The new VAT franchise regime has arrived to change the way freelancers and small businesses in Spain manage their taxes. This article will take you through the keys to this system and how it can benefit your business. Are you ready to simplify your taxation and optimize your operations? Read on to find out more!

Franchised VAT for the self-employed and small businesses

Significant tax relief is anticipated for the self-employed and small entrepreneurs in Spain in a possible situation projected for the year 2025. This relief materializes through the introduction of the Franchise Regime in the Value Added Tax (VAT). Or also called Franchised VAT.

The fundamental purpose of this modification in VAT for the self-employed is clear: to exempt those whose annual turnover does not exceed 85,000 euros from the obligation to make quarterly VAT payments.

This results in a remarkable simplification for your financial management. This measure is in line with the provisions of Directive (EU) 2020/285.

You may also be interested in: Ways to operate in Spain

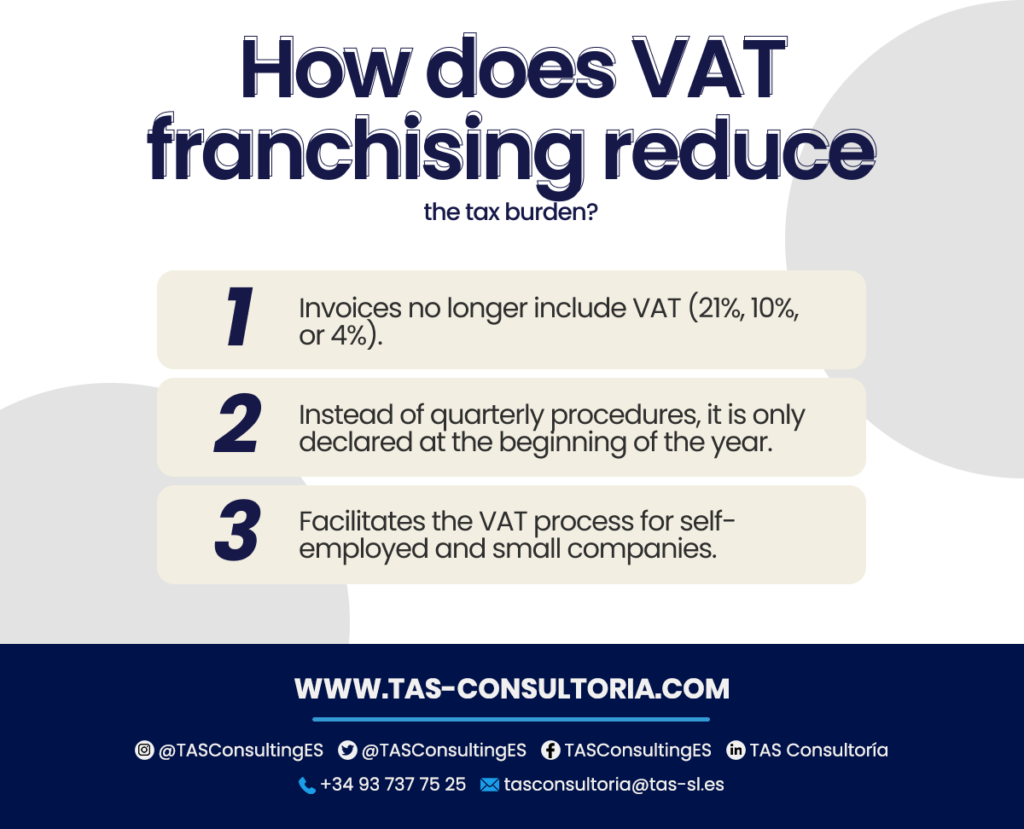

How does VAT exemption reduce the tax burden?

The VAT franchise for the self-employed presents this option as voluntary. Those who choose this regime will be exempt from filing VAT returns. Therefore, from applying or deducting the corresponding rates. Basically, you reduce the tax burden with these measures:

Modernizing the tax regime for the new era and new VAT

The tax environment for self-employed and small businesses was previously governed by Directive 2006/112/EC. However, these regulations were considered obsolete and did not reduce the administrative burden for small businesses.

