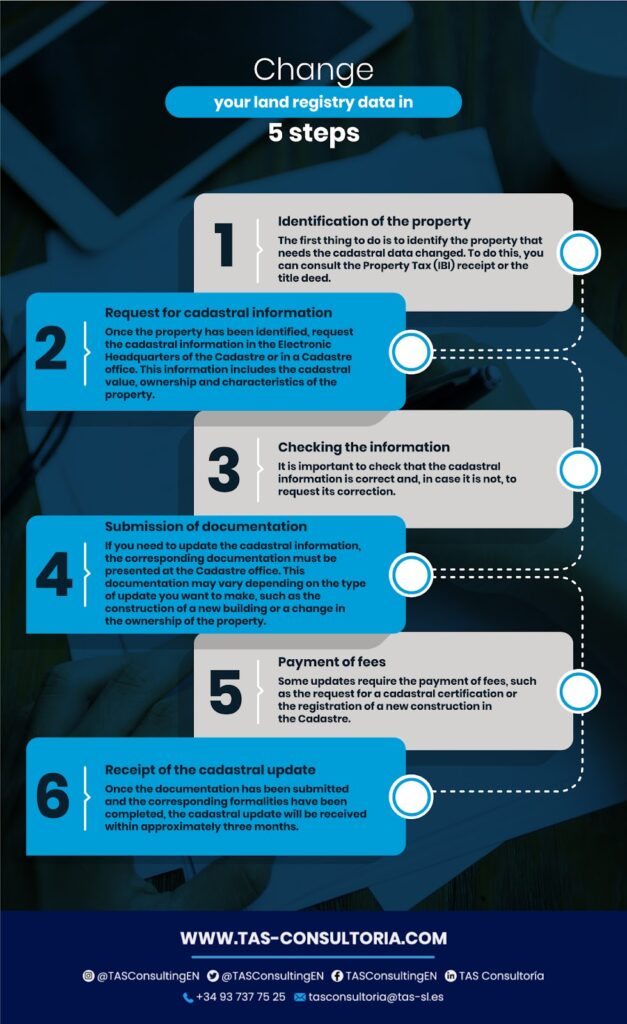

Here we explain how to change the cadastral data, just follow the steps below:

You may also be interested in: Hiring a real estate agency: what should you know?

How to request the rectification of land registry errors

It is possible that at some point errors are detected in the cadastral information of a property, such as errors in the description of the property or in the ownership of the property. Below, we list the procedures that you must follow to correct them:

Identifies the error

The first thing to do is to identify the error in the cadastral information, carefully reviewing the data corresponding to the property.

Gathers all documentation

Depending on the type of error, it may be necessary to collect documentation to correct the cadastral information. For example, in the case of errors in the description of the property, it may be necessary to provide plans or deeds that allow the correct identification of the property.

Request for rectification

Once the error has been identified and the necessary documentation has been compiled, a rectification request must be submitted to the Cadastre. This request can be made in person or electronically.

Resolution of the application

Once the request has been submitted, the Cadastre will proceed to study it and issue a resolution accepting or denying the requested rectification.

You may also be interested in: Know the safest autonomous communities in Spain

Changing your cadastral data is a relatively simple process, but it requires some specific paperwork and documentation. It is important to keep in mind that this change may have tax implications and therefore it is advisable to have the advice of a professional in the matter.

Contact us through tasconsultoria@tas-sl.es and we will offer you the help of great experts in taxation and tax law ready to help you in everything you need to make the change of your cadastral data efficiently and smoothly. Do not hesitate to contact us to request a personalized tax advice!

Your email address will not be published .

Required fields are marked with *