Since it is important for you to know under what circumstances you are entitled to unemployment insurance in 2023, in this post we will explain it to you. Find out here when the self-employed are entitled to unemployment benefit and how you can benefit from this if you need it. Don’t miss out on this valuable information that could make a difference to your financial security, read on and find out the details!

Do self-employed workers have access to severance benefits?

Are the self-employed entitled to unemployment and do they have benefits? They can obtain compensation when they close their business, just like employees in a dependent relationship.

However, this assistance is not called “unemployment”, but “cessation of activity”. Although many self-employed people are unaware of this right, severance pay has more than thirteen years of history. And it arose after efforts by self-employed organizations to equalize their rights with those of employees.

The regulations governing this benefit were introduced in Law 32/2010 to protect the self-employed in situations of layoffs. Despite referring to the “unemployment of the self-employed”, it does not function as unemployment insurance for employees. Social Security contributions finance both benefits.

However, access to termination for the self-employed is different. It is not automatic when closing the business, specific conditions and legal requirements must be met. Such as termination for economic reasons or force majeure, and meeting other criteria. Being so, since 2019 the self-employed are entitled to unemployment and allocate part of their monthly contribution to the cessation. Providing access to the benefit if they meet the requirements.

With the system of contributions based on actual income in 2023, the situations for accessing severance pay are expanded. In some cases, it is no longer necessary to close the business to receive compensation.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

In what situations are the self-employed entitled to unemployment benefits?

Not all self-employed workers who decide to close their business are automatically entitled to unemployment benefits. In fact, the main distinction between unemployment benefit and termination of activity lies in: for the self-employed, access to termination of activity is more complicated compared to salaried employees.

It is clear that the self-employed are entitled to unemployment benefits. But they can only access a benefit for termination of activity in specific situations and when they meet certain requirements. In the cases detailed below, an amount equivalent to 70% of the contribution base will be granted. The mutual insurance company will pay the self-employed person’s monthly contribution.

Closure due to economic, technical, productive or organizational reasons that make it unfeasible to continue with the economic activity.

The first scenario contemplated by the legislation refers to the so-called ETOP (Economic, Technical, Organizational or Productive) factors. To receive this benefit it is necessary to close the business or transfer it to third parties.

The self-employed are entitled to unemployment and if they have ETOP reasons, they will be able to access the termination of activity. We share with you the accepted cases:

You may also be interested in: Is it possible to hire personnel as a freelancer in Spain?

New scenarios for accessing the benefit in 2023

With the recent contribution system, there are more circumstances in which a self-employed person opts for the termination of activity. It is based on real income.

In that sense, the self-employed are entitled to unemployment under the circumstances mentioned above. But the following situations have also been incorporated to be entitled to the benefit, this year:

Self-employed with employees

They may apply for the benefit if they have reduced the working hours of their entire team by 60%. Or if they have suspended 60% of the company’s contracts through an ERTE.

Self-employed without employees

Self-employed persons are entitled to unemployment benefits and may receive the benefit if their debts are equal to 150% of the sales obtained during the last two fiscal quarters.

In connection with these two new benefits, two additional requirements must be met:

- In the two fiscal quarters prior to the application, a 75% decrease in income or sales must have occurred. With respect to the same periods of the previous year.

- The net monthly income (earnings) of the self-employed cannot reach the minimum interprofessional wage (SMI). This amounts to 1,080 euros.

In addition, for the first time, the law incorporates the notion of “partial cessation of activity”, which is for cases of closure due to force majeure. Now, when the activity is suspended due to force majeure, it will not be necessary for this suspension to be permanent.

This measure is beneficial in several situations. Especially in those where only part or one of the workplaces is affected by the force majeure. In the case of multiple workplaces.

The self-employed are entitled to unemployment and may partially cease activity due to force majeure. Only when this is linked to a declaration of emergency issued by the competent authority. For this, two requirements must be met:

- The drop in revenues should be 75% in relation to the same period of the previous year.

