The 2023 Income Tax Return campaign is just around the corner and it is important to be aware of the novelties that will affect the filing of your return. This involves everything from filing deadlines, to the new IRPF brackets. That said, it’s time for you to get ready to optimize your taxes this coming April 11. Want to know more? Keep reading our article.

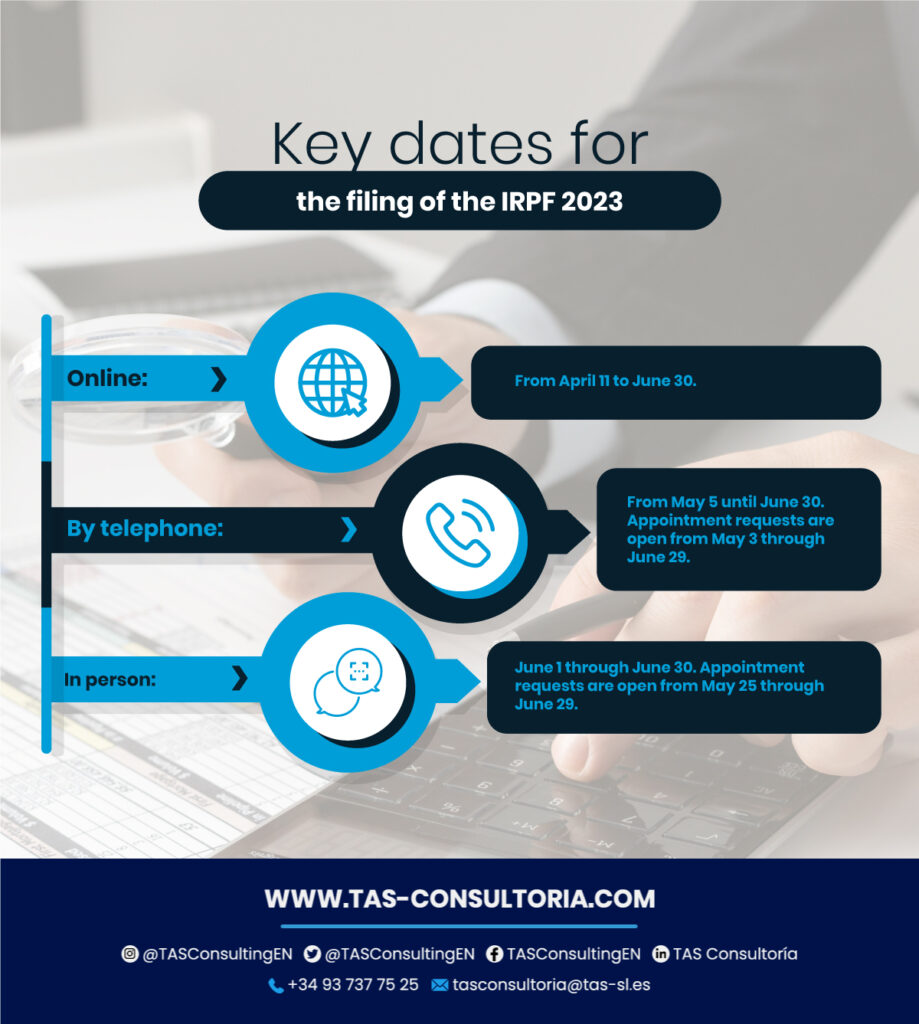

What are the key dates for the 2023 income tax return?

Just like every year, the 2023 income tax return campaign will take place between June 1 and 30. However, taxpayers can file their first Personal Income Tax and Wealth tax returns through the Internet as of April 11. That said, it is not necessary to file the income tax return for those whose gross income does not exceed 15,000 euros.

The use of the Internet to file tax returns is becoming increasingly popular, being used by nine out of ten taxpayers.

It is also important for taxpayers to be aware of filing deadlines to avoid problems. Failure to meet the deadlines could result in a fine ranging from 200 euros to 150% of the amount payable to the Treasury.

So, when is the 2023 income tax return due? The important dates to consider relate to taxpayer filing, as you will see in the image:

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

What is new in Personal Income Tax for the 2022-2023 tax year?

In addition to the importance of filing the tax return on time, it is essential to know the new features of the 2023 income tax return campaign. Although the changes with respect to 2022 are not very significant, there are some modifications that can help save money on taxes through tax deductions.

Some of the most relevant aspects include contributions to pension plans, the deduction for maternity and the income thresholds that make it mandatory to file income tax returns.

Therefore, it is essential to be informed and prepared to make the 2023 income tax return correctly and maximize savings opportunities. Below, we share with you the details:

Changes in personal income taxation in certain autonomous regions of Spain

Some autonomous communities, including Madrid, the Valencian Community, Galicia, Andalusia and Murcia, have introduced changes in the personal income tax brackets with retroactive effect, which will be reflected in the 2023 income tax return.

In September 2022, the President of the Community of Madrid announced the deflation of personal income tax to help families maintain their purchasing power in the face of rising prices.

This measure will benefit 3.5 million Madrileños and will save close to 200 million Euros. The personal income tax deflation in Madrid is 4.6%, which will allow Madrid citizens to save an average of 46 euros, with high incomes benefiting the most.

