The IBI payment season is one of the most worrying moments for the owners of local houses, offices or Spanish buildings, because for many it is a complicated time of the payment season. In view of this, every year the city councils apply aids or reductions in the IBI to facilitate this payment to the citizens. If you need help from the town halls to pay the IBI, below we tell you which are the ones that will provide these aids, help us!

What is the Real Estate Tax (IBI)?

The Real Estate Tax (IBI) refers to the tax levied on the value of urban, rustic or special characteristics real estate.

The General Directorate of Cadastre is in charge of determining the nature of the property, which catalogs the land.

In case of being catalogued with special characteristics due to its technical conditions, the value of the real estate, as well as its nature and uses, will be pre-established by the corresponding cadastral regulations.

You may also be interested in: Double taxation in Spain

Who has to pay IBI?

According to Article 63 of the Revised Text of the Law Regulating Local Treasuries, IBI is payable by individuals and legal entities.

It must also be cancelled by the entities provided for in Article 35.4 of the General Tax Law that have the ownership of a right that is constituted of the taxable event of this tax.

In the event that a property has different owners with rights over said property, the law establishes that:

- Taxpayers are the holders of administrative concessions.

- Holders of surface rights, holders of usufruct rights in rem.

- Holders of property rights.

Similarly, the Law clarifies that if there is a prior right, it excludes holders with subsequent rights from being liable for IBI. Thus, if a right of usufruct and ownership coincide, the taxpayer is the usufructuary.

In the event of a transfer, the new owner must pay IBI from the year following the date of acquisition.

What are the entities?

Article 35.4 of the General Tax Law considers as entities those groups of persons that, despite having interests in common and being holders of rights according to their legal status, do not have legal personality by themselves.

Within this group are included the inheritances, community property and those entities that, although they do not have any legal personality, constitute an economic unit or a separate estate susceptible to taxation.

When must IBI be paid?

The dates to pay the IBI will depend on each city council and they will determine in the tax ordinances the payment dates. After the end of the voluntary payment period, the debt will be enforced with the corresponding surcharge and late payment interest.

You may also be interested in: How to defer the payment of taxes in Spain?

Where is the Real Estate Tax paid?