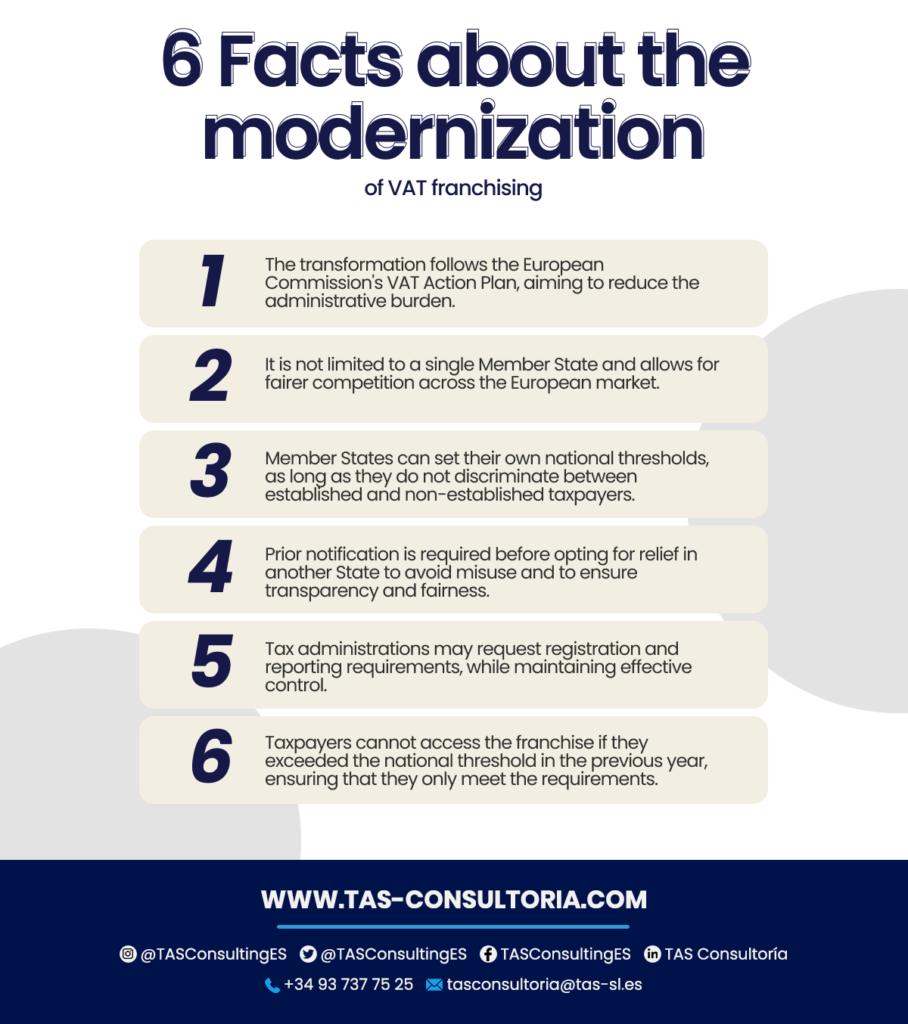

Following the European Commission’s VAT Action Plan, this transformation of the VAT franchise has been initiated. This with the purpose of reducing the administrative burden. Below, we share with you some key aspects of this new VAT taxation for the self-employed:

Establishment of thresholds and promotion of nondiscrimination

A significant change is that franchised VAT will not be limited to businesses established in the Member State of VAT origin.

This means that small companies from different Member States will also be able to benefit from franchising. Promoting fairer and more uniform competition in the European market.

In addition, Member States will have the flexibility to set their own national thresholds. Of course, as long as they respect the ceiling stipulated in the Directive and do not discriminate between established and non-established taxable persons.

In this way, VAT franchising for the self-employed is adapted to the specific characteristics of each country.

Control mechanisms

Prior notification is required before opting for franchising in another State. Especially to avoid its misuse and to ensure the access of States to essential information.

This process ensures effective control of its application and prevents any distortion of competition. Thus ensuring that the VAT self-employed franchise is implemented in a transparent and fair manner.

Obligations and Exchange of Information

Tax administrations have the power to request registration and information requirements related to VAT for self-employed persons. Especially to non-established taxable persons who do not comply with certain obligations.

Despite simplifying reporting obligations for compliant taxpayers, the requirement is still present. The VAT franchise seeks to simplify taxation for compliant taxpayers. And, at the same time, maintain effective controls on those who try to evade their tax responsibilities.

Turnover calculation

To avoid confusion in the calculation of turnover, you will detail the essential elements to be considered. Taxable persons will not be eligible for the franchise if they exceeded the national threshold in the previous year. Ensuring that only those who meet the requirements can benefit from this simplified franchised VAT tax regime.

You can see a summary of these points below:

You may also be interested in: What does it mean to be an entrepreneur with limited liability?

Benefits of the new VAT for the self-employed

When the VAT franchise is implemented, small businesses will experience a number of essential benefits to optimize their operation:

Personalized VAT registration

They will have a VAT registration procedure specifically designed for their situation. This process will include specific deadlines that will provide you with flexibility and simplicity in your tax procedures.

Simplified reporting obligations

These companies will enjoy the advantage of simplified reporting obligations. This implies not only a reduction of the administrative burden in terms of declarations and documentation. And also, the implementation of more agile and accessible processes.

Especially for reporting the necessary information within your franchisee VAT return.

An additional benefit

The new VAT for the self-employed gives States the power to allow small businesses to choose. Either between the general VAT regime or a special regime tailored to them.

This flexibility seeks to adapt to the particularities and needs of each company. Always with the objective of facilitating the transition of small companies to the new tax system in a comprehensive manner.

You may also be interested in: Supporting deductible VAT before starting the activity

In conclusion, the VAT franchise is an opportunity that you should not miss. If you want to take full advantage of the tax benefits for your business, we invite you to request a consultation with our experts.

We are here to help you navigate this new system and find the best solutions for your company. Don’t wait any longer, contact us today at tasconsultoria@tas-sl.es and take control of your taxation!

Your email address will not be published .

Required fields are marked with *