Did you know that the Tax Authorities have the power to carry out a limited verification procedure regarding your company’s accounting? This process, designed to examine certain tax aspects in a more agile way, raises doubts and concerns among businessmen. You too? Then you are in the right place. Join us to find out what this measure consists of, how it develops and what measures you can take to avoid it.

Scope of the Tax Agency in a limited audit procedure

In the framework of a limited verification procedure, the Tax Agency may have access to the accounting records of the companies. If requested by the authorities, they must provide their accounting books for review.

By means of this accounting review, the Tax Authorities will check the veracity of the information included in the tax self-assessments. In this way, they ensure concordance with the accounting records.

This being so, the introduction of the limited AEAT check is due to the amendment presented by PSOE and Unidas Podemos. The draft law amending the European directive on tax administrative cooperation, known as DAC7, adds this decision. The latter has as its main objective to improve and optimize tax collection by tax administrations and others.

What the Treasury wants to achieve is a new power to analyze tax data in a limited verification procedure. Especially for a single tax or tribute, which had no legal backing until now.

Currently, the Tax Agency can only require the accounting books as part of a full audit if it is carried out by a tax inspector. This is until the law reforming the European directive on administrative and fiscal cooperation enters into force.

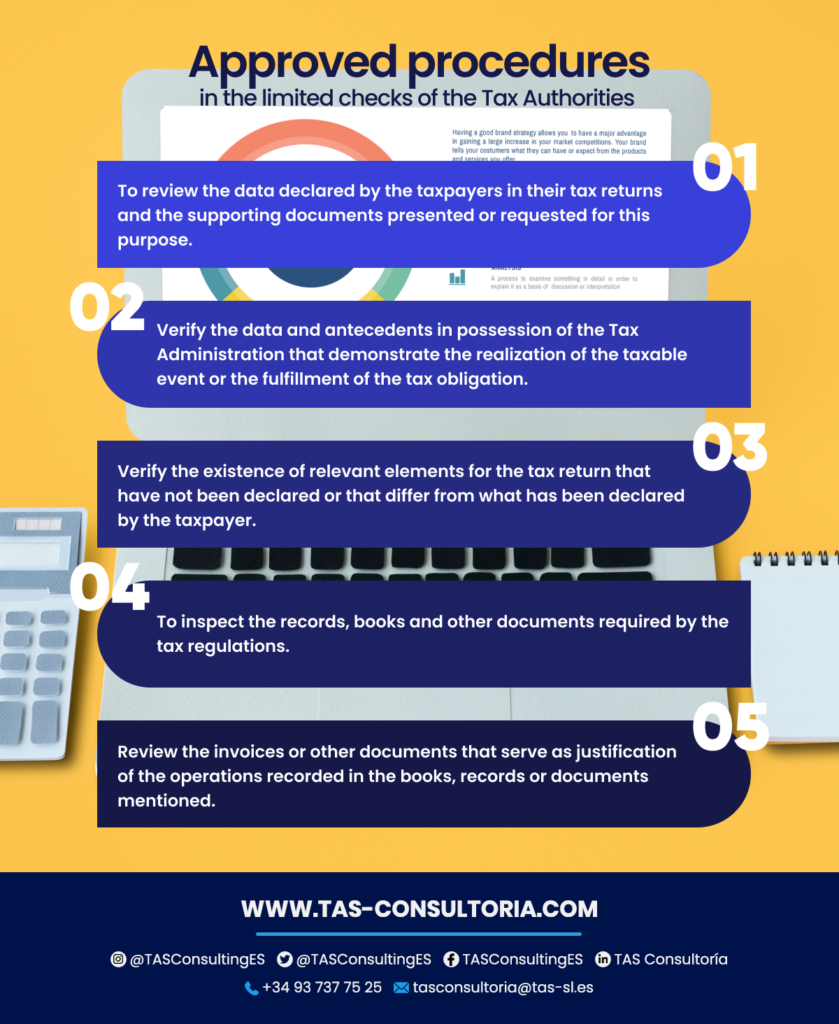

That said, here are the types of verifications that the Tax Agency can carry out:

You may also be interested in: Form 036 and 037: registering with the tax authorities

Key points regarding the limited verification procedure

As of January 1, 2024, companies will be required to use accounting and invoicing software. One that guarantees the integrity of records, preventing their modification or deletion.

Likewise, the data will be required to be accessible to the Tax Agency, with prior authorization. All with the aim of strengthening the Anti-Fraud Law.

This being the case, an accounting examination within a limited verification procedure seeks concordance. The purpose of this is to compare the data presented in a self-assessment and the information in possession of the Tax Administration, including that obtained during the procedure.

In addition, the Agency has the authority to request third parties to provide information and supporting documentation.

Legal changes allow lawyers not to report on aggressive tax planning

The text of the ruling of the Court of Justice of the European Union details that they will make modifications in the law for legal defense. This measure allows lawyers not to disclose aggressive tax planning carried out by their clients.

It is important to remember that in December, the CJEU annulled the paragraph of CAD 6. The latter restricted the professional secrecy of tax advisors and obliged them to report aggressive tax practices. In a limited verification procedure it would imply a more permissive investigation.

The current amendment dictates that intermediaries exempted from the duty of confidentiality are obliged to unequivocally inform other taxpayers. Only to those who participate in such procedures about their exemption. All this in connection with the declaration of cross-border tax planning schemes.

You may also be interested in: Taxes in Spain for Foreigners

How does the registration of VAT books work in a limited verification procedure?

The Tax Agency usually requests several books for a limited verification procedure. Among them are the VAT registration books, which usually include the following:

- Record book of invoices issued.

- Record book of invoices received.

- Investment property record book.

- Register book of specific intracommunity operations.

Accounting is responsible for facilitating the creation of these books, which form the basis for the VAT self-assessment. Specifically, the accounting must allow the following to be accurately determined:

- The total amount of VAT charged to customers.

- The total amount of tax paid on the purchase of goods and services from suppliers.

It is possible to keep these books in electronic or computerized form. However, in this case, it is necessary to keep the files, databases and programs in magnetic or optical format during the statute of limitations period. This guarantees full access to the information contained in the books. Whether for a limited verification procedure or another tax measure.

If you file your VAT self-assessments on a monthly basis, you must keep your VAT records through the AEAT’s Electronic Headquarters. Use the Immediate Supply of Information (SII). This involves the electronic supply of invoicing records.

In addition, commercial and accounting legislation requires the keeping of the following accounting books, which must be legalized at the Commercial Registry:

- A book of inventories and annual accounts (Article 25 of the Commercial Code).

- A journal (Article 25 of the Commercial Code).

You may also be interested in: EU Stability and Growth Pact

Conclusion

The limited audit procedure is a measure that the IRS uses to examine your company’s accounting and make sure that you are in compliance with all tax obligations. To avoid unpleasant surprises and keep your business on the right track, it is essential to have the support of tax experts with extensive experience in the field.

If this is the case, we invite you to contact us at tasconsultoria@tas-sl.es and schedule your free consultation. Don’t wait any longer! Request your personalized advice and prepare your company for anything.

Your email address will not be published .

Required fields are marked with *