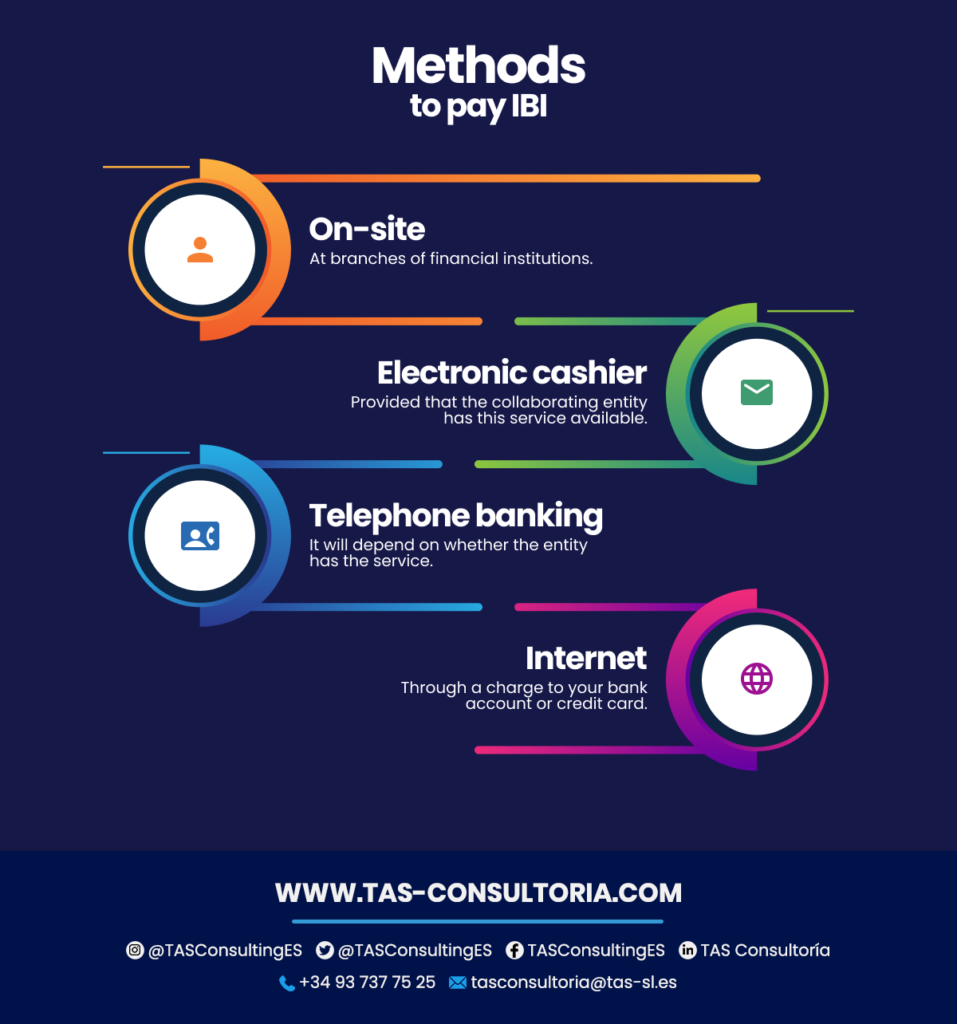

To pay the IBI you must go to the collaborating entities indicated in the payment letter. Then, you will have to pay according to the payment method you have chosen. In that sense, the modalities can be:

It is important to note that in order to pay the IBI you must have what is known as a payment letter that BASE sends by ordinary mail. This is in order to facilitate this procedure for the taxpayer.

In case you do not receive this payment letter, you will have to request a duplicate at any of the base offices.

Which municipalities have announced IBI subsidies or reductions for 2023?

Some municipalities, with the purpose of helping people to keep up with the payment of the IBI, decided to make aids or reductions to facilitate the cancellation of such tax.

That said, the list of municipalities that proposed rebates to pay the IBI 2023, were:

Torremolinos

The Torremolinos town hall has earmarked 2 million euros this year to help pay the IBI during 2023. However, in order to make use of this help, residents must not have applied for such help before.

To apply for this assistance, the application must be made from February 1 to March 1. This application can be made either in person or digitally.

Elche

The City Council of Elche recently announced that of the total number of applications for aid submitted last year for the payment of IBI, 90% of them had been approved. Of these, a total of 1.3 million euros has been paid.

Only 94 applications were pending for payment, and the increased flexibility in the requirements for these grants was also highlighted.

Almuñécar

The town hall of Almuñécar opened applications for the payment of the property tax. In the municipality of Granada, the aids are available for widows and people over 65 years of age with few economic resources.

Also, they are for people with disabilities over 65%, people at risk of social exclusion, families with dependent children and victims of gender violence, as stated by the councilman of finance.

Torrejón de Ardoz

The Mayor’s Office of Torrejón de Ardoz also recently announced that they will reduce the receipt to pay the IBI by 10% for all taxpayers and by an additional 5% if direct debit is used.

This measure is intended to help families in difficult economic situations. In addition, it will maintain the payment exception for families with all their members unemployed during 2022, and will also offer reductions of 5% for general installments in two payments.

Barruelo

The city council of Barruelo de Santullán (Palencia), also opened the deadline to apply for the IBI payment rebate for owners of rental properties and for new businesses.

In the case of rental property owners who can prove their situation, they can apply for a 50% discount on their IBI payment for this year.

On the other hand, new businesses that accrue IBI and are newly installed, can apply for a 95% bonus on the payment of the tax and the deadline to apply for the bonus.

Calpe

This municipality has dedicated itself to reissuing an IBI payment assistance program for retirees, pensioners under 65 years of age and the long-term unemployed.

The aid consists of including a bonus of up to 400 € and a reduction of 85% of the amount of IBI. In addition, the amount of the aid can be increased by 10% for people with disabilities or disabled family members with a degree of disability equal to or greater than 33%.

La Nucia

In the case of the Alicante City Council, it has allocated 2.8 million euros for social emergency aid. Among these aids are the aids for the payment of the Real Estate Tax and the water tax, as well as for adult education.

Quarta de Poblet

The mayor of this municipality has announced that the city has always been considered to be able to offer opportunities to people. Helping them with their education, with food aid, to pay the IBI and more.

Santander.

In the list of proposals agreed upon by the Santander City Council for 2023, they can be found in 3 categories: social, neighborhoods, and improvement.

The social category includes measures such as energy vouchers for families, a discount on IBI payments, help for rental housing, vouchers for start-up and hostelry and a quota of hours for free use of subway parking lots.

You may also be interested in: Hiring a real estate agency: what should you know?

Do you want to know if your municipality is also in this group? Just contact us through our email tasconsultoria@tas-sl.es. We will give you all the information and advice you need to pay the IBI. Do not miss the opportunity to contact us and request your free advice!

Your email address will not be published .

Required fields are marked with *