The date for filing the income tax return is approaching, you still don’t know what’s new? Then this article is for you. Here, we will provide you with the necessary information about what is new in the 2022 income tax return. You see, changes in interest rates and benefits for those with low incomes are coming. Also, specific measures will be applied for the Autonomous Communities and more. Stay until the end and don’t miss the details!

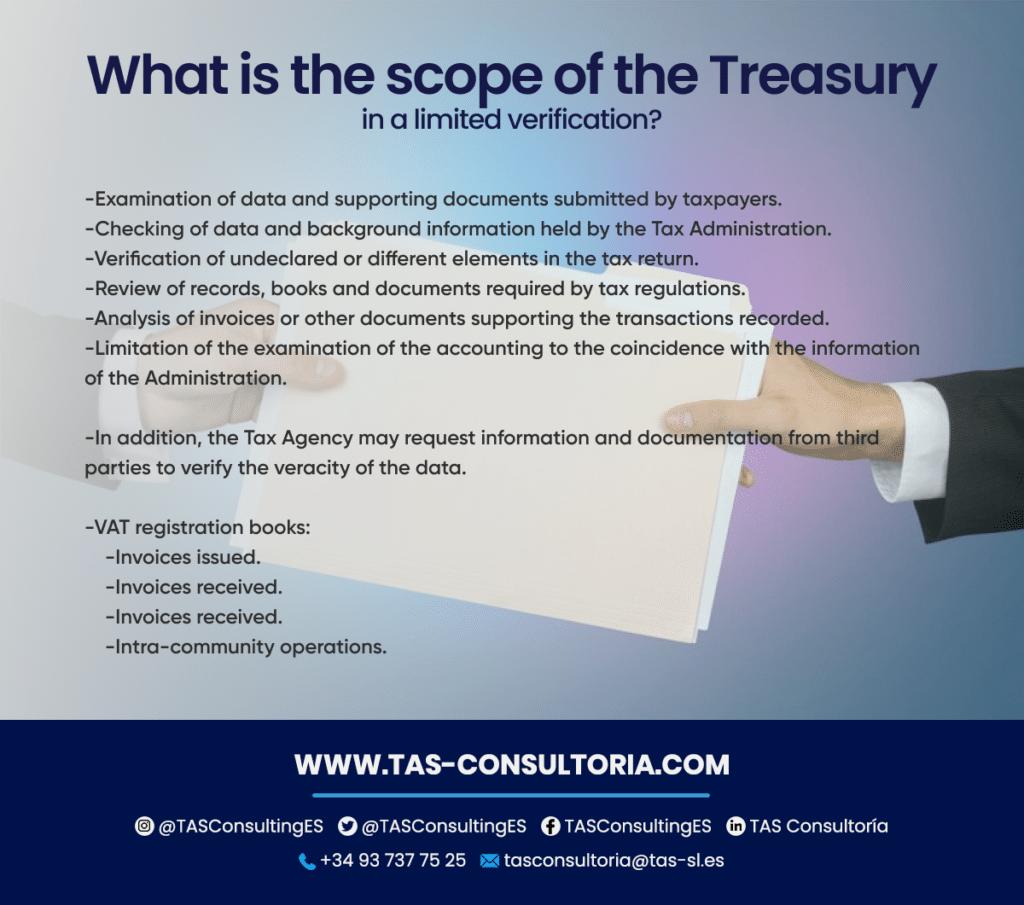

Treasury Department expands its capacity to review accounting records in limited audit procedures

As of May 26, the Administration will be able to request the accounting records of a company in a limited verification. An important part of the new 2022 income is that it will not be necessary to carry out an inspection procedure as it was required.

In addition, the documentation that the Administration may request from third parties has been expanded. This will be used, then, to verify the veracity of the information it already has in its control.

This important modification in the limited verification procedure is established by Law 13/2023. This measure amends the General Tax Law (LGT) and other tax regulations. In addition to this change, DAC 7 is incorporated into Spanish law.

As an important part of the novelties of the income tax return 2022, this law makes a real reform of the LGT. It broadens and specifies the actions that the Administration can carry out within the limited verification procedure.

