Often, when we think of investing, our minds turn to traditional businesses. However, there is a much wider range of options that deserve your attention. There is a universe of possibilities to diversify your portfolio and boost your earnings. That’s why we’ll take you beyond the conventional paths and reveal how to expand your investment horizons in Spain. Read on!

What are the different ways of operating in Spain?

Once you have decided to operate and invest in Spain as a foreign investor, you have several options available to you:

Incorporate your own Spanish company

You can choose between several types of mercantile entities offered by the Spanish legislation, such as the public limited company (S.A.) or the limited liability company (S.L.). It is one of the most common ways to start any investment procedure in Spain.

Entrepreneurship as an individual

If you meet certain requirements to invest in Spain, you can directly develop the activity as an individual.

Establishing a branch or permanent establishment

These options to start an investment in Spain have no legal personality of their own. Their activity is linked to the foreign parent company.

Business cooperation

You can partner with established entrepreneurs in Spain to share risks and resources.

Forms of collaboration in Spain

- Temporary Joint Venture (U.T.E.): temporary collaboration between companies.

- Economic Interest Grouping (EIG) and European Economic Interest Grouping (EEIG): specific forms of investment collaboration in Spain.

- Joint ventures and participating loans: collaboration through specific agreements.

- Joint Ventures through Corporations or Limited Liability Companies: association through legal structures.

Operating without incorporation or association

- Distribution agreements: establish agreements for the distribution of products and thus invest in Spain.

- Operating through agents or commission agents: carrying out operations through intermediaries.

- Establishing a franchise: option to expand your business under a recognized brand. A popular option for your investment in Spain.

You may also be interested in: Foreign investments in Spain: associated regulations

Four investment opportunities in Spain beyond business development

When it comes to investment, Spain is a destination full of possibilities for those looking to expand their financial horizons. Business development may be the first option that comes to mind. However, investment opportunities in Spain go far beyond that.

From acquiring real estate to participating in private equity entities, there is a diverse landscape to explore – look no further and choose the option that’s right for you!

