The Spanish Social Security General Treasury launched its new tool: the ImportaSS portal. With it, it aims to revive the agency’s online service and update its interaction with users. It will allow users to have access to all the information and personal data they need to carry out the procedures they require. To find out what procedures can be carried out with this tool, I invite you to stay with us until the end of this article.

What is the ImportaSS portal?

ImportaSS is a digital space created by the Social Security dedicated to offer information and processing services. This space has a personal area where you can consult your Social Security number, your work life report or check your employment situation.

To access the ImportaSS digital space, you only need to identify yourself with your digital certificate. After verifying your identity, you will be able to manage all the procedures you need from your own profile.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

How does the ImportaSS digital portal work?

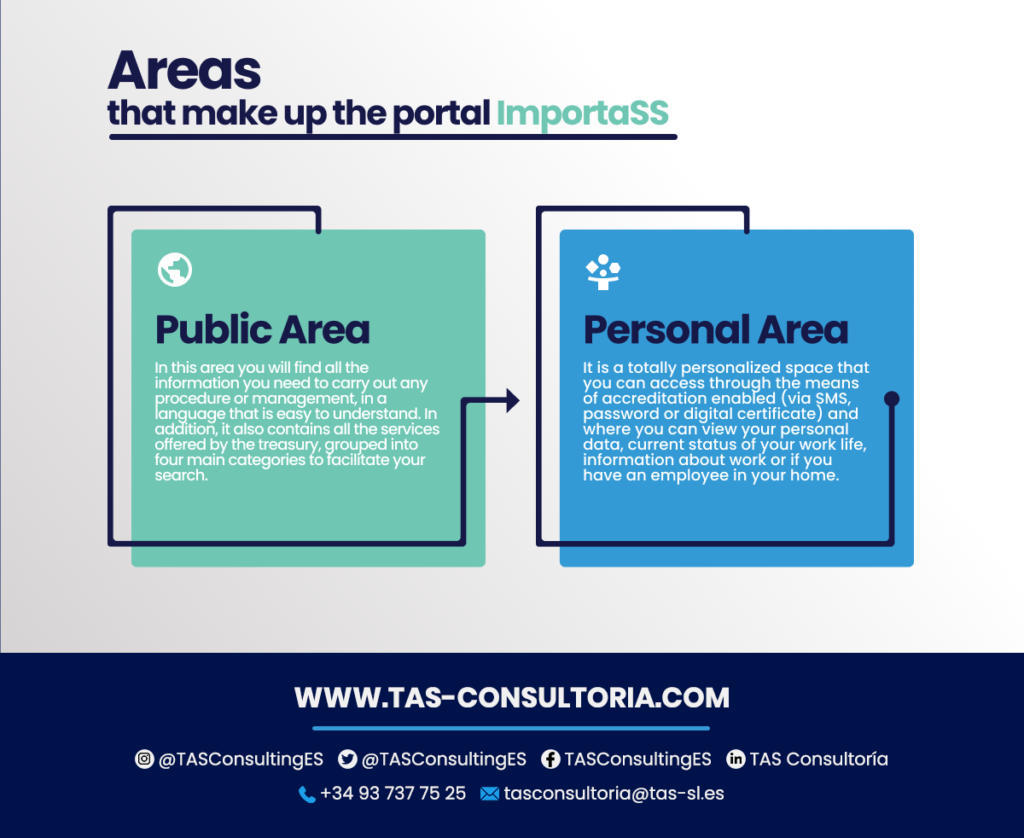

ImportaSS treasury portal is composed of two parts. A main page or public access area and a personal area. These areas can be described as follows:

What procedures can be carried out through the ImportaSS portal?

From ImportaSS you will be able to carry out multiple Social Security procedures through a simple and intuitive interface. Some of the main procedures that you can perform in this portal are:

You may also be interested in: Types of taxation in Spain: direct and indirect taxes

What is new in the ImportaSS portal for the self-employed?

For self-employed workers, the ImportaSS platform will make it easier to consult all their information, which they will be able to find in their personal area.

There you will be able to check your date of registration in the RETA, the details of the type of activity you carry out, know what contribution you are paying, if you have an insurance company and what coverage the Social Security protects you with.

Likewise, the portal also has a guide with which you will obtain answers or questions you may have before, during or after any procedure.

What does the ImportaSS treasury portal offer to the employer or household employee?

The design of the ImportaSS portal took into account people who work or are employed in the family home. This is due to the special characteristics that they present in the field of Social Security.

Thanks to this, they have a specific section in which the language, the formulation of the question and the messages are oriented to make the information simpler and more understandable.

In the section created for them, they also have a guide and a guide full of explanations of each of the decisions, rights and obligations involved in being part of this guild. In this sense:

- If you are an employer, you will have a specific section in your personal area where you will be able to consult your household employment data, who you have hired, the date you started working, the next installment to be charged to your account together with the declared working hours and salaries.

- If you are an employee, you will be able to check the working conditions declared by your employer when registering you with the Social Security, the contribution he/she pays and the part of this contribution that you must pay.

What do you need to navigate in the ImportaSS portal?

If you want to access the ImportaSS portal, what you need, first of all, is to use a compatible browser. That is why the official website recommends browsers such as Google Chrome, Windows Edge or Mozilla Firefox.

Then, you will have to access your personal area to proceed with your online procedure. However, you will need a means of identification in order to carry out this procedure. If your cell phone is associated with the treasury, you can log in by SMS; you will also have the option of verifying yourself through the Cl@ve system or by means of the Digital Certificate.

In case you do not have any identification method, it is recommended that you register in Cl@ve or try to communicate through your cell phone, by SMS. There, you will have to fill in the form as follows:

- Choose the working citizen category.

- Select the communication procedure and variation of contact data.

- Address.

You may also be interested in: Is it possible to hire personnel as a freelancer in Spain?

Do you want to know more about the ImportaSS portal and how it can be of great help to you as a freelancer? Contact us through our email tasconsultoria@tas-sl.es. We have the best experts in taxation and procedures that can guide and inform you about this new tool. Do not wait any longer and use these tools to update your procedures.

Your email address will not be published .

Required fields are marked with *