The examination of the accounts is limited to verifying the concordance between the information in the Administration’s possession, including that obtained in the procedure itself. However, the request for information on financial movements is not allowed.

Therefore, we share with you the details of this measure within the new income 2022 and its scope in the accounting documents:

You may also be interested in: What is an intra-community VAT number?

What will the tax authorities require in your company’s accounting?

Accounting must be adequate to generate the necessary records to support the VAT return and payment. Even so, what are the basic requirements that the Administration will evaluate after the new 2022 income tax return? Here are some of them:

- Accounting plays a key role in accurately calculating the VAT collected from customers. It is also vital in calculating the tax paid on the purchase of goods and services from suppliers.

- The books can be kept electronically. Therefore, you must keep the necessary files, databases and programs on magnetic or optical media during the statute of limitations period.

- Entrepreneurs with monthly VAT self-assessments must keep the VAT registration books through the AEAT e-Office. All this through the electronic supply of invoicing records (SII).

- Commercial and accounting regulations require accounting books to be kept, which must be legalized at the Commercial Registry.

- These books include an inventory and annual accounts book, as well as a journal.

New 2022 income tax return: a measure in favor of professional secrecy

Another aspect of the new 2022 income tax return is that modifications will be made in favor of taxpayers.

These measures will allow information about clients’ aggressive tax planning not to be disclosed by lawyers. This being so, the text of the amendment seeks to comply with the ruling of the Court of Justice of the European Union.

It is important to remember that in December of last year, this court annulled the section of DAC 6. This imposed restrictions on the professional secrecy of tax advisors, obliging them to report on the aggressive practices of their clients.

You may also be interested in: VAT rates in Spain: updates 2022

Updates and tax benefits for the self-employed in the 2022 income tax return

As the new 2022 income tax return developments arise, it is important for you to know how these measures affect the preparation and filing of your tax return. With this in mind, it is crucial that you know them in detail, since many of them could provide you with benefits. Take note, we present them below:

