Bonuses, like dividends, are benefits that can be received by employees or shareholders of a company. However, although they may seem to be the same concept, both are totally different, even in terms of taxation. In the following article we will tell you about each one and, in addition, we will detail the differences between them. Stay with us until the end to learn the details!

What is a bonus?

A bonus is a remuneration practice that some companies pay to their employees as an incentive for productivity, performance and achievement of the objectives set. The granting and amount of the bonus depends on productivity, profits or fulfillment of previously established objectives.

However, their calculation may vary according to the type of work and sector. Generally, these are fixed in the contractual conditions of the professionals, in addition to the fixed salary.

The amount of variable salary received as a bonus depends on the type of job and sector. This is because the amount of earnings and the difficulty of each job vary. Therefore, bonuses can be set to motivate employees to work harder and achieve higher earnings.

The objectives for obtaining the bonus are clear, measurable, achievable and attainable. These are established at the beginning for all professionals with this system and are linked to a remuneration system according to the fixed salary.

However, the bonus or variable salary does not necessarily have to be in cash. Instead, certain retributive or discounted benefits can be established, such as the delivery of company shares, the provision of a corporate vehicle, reduced working hours, among others.

You may also be interested in: 10 steps to start your own company

What is a dividend?

A dividend is defined as the part of the profits generated by a company that the company decides to distribute among its shareholders. In other words, it is the money paid to shareholders as remuneration for their investment in the company.

The amount of dividends is established in accordance with the company’s bylaws. Dividends are distributed proportionally among the associates, according to the percentage corresponding to the total number of shares they own.

In this regard, there are different types of dividends depending on when they are distributed and how they are distributed. These are as follows.

- Interim dividend. It is paid to the shareholder in cash as an advance on the profit obtained.

- Supplementary dividend. In addition to the interim dividend.

- Extraordinary dividend. Distributed when there have been extraordinary profits.

- Stock dividend. It is distributed in shares, rather than in cash.

- Fixed dividend. It is fixed by the company, regardless of the results obtained during the year.

To calculate the dividends you will receive from a company, you must multiply the dividend paid per share (also known as “DPA”) by the number of shares you own.

The DPA, then, is determined by dividing the amount of money the company paid in regular dividends by the number of shares of the company owned by the investors.

Differences between bonuses and dividends

Now for the part that interests us: dividends are the portion of profits distributed to shareholders. Shareholders receive a dividend at the end of the company’s fiscal year if the company makes a profit.

On the other hand, bonuses are a form of variable compensation linked to the production or quality of employees’ work.

As regards taxation in Spain, income from work obtained as a bonus is taxed in full in the year in which it is received. Regardless of whether they remunerate work performed in a previous period.

They will be added to the rest of the earned income obtained during the year and to the rest of the income of the general tax base. As a result, these are subject to taxation.

The bonus will be taxed in the IRPF at the applicable marginal rate (which can be 45% or higher depending on the autonomous community). However, it will also be a deductible expense for the company (so that it will save 25% of the amount paid).

The dividend will be taxed at a lower personal income tax rate (between 19% and 23%), unlike the bonus, which will not be a deductible expense for the company.

Therefore, according to these premises, the bonus will be more profitable if the general base does not exceed 60,000 euros when it is included in your personal income tax. In this case, a marginal rate of 37% is applied.

However, if the income taxed in its general base is already high, the bonus will be taxed at the maximum marginal rate (45%). Therefore, the best option will be the dividend.

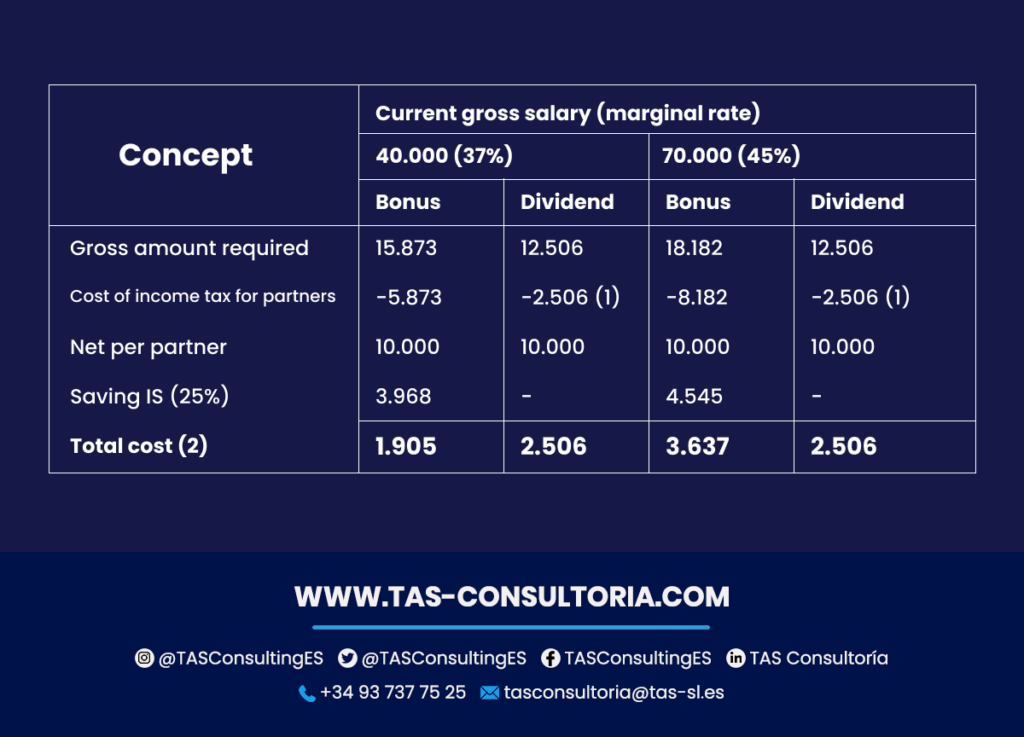

Below is an example of the cost if you want to obtain an additional 10,000 euros net, depending on your current gross salary.

You may also be interested in: What is ROA and how to calculate it?

Dividend and bonus benefits

There are many benefits that dividends generate for business partners. Therefore, we will mention the most outstanding ones:

- It is an income received by the shareholder for owning the company. They obtain it when the company has made a profit.

- They provide good inflation protection and are often sustainable because many companies are reducing their payout ratios.

On the other hand, bonuses are a benefit for employees that they can get depending on their work and achievements. Some of the benefits they can get are:

- They are an economic reward given to employees for their work performance.

- They can be an effective way to motivate employees and improve their performance.

- They are an effective way to retain talented and experienced employees.

These are some of the benefits you can get from these two concepts, whether you are an employee, employer or business partner.

You may also be interested in: Why are corporate bylaws important?

Are you the partner of a company and you do not know if bonuses or dividends are more convenient for you? Contact us at tasconsultoria@tas-sl.es and we will advise you. We can help you define what is best for you and your business, we are experts in taxation, real estate law, entrepreneurship, digitization of companies, business creation and management, and much more. What are you waiting for?

Your email address will not be published .

Required fields are marked with *