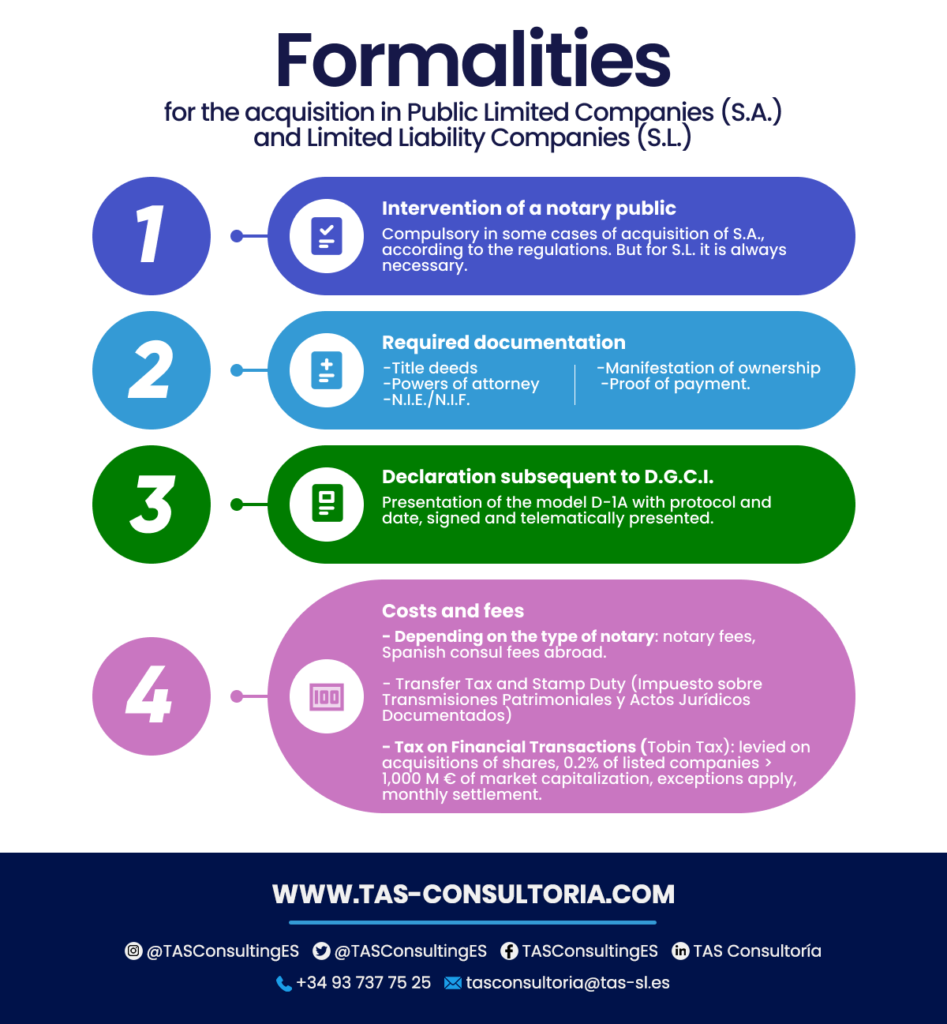

Acquisition of shares or participations in existing companies.

Are you planning to invest in this type of business? Take into account this aspect as a partner in limited liability companies or shareholder in corporations (except in specific cases). You have the right to separate if dividends are not distributed after five years from their registration in the Commercial Registry.

Learn about the requirements to apply for this investment in Spain:

These are the requirements to exercise your right of separation (within one month from the general meeting of shareholders). This after the last modification of article 348 bis of the Capital Companies Act:

- Indicate your objection to the lack of sufficient dividends in the distribution of results. This may occur with your investment in Spain, so you should be prepared.

- You need the distribution of at least twenty-five percent of the profits obtained in the previous fiscal year that are legally distributable. Specifically if the profits have been positive during the previous three years.

Even if the above requirements are not met, you have the right of separation. Only if you are a partner of the parent company of the group and this company is obliged to file consolidated accounts. This applies when:

- The company’s shareholders do not approve the distribution of at least 25% of the consolidated net income. They must be of the parent company of the previous year, provided that they are legally distributable.

- Consolidated positive results attributed to the parent company have been obtained during the three previous fiscal years.

