Have you ever wondered why you should include Value Added Tax in your commercial offers? From meeting tax obligations to establishing an image of transparency and trust for your customers, VAT can have a significant impact on your business. Read on to find out why including Value Added Tax (VAT) in your offers can ensure the growth and success of your business!

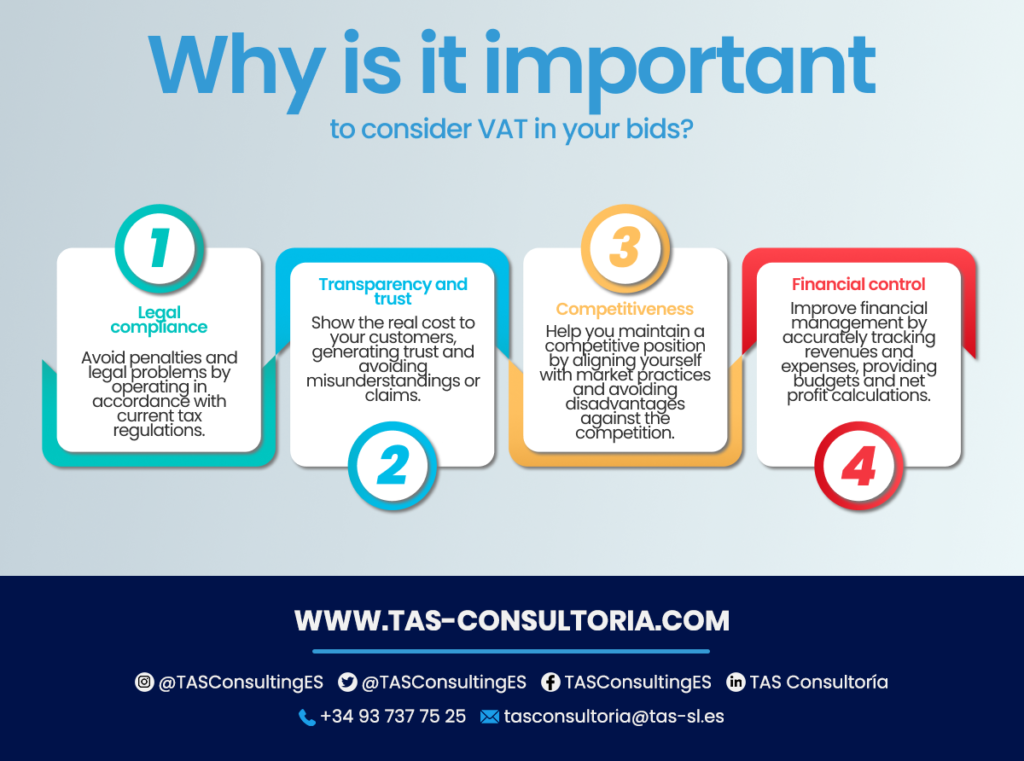

What is the importance of adding Value Added Tax in your offers?

When it comes to pricing and bidding, considering Value Added Tax (VAT) is of vital importance. Of course, it’s not just about complying with tax obligations. It’s also about understanding the impact VAT can have on your customers and your company’s profitability.

Legal compliance

Value Added Tax is established by the tax authorities. Thus, its omission can lead to penalties and legal problems for your business. In that sense, including VAT in your offers guarantees that you are operating in accordance with current tax regulations.

Generating transparency and trust

By incorporating Value Added Tax in your offerings, you are demonstrating transparency. This provides your customers with a clear view of the real cost of your products or services. As a result, you strengthen trust in your company and avoid possible misunderstandings or price-related complaints.

Competitiveness

By considering Value Added Tax in your offers, you are in line with common market practices. Thus, you avoid putting your company at a disadvantage against competitors that already include this tax in their proposals. This allows you to maintain a competitive position and reduce possible business losses.

Financial control

By adding Value Added Tax to your bids, you can better track your company’s income and expenses. This facilitates financial management, budgeting and net profit calculation.

It is important to keep in mind that the inclusion of Value Added Tax in your commercial proposals varies according to the type of economic activity and the specific situation of your business.

It is advisable to consult a tax advisor or accountant to obtain accurate and updated information on how to correctly apply Value Added Tax in your commercial proposals.

These factors are summarized below:

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

VAT rates in Spain and their applications

It is important that you familiarize yourself with VAT and its variants. Thanks to this, you will be able to understand how they affect your daily economy, purchases and sales.

Currently, there are three VAT rates in Spain (taxable and in force): the super-reduced, the reduced and the general. Each of them has its own applications and percentages.

In addition, it is worth mentioning that a measure to reduce electricity, gas and natural fuels services has been recently implemented. Thus, the Value Added Tax is reduced to 5%. You should consider these percentages to know in which offer you should apply them:

- Super-reduced VAT (4%): necessities, feminine hygiene, condoms, books, medicines and more.

- Reduced VAT (10%): foodstuffs, passenger transportation, horticultural plants and amateur sports, among others.

