Do you want to venture into the world of exports, but you don’t know about the VAT applied to this type of operation? Then you have come to the right place. Here we will tell you in detail who is exempt from VAT when exporting in Spain. We will explore the regulations that determine this exemption and how they affect commercial operations. If you want to understand in depth this vital aspect for your business, read on!

What is considered an export in terms of VAT?

When talking about VAT on exports, it is essential to understand which operations are considered exports and which are not. The VAT treatment and exemptions vary according to this distinction.

In general, export is understood as the legitimate traffic of goods and services from one country to another. However, not all commercial transactions between different countries meet the export criteria.

This is due to the fact that some territories share a common economy, as is the case of the European Union (EU). In this case, the application of VAT on exports is different.

That said, for a transaction to be considered an export for VAT purposes, it must involve: the shipment of a product or service outside the EU or to a country that does not apply VAT. Even if that country is a Member State of the European Union.

You may also be interested in: What is an intra-community VAT number?

Which law addresses the handling of VAT on exports?

The regulation of the legal aspects related to VAT on exports is in the Value Added Tax Law 37/1992.

This is commonly known as the “VAT Law”. This legislation covers all matters related to VAT in the country. Including those that are exempt from VAT on exports.

VAT management in the EU is established in a common framework defined by the European Council Directive 2006/112/EC. It deals with the common system of value added tax. In that sense, this directive is part of the laws of each EU member country, ensuring a proper functioning of the tax at intra-community level and assessing those who are exempt from VAT.

VAT applied to exports to EU countries

As we told you, the sale of goods or services to another country is usually considered an export. However, in the context of intra-EU transactions, these are not technically categorized as exports.

This is because the EU has abolished the “fiscal borders” between its Member States. This provides more flexibility in the application of VAT on the export of goods and services. It thus gives rise to a more appropriate term to describe these actions: intra-community transactions.

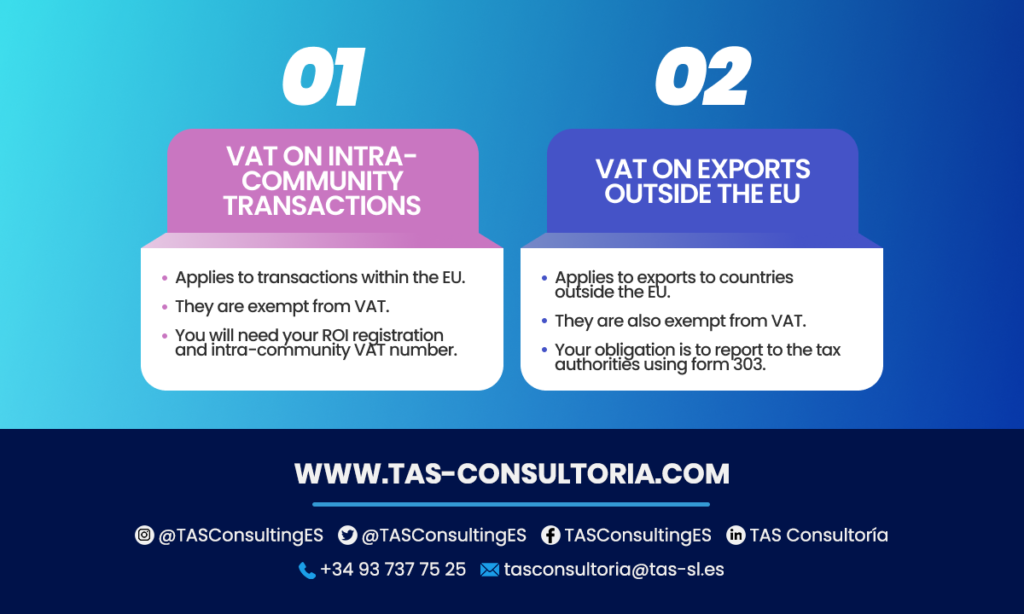

In general terms, intra-community operations (between EU countries) and those who carry it out are exempt from VAT. This means that you can sell products from Spain to another company located in an EU country without applying VAT on the invoice. However, for businesses to be exempt from VAT, they must meet certain requirements.

- Firstly, it is essential to register in the Register of Intra-Community Operators (ROI). For exports within the EU to be exempt from VAT, all parties involved in the transaction must be registered in this registry.

- If you are already registered with the ROI, it is possible to obtain an intra-community VAT number. This will allow you to carry out intra-community operations and to be among those who are exempt from VAT.

VAT levied on exports to non-EU countries

A similar situation occurs for exports to countries outside the European Union. They are also called extra-EU operations and it is not necessary to include VAT in the sales invoices.

According to the Law, transactions with non-EU countries are considered exports. Consequently, those exporting services and goods are exempt from VAT. This exemption applies to sales to other companies as well as to individuals.

However, professionals and businessmen must inform the tax authorities of these extra-Community transactions by means of form 303.

We share with you the key points below:

You may also be interested in: Form 036 and 037: registering with the Tax Authorities

Other benefits for those exempt from VAT on exports outside the EU

In addition to not incorporating VAT on invoices, there are other advantages for those who carry out operations outside the EU. Professionals and entrepreneurs who meet certain requirements will be able to access what is known as full VAT exemption.

This implies that not only VAT will not be applied on the sales invoice. They will also be able to deduct VAT on purchases related to that export.

In short, VAT is not charged on the sales invoice, but the money spent on the purchases necessary for that export can be recovered. This represents an obvious advantage for VAT-exempt businesses.

Therefore, the criteria for exporting to non-EU countries with full VAT exemption are as follows:

- The transaction must be a sale documented before the corresponding Tax Agency.

- In the case of the sale of goods, the goods must leave the EU territory within a maximum period of 30 days.

- In addition, professionals and companies involved in operations involving customs procedures will need to obtain the EORI number. This is essential for import and export operations.

You may also be interested in: FDI in Spain: main sectors of opportunity

Now that you know who is exempt from VAT on exports in Spain, it’s time to take action. Do you need personalized tax advice and want to explore how to apply this knowledge to your business? Don’t hesitate to schedule a tax consultation with us at tasconsultoria@tas-sl.es.

We are here to help you optimize your business operations, don’t miss this opportunity and ensure your company’s success! Contact us for a tax consultation specific to your business.

Your email address will not be published .

Required fields are marked with *