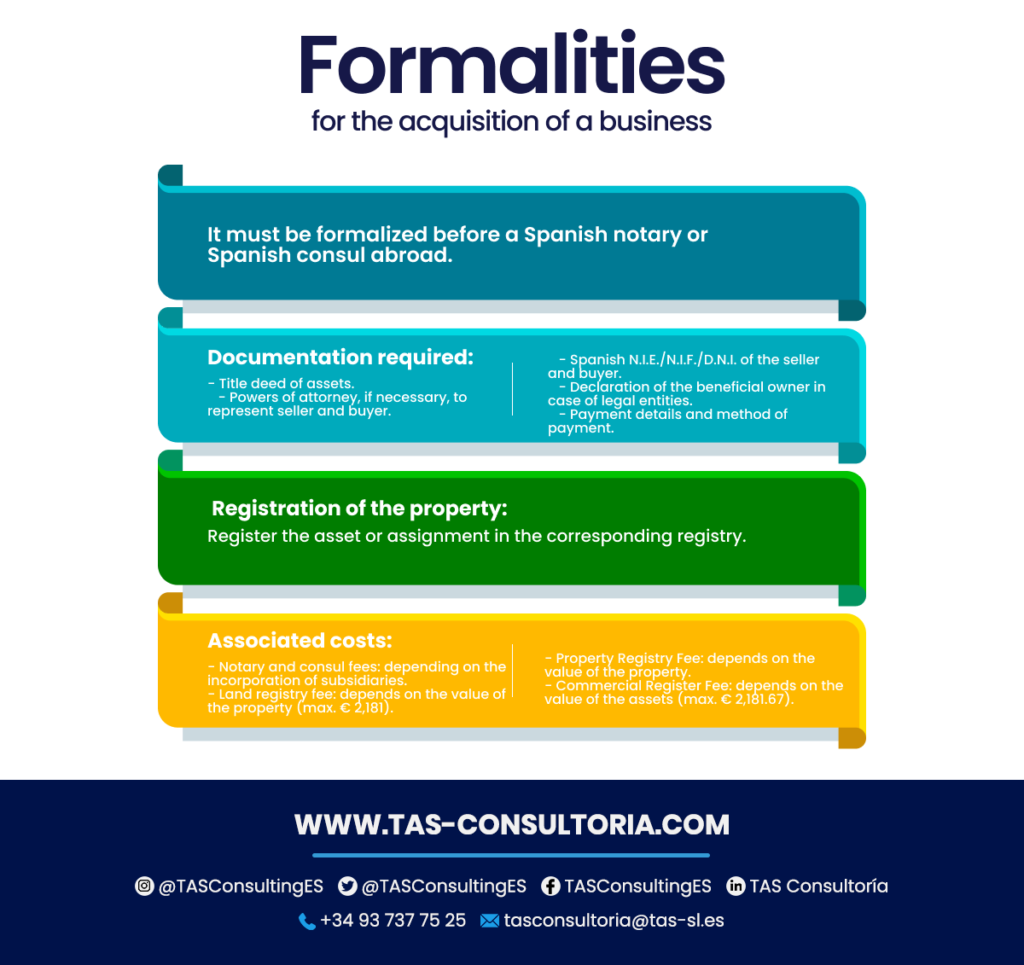

2. Acquisition of a business: an alternative to the purchase and sale of shares or participations.

If you are thinking of acquiring a business as a form of investment in Spain, consider these legal steps:

For the sale and purchase of assets and liabilities, you require the approval of the shareholders’ meeting. Either of the selling or buying company (in cases of essential assets). In the global assignment, it is necessary a project, report and approval of the partners/shareholders of the assigning company.

Remember, this investment process in Spain has specific costs and formalities. Before deciding, evaluate both legal and financial aspects.

You may also be interested in: What are Temporary Joint Ventures?

3. Acquisition of real estate in Spain

If you are considering acquiring a property as an investment in Spain, it is important that you take into account the following legal steps:

- Presence of a notary or consul: you must carry out the formalization before a Spanish notary or a Spanish consul abroad.

- Title to the property.

- Powers of attorney, if necessary, to represent seller and buyer.

- If you granted it abroad, it must be legalized.

- N.I.E./N.I.F./D.N.I. Spanish of the seller and buyer.

- Declaration of the beneficial owner, especially in the case of legal entities.

- Payment details and method used.

- Subsequent declaration of investment: in certain cases, you will have to declare the investment to the D.G.C.I.

Once the deed of sale has been formalized and taxes have been paid, your investment in Spain must be secure. Therefore, register it in the corresponding Land Registry to protect your property rights.

Associated costs

- Notary fees applied according to the scale established for the incorporation of subsidiaries.

- Tariff of the Spanish Consul abroad. It will be in force for notary fees.

- Land registry fee. For reference, it ranges between 24 € (if the value is ≤ 6.010 €). With a variable percentage (0.175% to 0.02%), with an overall limit of €2,181.

This investment process in Spain has specific costs and formalities. Be sure to consider both legal and financial aspects before making a decision.

4. Investment in venture capital entities

If you are looking for new ways to invest in Spain, consider this option. You should participate temporarily in the capital of companies established in our country through venture capital entities.

This approach allows you to contribute to the development of non-real estate and non-financial companies that are not yet listed on the stock exchange. Learn about the key points to carry out this investment in Spain:

Remember that investing in venture capital can offer substantial returns, but it also involves risks. Before making a decision, carefully evaluate your objectives and consider consulting financial professionals.

You may also be interested in: Business alternatives in Spain: 4 ways of doing business

This country offers you the possibility of diversifying your investment portfolio in ways you may not have considered. Are you ready to make the most of these alternatives and explore new perspectives to grow your wealth?

Don’t hesitate to contact us for personalized advice according to your needs and financial goals! Write to us at tasconsultoria@tas-sl.es, we are here to help you chart the path to an effective and successful investment in Spain.

Your email address will not be published .

Required fields are marked with *