Are you planning to expand your trade internationally? Then it is essential that you understand the importance of the EORI number. This unique identifier is fundamental to carry out commercial transactions legally and efficiently in the European market. We guide you through the necessary steps to validate and obtain your EORI number in Spain. Discover how this number can open the doors to international trade safely and effectively!

What does it mean to have an EORI number?

The EORI is a unique identifier in the European Union. It is issued by the customs authority of a member state to self-employed persons or companies planning to import or export goods. Any economic operator importing or exporting must register and obtain its EORI number.

Comparatively, between EORI and VIES, consider this example: when a Spanish freelancer imports a machine from China, he must provide his EORI number to customs. Otherwise, the item will be detained.

That said, the term import or export refers to the entry or exit of goods into or out of a European country. Either from the EU or from an external country. At which point the EORI number of the economic operator becomes essential.

On the other hand, if the article comes from Germany, for example, it is necessary to register in advance in the VIES census. In order to manage the VAT reverse charge. Accessible from any country in Europe.

The structure of the EORI number is composed of two main elements:

- A 2-digit ISO code, which in the case of Spain is represented by ES.

- This is followed by the tax identification number (NIF) assigned by the Tax Agency. If you are self-employed, this number will correspond to your National Identity Document (DNI).

You may also be interested in: Expansion and Diversification Strategies

Who should obtain the EORI code?

All economic operators of the member states involved in customs activities must apply for the EORI number.

The obligation to use the EORI has been in force since July 1, 2009. In accordance with Commission Regulation (EC) No. 312/2009 dated April 16, 2009.

Therefore, it is essential to have the EORI number regardless of whether the goods enter through a port or an airport. Otherwise, the shipment cannot be cleared by customs.

That said, every company must acquire its EORI number in the member state in which it initially markets goods. Once obtained, this number will be valid in all EU member states.

In summary, the EORI number is granted to operators with their own legal entity, such as Spanish companies. In the case of branches and permanent establishments of non-resident entities, they must apply for it if they wish to carry out customs operations.

While individuals who import on a personal basis are not required to have an EORI until they perform five transactions. At that time they must apply for an EORI:

- Enter the website of the State Agency of Tax Administration (AEAT).

- Access the section: Spanish EORI Registration.

- During the application process, you will be asked for a digital certificate, electronic ID or Cl@ve PIN for authentication.

- Once you have completed the application, the validation is done almost immediately, speeding up the process.

Moreover, an additional advantage is that you have the possibility to consult the data associated with an EORI number. All through the European Commission’s Taxation and Customs Union web platform. This facilitates access to relevant information about this identifier.

What is the difference between EORI and NIF?

The EORI number functions as a customs code. One that allows a quick linkage between import or export operations and the corresponding economic operator. In contrast, the NIF, or Tax Identification Number, has the function of identifying individuals before the Tax Agency.

You may also be interested in: Opening license in Spain: how to obtain it?

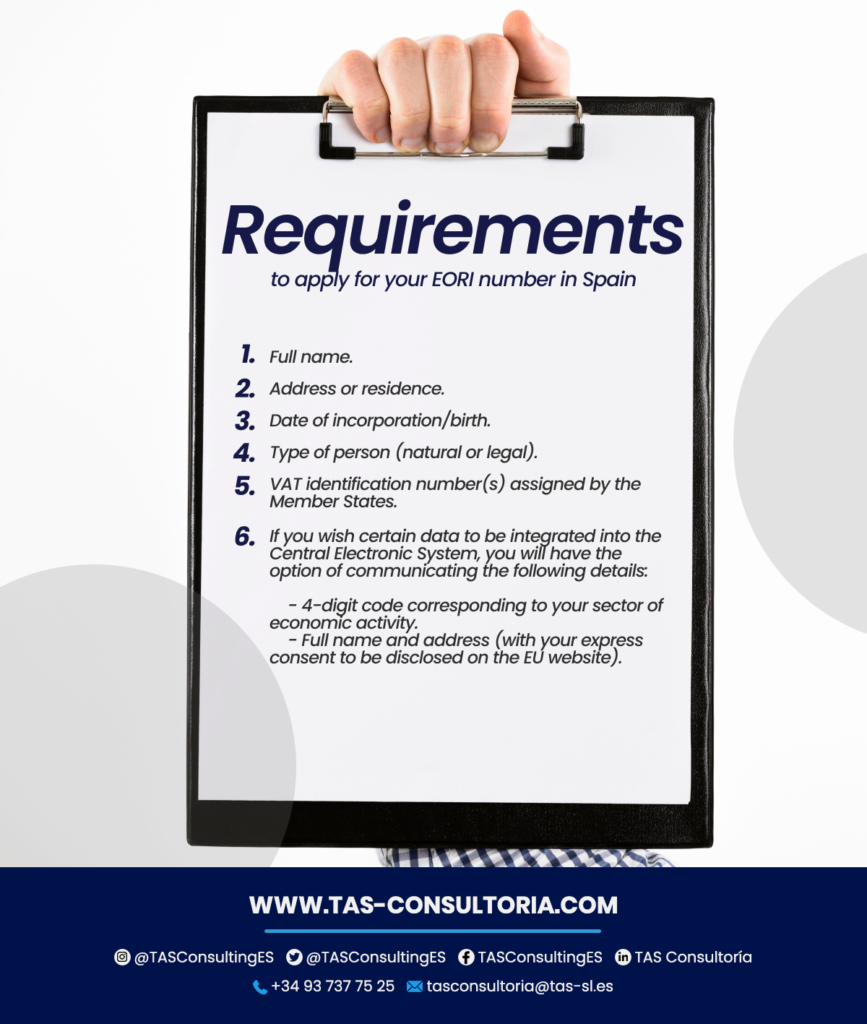

What are the requirements to apply for an EORI number in Spain?

Although the application process through the Tax Agency is relatively simple, you will need a series of essential data. First, you will need to access the AEAT processing page using your DNI/NIE, certificate or electronic DNI. Next, you must provide the following information:

One point is critical to keep in mind. When you apply for the EORI number, the system assumes that you intend to import or export goods in the short term. Therefore, you should make sure that you have all the data related to your shipment prepared in advance.

Including the destination address, sender’s address, information about the contents of the package and any other necessary documentation.

Why is it so important to have an EORI number?

The EORI number is a mandatory requirement in the EU for any individual or company involved in international business activities. Such as operations with the UK after Brexit, for example.

Its main purpose is the registration of the economic operator. This registration facilitates the entity. Whether it is a natural or legal person, the processing of the documentation required in import or export transactions.

The need for an EORI number originated as a security measure to ensure the flow of information between customs authorities.

How to verify your EORI number?

Now that you know the process of applying for an EORI number, you will be pleased to know that checking the validity of an EORI code is just as easy.

Simply go to the website of the European Commission Taxation and Customs Union. On the page, scroll to the bottom, where you will find a section titled EORI Number Validation.

Next, enter the number in the text field labeled Enter valid EORI number and click the Validate button.

You may also be interested in: What are Temporary Joint Ventures?

Does your business idea involve exporting or importing products? Contact us at tasconsultoria@tas-sl.es and our professional advisors will accompany you through every step of the process and provide you with the best advice.

The time has come for your business to succeed, TAS Consultancy advisors will always keep you updated on the legal requirements and responsibilities you must comply with, contact us and ensure the success of your business!

Your email address will not be published .

Required fields are marked with *