Form 3249 AEAT is an informative or recapitulative declaration of intra-Community transactions. If you are self-employed or have an SME, you should be well informed about this procedure, know what it is, when you should do it, what are the deadlines for filing it and other features that will allow you to keep your business safe. If you still do not know about this procedure, we invite you to stay with us until the end of this article, come on!

First, what is Form 349?

Form 349 AEAT, as we said, is a periodic informative declaration that can be monthly, quarterly or annual. By means of it, the self-employed or companies will be able to detail each one of their intracommunity operations.

It is not superfluous to remind you that intra-community transactions are those purchases or sales of a good or service to companies located in another member country of the European Union.

In order to comply with this model and declare an intracommunity operation, it is necessary that both parties are registered in the Intracommunity Operations Register (ROI), have the intracommunity VAT number and issue the invoice without VAT.

You may also be interested in: Form 036 and 037: registering with the tax authorities

3 points you should bear in mind about the AEAT Form 349

There are some points that should be highlighted when considering the 349 AEAT form and that every self-employed person or company should know in order to carry out intra-community operations with other EU members without any kind of problem. These are 3!

Who must file Form 349?

All Value Added Tax (VAT) taxpayers who have carried out intra-Community transactions are obliged to comply with form 349 AEAT. They must notify the Tax Authorities that they have carried out this type of operation and the following conditions must be met:

- The transaction was not carried out in the territory where the tax is applicable. This means that the sale and purchase must have been made from one of the 28 EU countries and was directed to another EU country but with a different taxation.

- Both the seller and the buyer of the transaction must be self-employed or a partnership.

- Both must be registered as intra-community operators in the ROI and as such must have their identification number.

What are the deadlines for filing Form 349?

The AEAT Form 349 must be filed monthly during the first 20 calendar days of the month immediately following the corresponding monthly period. The regular deadlines for this form are usually:

- Monthly filing: if the total intra-Community transactions amount to more than 50,000 euros.

- Bimonthly filing: at the end of the second month of a quarter and when the amount of the transactions exceeds 100,000 euros.

- Quarterly filing: this case occurs only when the general computation of deliveries of goods and services does not exceed 50,000 euros.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

How should you file Form 349?

The self-employed can file the model 349 AEAT telematically with their DNI or electronic certificate. Either through the Virtual Office of the Tax Authorities or through any accounting software that allows you to make this calculation.

In Gestion Direct we have an excellent management software that will help you to simplify this task. You will only have to print the certificate and save time.

To purchase and download your digital certificate you only have to access our website and follow the instructions in our explanatory video. Now, as for our software, you can access our ERP system that will allow you to manage and access all the financial information of your company wherever you want and in real time. All that and more.

How do you have to fill in the 349 form?

On the first sheet, which is the summary sheet, you will find several different parts that you must complete in order to comply with the AEAT Form 349:

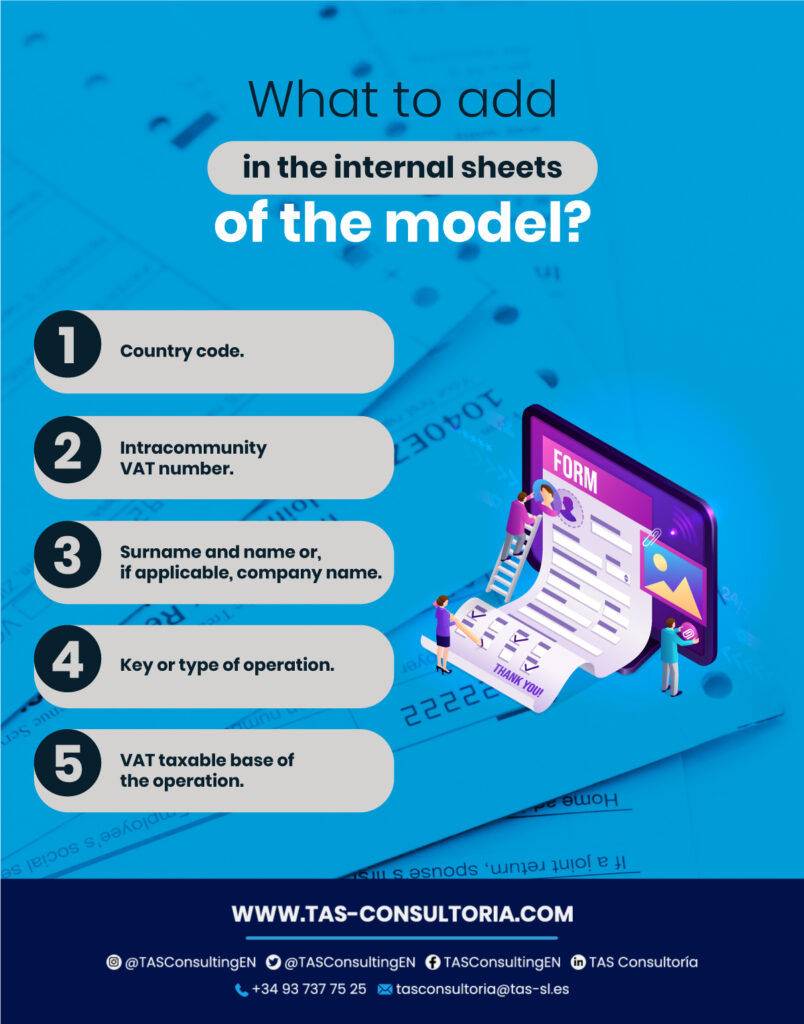

In the inner sheets of form 349 AEAT is where you will be able to detail the bulk of the declaration, the relation of the intracommunity operations and the rectifications of the previous periods.

In the first of the sheets you must detail all the operations providing in each one of them the following data:

Key operations.

The keys to intra-community operations will depend on the type of transactions carried out:

- A: Intra-Community acquisitions of goods made by the taxpayer, including transfers of goods from another Member State.

- E: Intra-Community supplies of goods made by the taxpayer, including transfers of goods to another Member State.

- T: Deliveries in another Member State subsequent to exempt intra-Community acquisitions, carried out within the framework of a triangular operation.

- S: Intra-Community supply of services by the declarant.

- I: Intra-Community acquisitions of services located in the territory of application of the tax, presented by entrepreneurs or professionals established in another Member State, whose recipient is the declarant.

- M: Intra-Community deliveries of goods subsequent to an import exempt under Article 27.12 of the VAT Law.

- H: as in key M, the difference is that the deliveries are made by the tax representative in accordance with Article 86.3 of the Law.

You may also be interested in: Substitute, complementary and corrective declarations.

To learn more about the Model 349 AEAT you only have to contact TAS Consulting, through our email tasconsultoria@tas-sl.es. We have an excellent team of legal advisors who can inform you about this model and guide you through it.

Do not miss this great opportunity and request your free consultation. Do not wait any longer and contact us.

Your email address will not be published .

Required fields are marked with *