In the complicated web of tax regulations in Spain, “income” occupy a special place. Especially when it comes to irregular labor income. Wondering how this affects your earnings? Explore in depth the tax treatment of these yields and get clarity on an issue that can directly impact your financial situation. Read on to discover the details and make the right decisions about your personal finances, let’s go!

What is irregular employment income?

The Personal Income Tax (IRPF) regulations establish a special approach for non-habitual employment income. So that only 70% of the amounts received are taxed. Here are some of the rules governing this benefit.

What does it consist of? Non-habitual labor income or yields receive a particular tax treatment:

30% of its value is exempt from taxation. Provided that the maximum base to apply this reduction does not exceed 300,000 euros.

It should be noted that they are considered non-habitual:

- Income generated over a period of more than two years (calculated from one date to another).

- Those that, regardless of their generation during said period, are qualified as non-habitual. This is in accordance with current regulations.

You may also be interested in: How to obtain a loan in Spain?

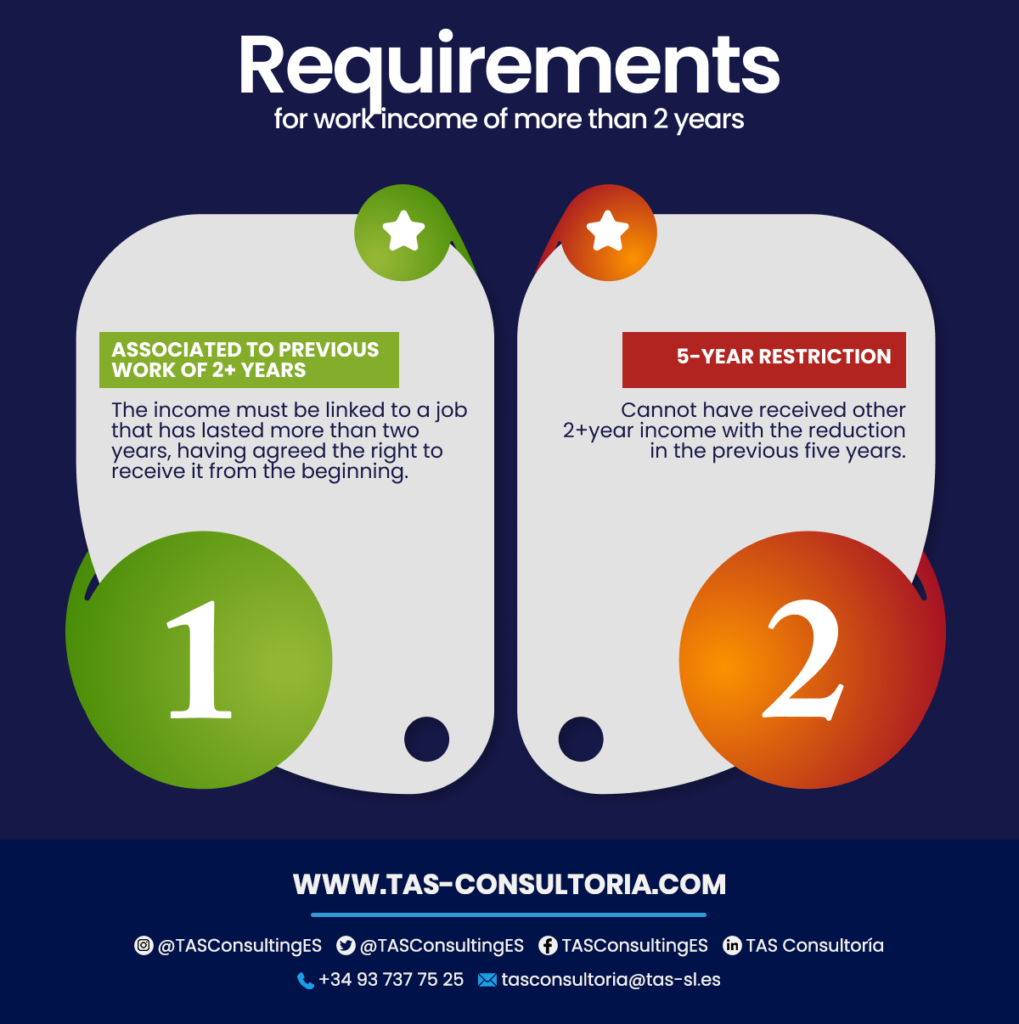

What are the requirements for earned income generated over a period of more than two years?

It is possible to apply the 30% reduction in the income from work generated in more than two years. However, you must meet the following requirements:

This being the case:

- The income must be associated with previous work that has been performed for more than two years. In this case, the right to receive such income has been established from the beginning.

- In addition, in the five previous tax years, the individual must not have received other income. Some generated in more than two years and which would have benefited from this reduction.

Let’s see some examples…

As mentioned above, it is valid to apply the 30% reduction to a bonus related to the success of a project. Provided that it has a duration of more than two years and that it was agreed at the beginning of the project. However, the Tax Administration could question the reduction. Specifically, if the existence of this performance agreement cannot be demonstrated sufficiently in advance.

- You can also apply the reduction to a bonus for remaining with the company for five years.

