You should know that VAT is not applied uniformly. The Regime of Differentiated Sectors in this tax is a key element because it modulates its application. This depends on the nature of the business activities. We will explain this regime and we will see which companies it directly affects. Do you want to clarify your doubts about value added tax in Spain? Keep reading!

What is the VAT pro-rata rule?

The VAT pro-rata rule is a tax system that deals with the deduction of the VAT paid. Either in the acquisition of goods or services by self-employed, professionals or entrepreneurs. This system is applied when these professionals issue invoices with VAT and others without VAT. Especially in the development of the same or multiple activities that are not categorized as differentiated sectors. This subject will be dealt with later on.

In this context, pro-rata rule applies. Following the guidelines established in articles 102 to 106 of the VAT Law 37/1992.

The pro-rata rule solves the challenge related to the deduction of VAT paid by self-employed and SMEs. Specifically, when simultaneously performing value added tax taxable and non-exempt activities.

If you find it difficult to understand the complexities of apportionment, it is advisable to seek the support of an advisory service. One that can fulfill your tax obligations on your behalf.

You may also be interested in: Types of taxation in Spain: direct and indirect taxes

Classification of VAT apportionment methods

There are two variants of VAT apportionment: the General Apportionment and the Special Apportionment, which differ in their application process.

The choice between general and special apportionment, which we will detail below, is free choice. Except in certain cases where the special prorata is required to be applied. Read the formulas for calculating each and other key points:

General VAT apportionment

It implies the partial deduction of expenses that include VAT. This is based on the percentage of sales that does generate the right to deduct from total sales. Here is an example to illustrate its application:

You are a freelancer dedicated to training. An activity subject to VAT which in many cases is exempt, but in others it is not. For this reason it lends itself to this example.

Your sales or services during the last year were:

- Domestic sales with VAT: 1,000 euros

- VAT exempt domestic sales: 4,000 euros

- Input VAT on the purchase of goods and services amounted to 3,000 euros.

Calculation of the general VAT apportionment:

1,000 / (1,000 + 4,000) = 0.2%

Once this percentage is obtained, it is multiplied by the total expenses incurred:

- 3,000 * 0.2 = 600 euros, which are deductible.

This pro rata is not definitive. It is applied until the end of the fiscal year, during the presentation of the fourth quarter with the form 303.

At that moment, a definitive apportionment is made to regularize the situation. This definitive apportionment is taken as provisional for the beginning of the new fiscal year.

In form 390, it is necessary to include certain information related to the pro-rata.

Special VAT apportionment

In order to apply the special VAT apportionment, it is necessary to distinguish between:

- Expenses related to invoices issued with VAT, which can be deducted in full.

- Expenses related to invoices issued without VAT, which cannot be deducted in any proportion.

- Common expenses: it is to which the percentage resulting from the general VAT pro-rata must be applied. In the previous case it amounts to 0.2%.

With this type of apportionment, the self-employed can fully deduct the VAT related to the activity subject to this tax. In addition to a percentage of the VAT linked to common expenses between both activities.

The choice between one or the other VAT apportionment depends on the turnover volume of each activity. As well as the volume of expenses that you have in each one of them.

However, it is obligatory if the deductible installments exceed 10% of the result of the general pro rata.

When starting the activity, you can choose the special pro-rata through the census form (036 or 037). Or also, during the declaration of the fourth quarter (form 303), with the possibility of retroactive effects for the whole fiscal year.

You may also be interested in: What is the Financial Transaction Tax?

What is the Differentiated Sectors Regime?

The Regime of Differentiated Sectors (RSD) is a model of sectoral organization that seeks to promote competition and efficiency in the economy. It establishes that economic sectors are organized at different levels of government. This allows for greater agility and responsibility in decision making.

When are the business activities you carry out (and affect your VAT taxation) considered to be of distinct sectors? To do so, one of the following two situations must be met:

- If you are engaged in several economic activities and one of them is under the equivalence surcharge regime. Also to the simplified regime or special agricultural regime.

