What does the General Chart of Accounts for SMEs really mean? Below, we break down its meaning, associated regulations and how it affects the accounting of small and medium-sized companies. If you want to know more about this essential topic for financial management, we invite you to read on and find out more!

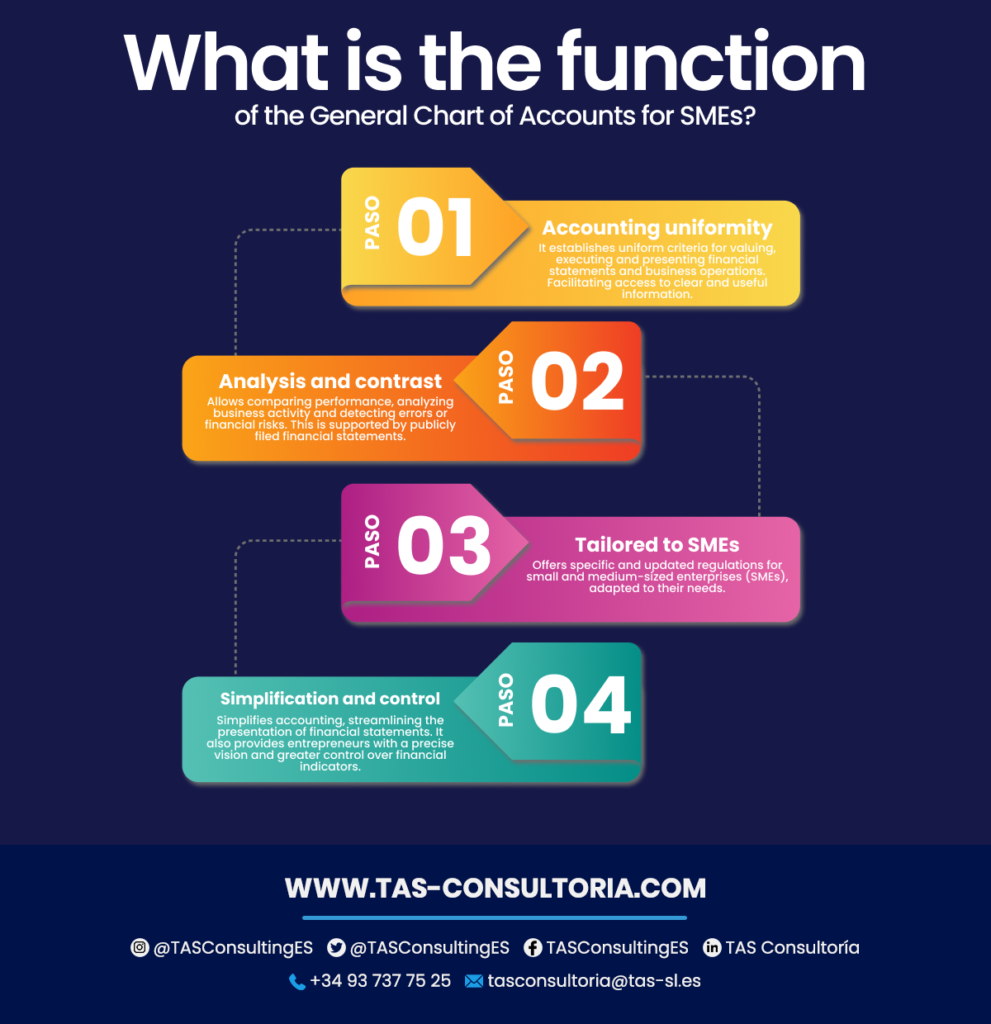

What is the function of the General Chart of Accounts for SMEs?

The General Accounting Plan for SMEs stipulates that companies must follow its guidelines. The plan was established in 1973.

Royal Decree 1/2021 approved the most recent of several revisions. Prepared by the Instituto de Contabilidad y Auditoría de Cuentas (Accounting and Auditing Institute). This legal document aligns with European procedures and aims to standardize accounting criteria.