New brackets for earned income

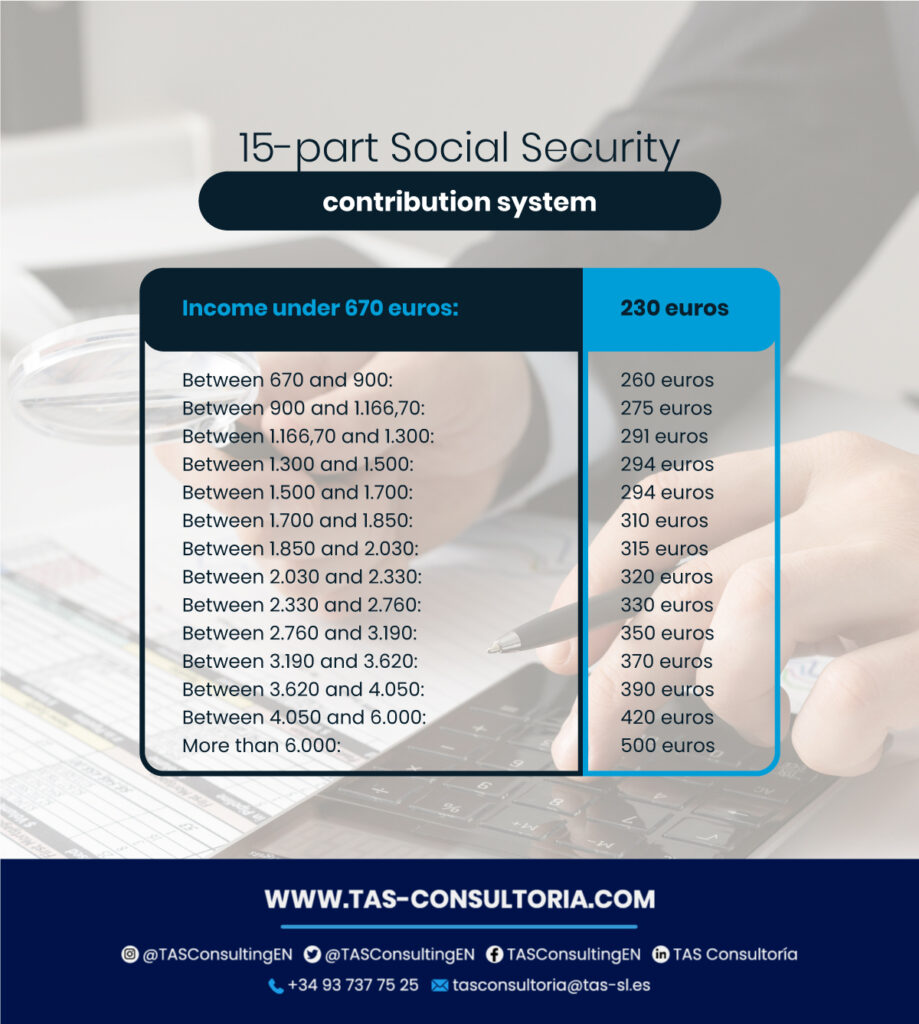

One of the most relevant new features of the 2023 income tax return is the change in the system of Social Security contributions for the self-employed.

From now on, the contribution will be calculated based on the actual income and not on the previously chosen base. In addition, 15 brackets have been established for the new contribution system.

A simulator has been implemented by the Social Security to facilitate the calculation of the new contribution system based on actual income. The calculation is made on the basis of net income with a 7% deduction for generic expenses. This changes the 2023 income tax return significantly.

The new regulation establishes 7% of expenses that are difficult to justify for self-employed workers in simplified direct estimation. In addition, the self-employed with two children and a joint declaration with their partner will have a minimum taxation of 19,000 euros. The self-employed in a situation of pluriactivity and with earned income over 15,000 euros will be exempt from the payment of Personal Income Tax.

You may also be interested in: Taxes in Spain for Foreigners

Changes in the tax deduction for private pension plans

The Treasury has introduced changes to the tax deduction for private pension plans. The maximum amount that can be deducted annually has been reduced from €2,000 to €1,500.

On the other hand, the maximum deductible amount has been increased from 8,000 to 8,500 euros in case the taxpayer has a company pension plan.

These modifications within the 2023 income tax return are aimed at increasing the collection to guarantee the viability of the pension system and it is important to take them into account, as they can directly affect your personal economy.

Deduction for dependent child or maternity

Another tax innovation is the deduction for dependent children, which becomes a “universal allowance” for mothers with children under three years of age, regardless of their employment situation.

Previously, the deduction was limited to 100 euros per month per child and only applied to mothers in permanent employment. It is estimated that this deduction, part of the 2023 income tax return, will benefit more than two million families and the tax benefits will exceed 200 million euros.

Wealth tax for large fortunes

The new wealth tax for large fortunes is already in force and will be applied as from the 2022 tax year, within the 2023 income tax return for those with a net worth of more than three million euros.

The tax is divided into three brackets and its tax rate varies according to the net worth of the estate:

- For assets between 3 and 5 million euros, a rate of 1.7% will be applied.

- For assets between 5 and 10 million euros, a rate of 2.1% will be applied.

- For assets over 10 million euros, a rate of 3.5% will be applied.

The objective of the Ministry of Finance is to collect 1.5 billion euros per year with this tax during 2023 and 2024, although it could be permanently incorporated into the tax system.

The reduction of earned income for gross salaries between 15,000 and 21,000 euros, which is estimated to save 1,881 million euros for 50% of the workers, was also highlighted.

You may also be interested in: Double taxation in Spain

If you are one of these workers and you need help to make your income tax return 2023, do not hesitate to contact us. In our team we have experts in tax matters who will be happy to help you in everything you need.

Email us at tascontusoria@tas-sl.es and ask for your personalized advice. Don’t miss this opportunity to get your finances in order!

Your email address will not be published .

Required fields are marked with *