In the case of dismissals, severance payments, the rules are different:

- If you receive severance compensation, the five-year restriction does not apply. This means that the reduction is valid even if you would have received a bonus with reduction during that five-year period.

- In the case of bonds, the reduction is only applicable if declared in a single tax year.

However, in the case of severance payments received over several years, please note the following. The reduction will continue to apply only if the quotient between the years in which it was generated and the years in which the severance payment is divided is greater than two.

Remember: it is always an option to apply the yields

An employee may be aware that he/she will receive multiple incentives that may benefit from the 30% reduction. If so, he has the option of deciding whether or not to apply the reduction on the first incentive. And, instead, apply it in the second one, thus avoiding the application of the five-year rule. This will allow you to optimize the tax benefit derived from this reduction.

You may also be interested in: Types of taxes in Spain: direct and indirect taxes

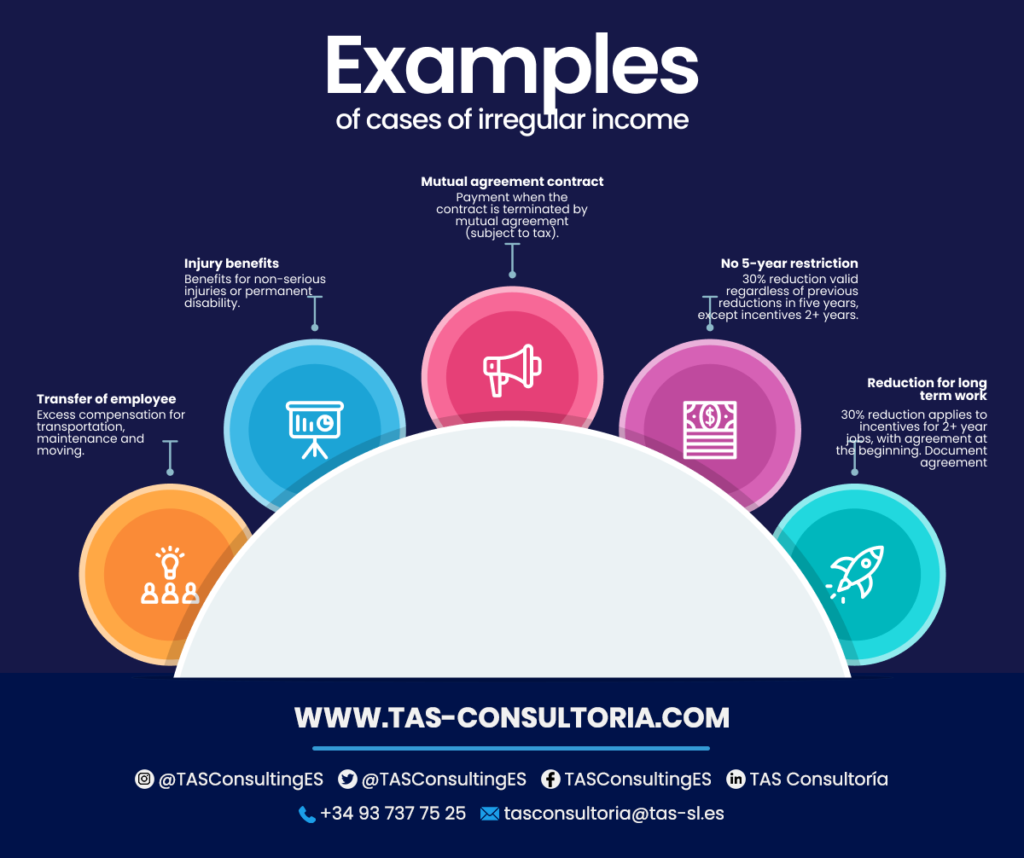

Classification of other cases as irregular income

In addition to income generated over a period of more than two years, there are other possible cases. Certain income obtained in a non-habitual manner over time is also eligible for reduction. As long as they are allocated in a single tax year.

The regulations establish a closed list of these cases. Here are some common examples:

- The case of the transfer of a worker and its yields. It should be the portion of the compensation that exceeds the exempt amounts. Also what is intended to cover transportation, living and moving expenses.

- Benefits provided for non-disabling injuries or permanent disability.

- The amount paid to an employee when the contract is terminated in a mutually agreed manner. In this case, the amount received is subject to income tax.

This irregular income is entitled to the 30% reduction. Even if the employee applied the reduction in any of the five previous tax years. This limitation only applies to incentives generated in a period of more than two years.

The 30% reduction applies to incentives generated by work with a duration of more than two years. Provided that the agreement for payment has been established at the beginning and not at the final stage. Make sure you have evidence of this initial agreement.

Read the summary of the most important points here:

You may also be interested in: Keys to carry out a capital increase in your company

Understanding the tax treatment of income in the area of irregular employment income is essential. Especially for making sound financial decisions and minimizing tax surprises. In such a changing landscape, having accurate and up-to-date information is key.

Do you need specific guidance for your fiscal and tax processes in Spain? Our experts are ready to provide you with personalized and reliable advice, ensure your financial peace of mind and consult with us today!

Your email address will not be published .

Required fields are marked with *