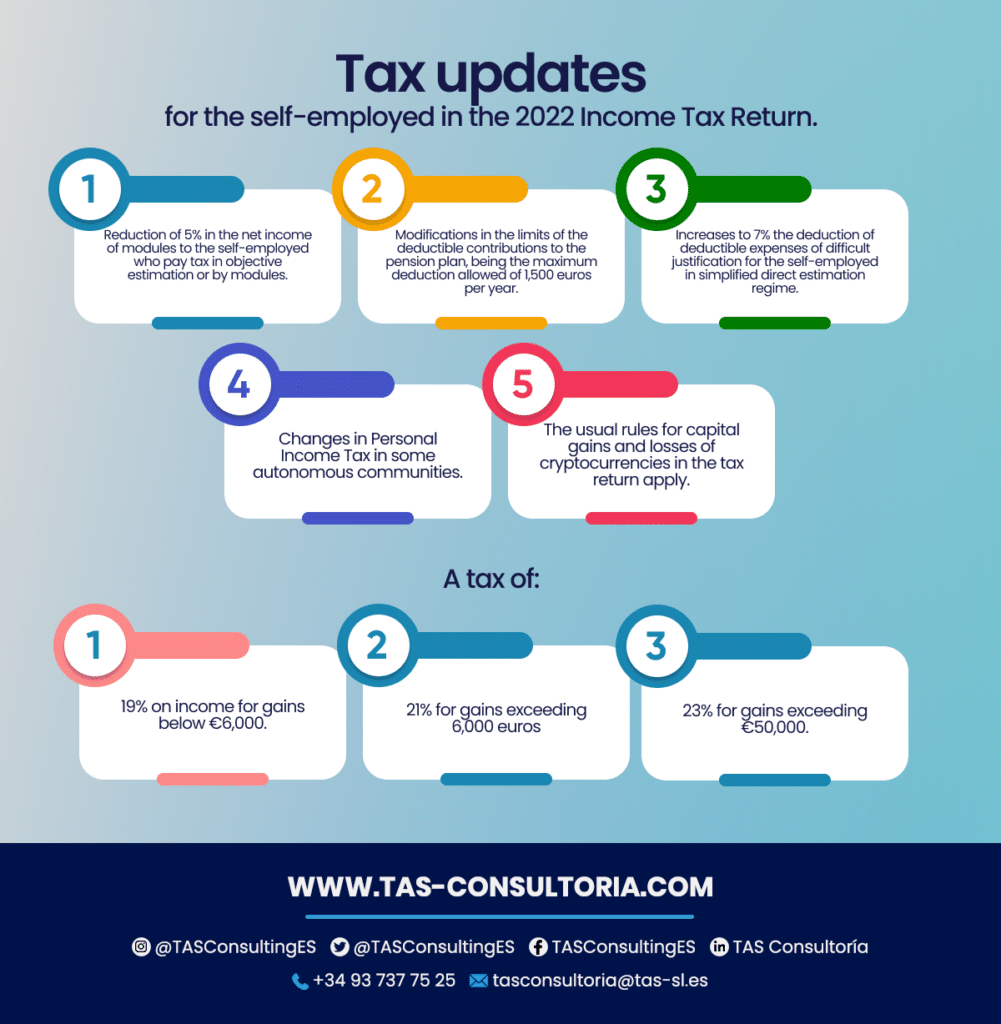

New 5% reduction in income tax (IRPF)

One of the most beneficial new income 2022 is for the self-employed, who are taxed in objective estimation or by modules. Additionally, their net income from modules will be reduced by 5%.

This means significant savings for the self-employed when filing their taxes.

Establishment of an additional limit on contributions to pension plans

In order to file your income tax return, you can deduct a specific amount from the contributions made to the pension plan.

As of July 1, 2022, a law regulating the promotion of occupational pension plans came into force. This law included several modifications to the limits.

This year, the maximum deduction allowed is 1,500 euros per year. Previously, during the last campaign, the limit was 2,000 euros.

On the other hand, for the Income tax returns filed in the year 2023, corresponding to the previous year, it has been reduced. These new features of the 2022 income tax return may change important details in your pension plan.

Modifications to the deduction for expenses not justifiable by invoice

In the daily life of a self-employed person, various expenses related to his or her activity arise. These expenses can be considered deductible before the tax authorities if their relationship with the business can be demonstrated. In that sense, there is a percentage of expenses, called “difficult to justify”, that can be deducted even without an invoice.

Likewise, an important change was established for these cases. The deduction of deductible expenses that are difficult to justify is increased to 7% for self-employed taxpayers under the simplified direct estimation regime. In the case of the corporate self-employed, the deduction is reduced to 3%.

Tax advantages in certain autonomous communities

This year, one of the novelties of the 2022 income tax return is that 5 autonomous communities implemented changes in the Personal Income Tax. These are:

- Madrid, which will reduce the tax by 6.26% for the lowest incomes, with a gross annual salary of 20,000 euros.

- Andalusia, Galicia and Murcia will reduce the regional personal income tax rate by 4.3%.

- Valencia will decrease personal income tax for incomes below 60,000 euros and will increase all regional deductions by 10%.

What will happen to cryptocurrency with respect to the new 2022 income tax return?

It is necessary to include cryptocurrencies in the tax return. This is because the usual rules for capital gains and losses apply.

If they are sold, regardless of whether profits or losses were obtained, they must be declared. Even if income was generated in another currency and not in euros, it must also be reported to the Tax Agency.

If you find yourself in any of these situations and wish to avoid penalties from the Internal Revenue Service, you should consider the following impositions of the Tax Agency:

- Gains from cryptocurrency transactions of less than €6,000 are subject to a 19% income tax.

- In the case of gains from cryptocurrency transactions in excess of €6,000, a 21% income tax is levied.

- When profits from cryptocurrency transactions exceed €50,000, the tax is increased to 23%.

You may also be interested in: Tax advantages offered by the Canary Islands

The new 2022 income tax returns for the self-employed are significant changes that require a clear and accurate understanding, ensuring proper compliance with tax obligations. Our team of experts is ready to help you navigate this new scenario and optimize your tax return.

Do not hesitate to contact us and get the personalized advice you need to maximize your benefits with the new rent 2022!

Your email address will not be published .

Required fields are marked with *