This document contains the accounting regulations currently in force that apply to companies in Spain. Therefore, it becomes a manual for consultation and reference. All accounting professionals turn to it to resolve their uncertainties and establish procedures.

In this sense, the General Accounting Plan provides a legal and regulatory framework to carry out the mandatory financial accounting of companies. Its main functions are:

You may also be interested in: Spanish companies and ICO guarantees

How does the General Chart of Accounts for SMEs work and what are the application criteria?

The BOE General Accounting Plan designed for SMEs is an optional alternative to the standard version. You can adopt it instead of the general approach if you meet at least two of the following requirements for two consecutive fiscal years:

- Not to exceed an average of 50 employees during the fiscal year.

- Maintain total assets not exceeding 4 million euros.

- Not to exceed an annual net turnover of 8 million euros.

In the specific case of micro-enterprises, the criteria for applying the General Chart of Accounts vary, as follows:

- Not to have more than 10 workers on staff during the year.

- Maintain total assets not exceeding one million euros.

- Not to exceed an annual net turnover of 2 million euros.

You may also be interested in: Ways to operate in Spain

What is the structure of the General Chart of Accounts for SMEs?

The fundamental elements comprise accounting principles and accounting standards. The information requirements and components of the financial statements are established within this conceptual framework. In addition to the recording and valuation criteria, regulatory guidelines to be applied are also established.

Recording and valuation guidelines for SMEs

This section details the accounting principles that SMEs must apply in different scenarios. Either to record and account for their economic and financial operations. This section of the General Chart of Accounts covers:

- Development of accounting principles.

- Property and equipment.

- Specific regulations on property and equipment.

- Real estate investments.

- Intangible assets.

- Specific regulations on intangible assets.

- Current assets and assets held for sale.

- Leases and similar operations.

- Financial instruments.

- Inventories.

- Transactions in foreign currency.

- Indirect taxes such as VAT and others.

Presentation of financial statements

Section of the General Accounting Plan that details important guidelines. They are for presenting the results of the SME’s economic activity in the Commercial Registry. They explain the criteria for the preparation of the Financial Statements, ensuring that they provide relevant and accurate information on the company’s situation.

The mandatory financial statements that must be included in the annual accounts are as follows:

- Balance Sheet or Statement of Financial Position.

- Income Statement or Profit and Loss Statement.

- Statement of Changes in Stockholders’ Equity.

- Statement of Cash Flows (required only for large companies).

- Annual Report for the year.

These documents required by the General Chart of Accounts are aligned with the guidelines of the Commercial Code.

They also cover various aspects of the business, from its historical value to financial investments, liabilities, and changes in equity. It is important to note that the annual accounts must be filed once a year with the Commercial Registry. One month after their approval by the company’s general meeting.

Structure of the chart of accounts

This section of the General Chart of Accounts provides detailed information for the creation of the chart of accounts. It classifies it into groups and subgroups that correspond to the economic events and types of accounting data to be recorded. The various groups are:

It is important to note that each group or subgroup consolidates the accounting information recorded in lower-level accounts or subgroups.

Definitions and accounting relationships

This section details how the company’s assets and liabilities are managed and related. Explaining the connection between different accounts when recording transactions and journal entries.

For example, they establish which accounts should appear on the “debit” or “credit” side, as well as which accounts represent assets or liabilities.

They also detail the accounts related to the net worth and long-term external financing of the SME. This financing is intended to support non-current assets and to cover a portion of current assets. In addition, transitory situations requiring financing are addressed.

The BOE General Accounting Plan for SMEs is a fundamental pillar for a solid and transparent accounting in our business environment. With its specific guidelines and regulations, SMEs can chart a safe and efficient financial path.

You may also be interested in: Business alternatives in Spain: 4 ways of doing business

Make the most of the benefits of this plan and ensure its correct implementation in your company. Our team of experts is here to help you achieve the financial success you deserve. Do not hesitate to request our advice and maximize the benefits of the General Accounting Plan today!

Your email address will not be published .

Required fields are marked with *