Choosing the right sources of financing becomes a critical factor for the growth and adaptation of your company. Especially for expanding and thriving in the competitive business environment. Explore the financing options available and analyze which of them could be the most beneficial for your business: should you opt for your own resources or turn to external sources of financing? Read on!

What is and what are the two forms of internal financing?

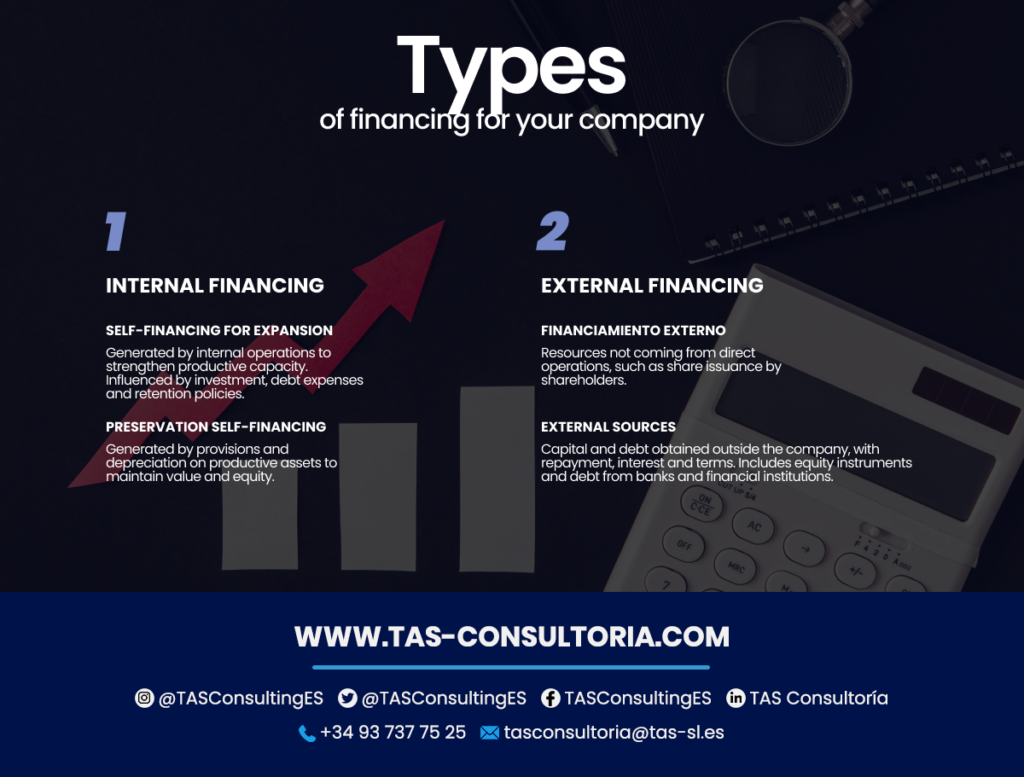

Within the sources of financing to sustain the operation of your company we have internal financing. This involves generating its own resources. Thus, two variants of internal self-financing can be distinguished:

Self-financing of expansion

This type of self-financing is derived from the company’s own economic operations. It is often referred to as asset accumulation and is intended to strengthen the company’s productive capacity.

That said, the factors that impact this type of self-financing and, therefore, the company’s economic growth, are as follows:

- Return on investment

- Debt expenses

- Earnings retention policy

- Tax obligations, among others.

2. Self-financing of preservation

This approach within the sources of financing comes from provisions and depreciation on productive assets. Its objective is to maintain the value of the assets, ensuring the continued development of the company and the safeguarding of its equity.

You may also be interested in: Expansion and Diversification Strategies

What is external financing and what are its two variants?

The need for external financing arises when the company lacks sufficient financial resources to maintain its continuous operation. It is important to note that the lack of liquidity at a specific moment does not imply the company’s non-viability or lack of profitability. It is, rather, a momentary need for external resources.

In this regard, two types of external financing can be identified:

1. Internal financing sources

These financial resources are considered internal resources, since their reimbursement is not a mandatory requirement. Although they originate outside the company because they do not come from its direct economic activity.

An example is the issuance of shares by the company’s shareholders as a source of financing.

2. External sources of financing

These are also financial resources obtained from sources outside the company. However, they are characterized by repayment with interest, repayment terms, contractual payments and priorities in solvency situations.

These resources may come from banking, financial or private entities. Among the services offered by these institutions are financial leasing, leasing, collective financing, confirming, and others.

This category includes equity instruments, where the company trades a residual interest in its assets. Debt instruments are also included. All through contracts that involve a monetary delivery that the supplier will receive in a fixed term with an interest cost.

Have the summary of both funding sources available:

Differences between internal and external financing

You already know the nature of each type of financing source within a company. Now, we will explore the disparities between internal and external financing.

To achieve this, we will analyze the positive and negative aspects associated with each of these two sources of financing.

Internal financing

- Positive aspects

Within this category of financing sources, it is not necessary to obtain external approval. This provides greater autonomy and speed in decision making due to the absence of collateral or guarantee requirements. However, it is always prudent to make a secondary evaluation of the profitability of the investment.

Since these resources are internal, this form of financing does not involve reciprocity, disbursement or interest to any other organization. This leads to greater profitability by reducing financial, banking and administrative costs.

- Negative aspects

Opting for internal financing sometimes results in a decrease of the company’s own resources. Leaving them unavailable to address short-term challenges.

You must also consider the opportunity costs associated with using the company’s resources as sources of financing. It is imperative to evaluate both the short and long-term ramifications. Finding a balance between liquidity and profitability of our economic activities is key.

External financing

- Positive aspects

External sources of financing are quite common. Since companies do not always have sufficient internal resources to support their projects.

External financiers are often valuable in providing a fresh perspective. Especially on the profitability and opportunities presented by project finance. In addition, they are efficient due to their unbiased and independent nature.

- Negative aspects

A drawback of these financing sources is the associated cost. Therefore, it is crucial to weigh the cost-benefit ratio, along with evaluating the financial returns of the financing.

Delegating project financing to another organization does not necessarily imply greater dependence in decision-making. On the other hand, it does require more time due to the technical and legal procedures inherent to such operations.

You may also be interested in: How to establish a branch in Spain?

Which source of financing to choose: in-house or external resources?

When making financial decisions, a thorough analysis of the business economics becomes imperative. Such an evaluation makes it possible to accurately assess the advantages and challenges inherent in each of the possible sources of financing.

In this regard: it is essential to know that there are no universal master formulas. Instead, you must understand that the different sources of financing find their optimal deployment at specific times. Always related to the company’s position.

This notion takes on a crucial nuance, because you can opt for an alternative, solid and reasonable solution: the convergence of resources. Through this union, an approach is born that harmonizes two seemingly disparate forces:

- By adopting this strategy, you avoid the inherent risk of premature depletion of internal resources.

- You also avoid the vulnerability of being totally dependent on external financing.

The implementation of this convergence strategy not only safeguards the company’s financial equilibrium. It also lays a solid foundation for its sustainable development.

You may also be interested in: All about the entrepreneur visa in Spain

The choice between equity and external resources as sources of financing is a crucial step on the path to business growth. A detailed understanding of their advantages and challenges will provide you with the guidance you need to make successful decisions.

Ready to take the next step in your financial strategy? Consider seeking accounting advice to complement your approach to growth. Also, if you are in the early stages, create your business with us! Lay a solid foundation for your business success.

Your email address will not be published .

Required fields are marked with *