For example:

You have an activity in the General Regime. Such as the preparation of homemade food. Along with an activity of purchase and sale of beverages and other food products ready for consumption. These could be in the equivalence surcharge.

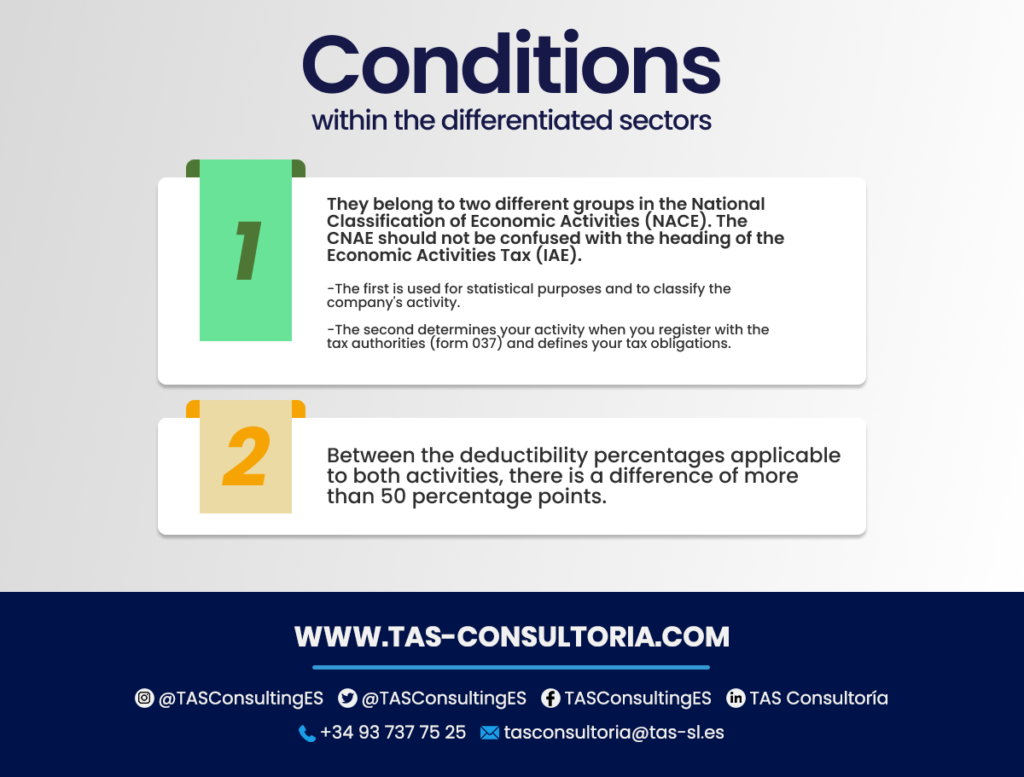

- If you carry out multiple economic activities and meet the following conditions:

For example:

The economic activities of a self-employed person are training, which is exempt from VAT, and a professional architectural activity. Both activities belong to different groups in the CNAE.

While the former does not generate a right to deduction, the latter has a right to deduction of 100%. Therefore, the difference between the deduction percentages of both activities exceeds 50%.

If you find yourself in either of these two cases, you should know that your ability to deduct VAT will be limited. You will have to follow rules similar to those for the special apportionment. Following the example above:

- VAT on goods and services related to the training activity may not be deducted to any extent.

- VAT incurred in the acquisition of goods and services related to the architectural activity may be deducted in full.

- The input VAT on expenses common to both activities will be deductible proportionally. Applying the percentage explained in the general pro-rata section.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

The correct application of this regime can result in substantial savings. If you need personalized advice for your business in relation to VAT and optimize your tax situation: do not hesitate to contact our experts at tasconsultoria@tas-sl.es.

We are here to help you navigate this complex tax landscape and maximize your tax advantage. Don’t wait any longer to make strategic financial decisions!

Your email address will not be published .

Required fields are marked with *