- The monthly income of the self-employed must not reach the SMI. Or the amount of the base for which he/she was previously contributing.

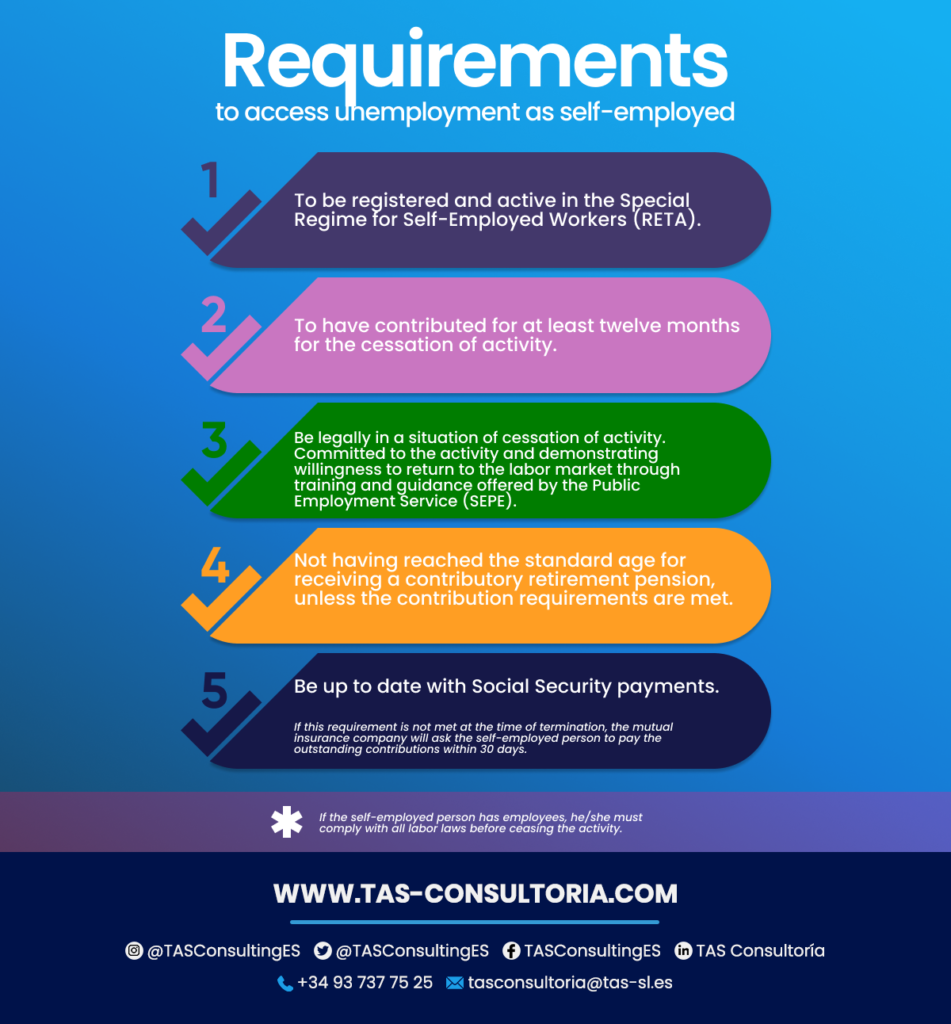

Requirements for accessing unemployment benefits as a self-employed worker

In each situation that allows the cessation of activity, the self-employed must meet specific conditions to receive the benefit. Just as there are general requirements for all cases that self-employed workers must meet:

You may also be interested in: Learn about the new quotas for the self-employed 2023-2031

Knowing when self-employed individuals are eligible for unemployment is crucial to making sure your entrepreneurial efforts are supported. Requirements and situations vary, but having this information can make all the difference in your financial security.

If you are looking for further guidance in this process, we strongly encourage you to request a personalized and expert tax consultation. Our team is here to help you understand and make the most of the options available to you. Feel free to contact us at tasconsultoria@tas-sl.es to get the advice you need at this stage of your freelance career.

Your email address will not be published .

Required fields are marked with *