- General VAT (21%): applies to most products and services.

You may also be interested in: VAT exempt activities: in which cases does it apply?

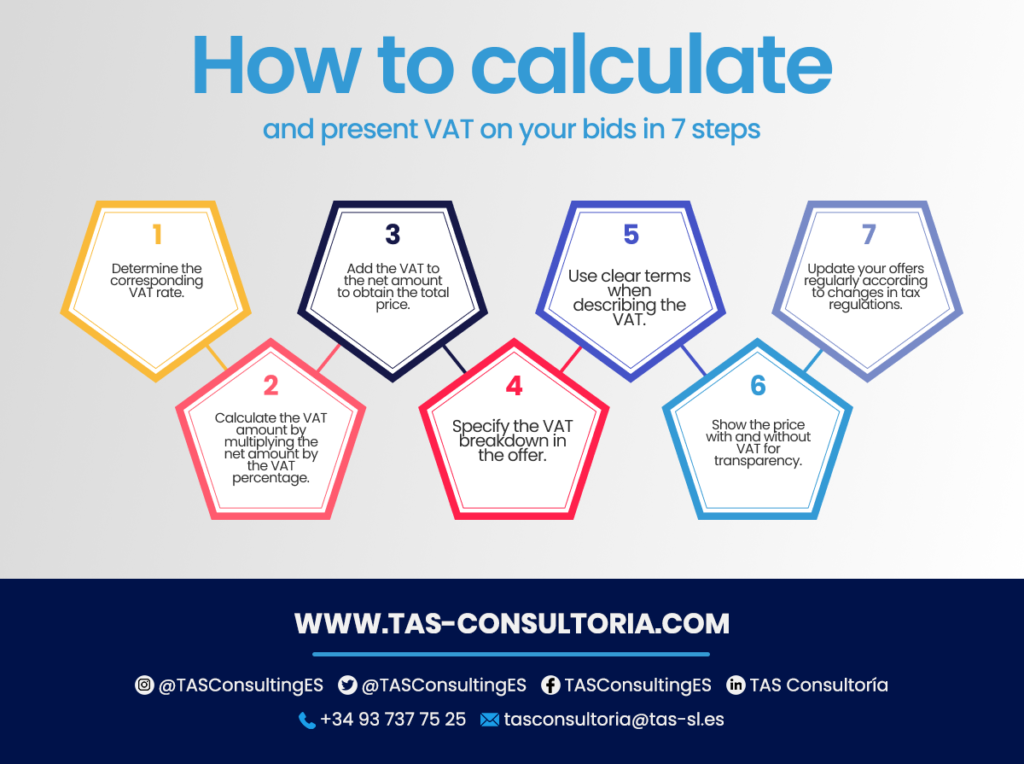

How to calculate and present VAT in your bids effectively

In the Spanish business world, the calculation and correct presentation of Value Added Tax (VAT) is crucial. Knowing how to calculate it in your prices guarantees transparency, legal compliance and efficient financial management. Do you know how to do it efficiently? We explain it to you.

Determines the VAT rate

In Spain, there are different types of Value Added Tax. As mentioned before, there is the general rate (21%), the reduced rate (10%) and the super-reduced rate (4%). It is important to identify the VAT rate corresponding to the products or services you offer.

Calculate the VAT amount

Once the Value Added Tax rate has been identified, you must calculate the amount of the tax. To do this, multiply the net amount of the bid (excluding tax) by the percentage corresponding to the VAT rate. For example, if the net amount is 100 euros and the VAT rate is 21%, the VAT amount would be 21 euros.

Add VAT to the net amount

Once you have calculated the VAT amount, add it to the net amount to obtain the total tax price. In the example above, the total price would be 121 euros (100 euros net amount + 21 euros VAT).

Specifies the VAT breakdown

Within the offer, it clearly shows the breakdown of the Value Added Tax. It indicates the net amount, the VAT amount and the total price so that the customer can easily understand how the final cost is composed.

Use clear terms

Using precise terms when describing the amount of Value Added Tax in your offer is of great importance. Avoid confusion or ambiguity when indicating whether prices are subject to VAT.

Shows price with and without VAT

For clarity, you can show the price both with and without Value Added Tax included. This allows the customer to have a clear reference of the total cost and also the amount of tax being applied.

Update your offers regularly

Consider that Value Added Tax rates may change or there may be exceptions depending on the product or service. Keep up to date with tax regulations and adapt your offers accordingly.

Follow the step by step with this material:

You may also be interested in: Types of taxes in Spain: direct and indirect taxes

Merchants must include Value Added Tax in their Spanish offerings to provide the buyer with a better understanding of the total costs. Also, to comply with the mandatory collection of the tax.

If you need personalized advice on tax matters and want to make sure your Value Added Tax calculations are done correctly, our team of experts is ready to help you. Take control of your tax obligations with confidence and peace of mind, contact us at tasconsultoria@tas-sl.es and tell us your doubts!

Your email address will not be published .

Required fields are marked with *