Keeping an impeccable management of your income in accounting is essential. One of the issues that has generated the most debate is the practice of “disguising” income as loans from creditors. Discover the implications and key tips for keeping your accounting records in order. If you want to make sure your financial practices are sound and in compliance with the law, read on!

Do you know the income concealment strategy?

The practices of “disguising” income in accounting as debts against creditors are risky strategies. Generally, they are used by some companies to avoid paying taxes. However, it is important to understand the possible consequences of this action.

It is true that what some might consider a simple accounting “mismatch” can become a problem. Either having debts registered with suppliers without knowing their origin or exact nature.

This is especially relevant, since the lack of adequate measures in your accounting income has serious consequences. It may give rise to the presumption of the existence of undeclared income, or fictitious liabilities by the tax authorities.

You may also be interested in: Double taxation in Spain

What can you expect from these questionable transactions in your accounting income?

Often, these companies design complicated cash collection and payment schemes. The purpose of this is to leave no trace and, in this way, reduce their tax burden on income in accounting. However, these operations are not always beneficial:

1. No real benefit

If unreported income is used for expenses that will also not be reported, no real savings are achieved.

Risk of detection

In case the income in accounting is used to remunerate the partners, it may happen that the tax authorities want to investigate these practices. In this case, you would evade the tax declaration, but not the declaration of expenses.

Since the tax authorities have access to data on company margins. It often examines the partners of suspect companies.

Companies that follow this type of operation frequently face liquidity problems. By diverting revenues in accounting, they are often unable to meet official payments.

To solve this problem and keep this information hidden, these companies record the income as if it were loans received instead of sales. This allows you to record the money legally in your accounting and use it to make business payments without problems.

You may also be interested in: VAT exempt activities: in which cases does it apply?

What is your responsibility as a company?

A critical point to remember is the company’s responsibility is to prove the actual existence of the income in accounting. Along with the origin of the debts recorded in its accounting books.

The problem arises when a company has debts recorded with one or more suppliers that are still outstanding from previous years. This, for example, could be noted if the balances of these debts have not changed over time.

In such cases, the AEAT may require the company to audit its income in accounting. This in order to prove the existence and reality of these debts or to prove their payment.

Article 121.4 of the Corporate Income Tax Law 27/2014 (LIS).

Take, for example, Resolution 01269/2022 by the Central Economic Administrative Court (TEAC). Issued on September 25, 2023.

Although its main conclusion is not the focus of this discussion, it serves to emphasize one message. It is the importance of diligence in our accounting entries and daily professional activities. Neglecting matters that we consider minor can lead to problems with the State Agency of Tax Administration (AEAT).

If the company cannot satisfactorily justify these outstanding debts, the tax authorities could rely on Article 121.4 of the Corporate Income Tax Law 27/2014 (LIS).

This article suggests the possible existence of undeclared income. Especially in situations where it is estimated that the debts recorded in the accounting books lack substantial validity.

In this regard, it is important to remember that the burden of proof is on the company. This underscores the need to maintain accurate accounting entries, where properly documenting transactions and debts is a priority. Negligence in this regard can lead to unnecessary complications with the tax authorities.

What would be the tax consequences?

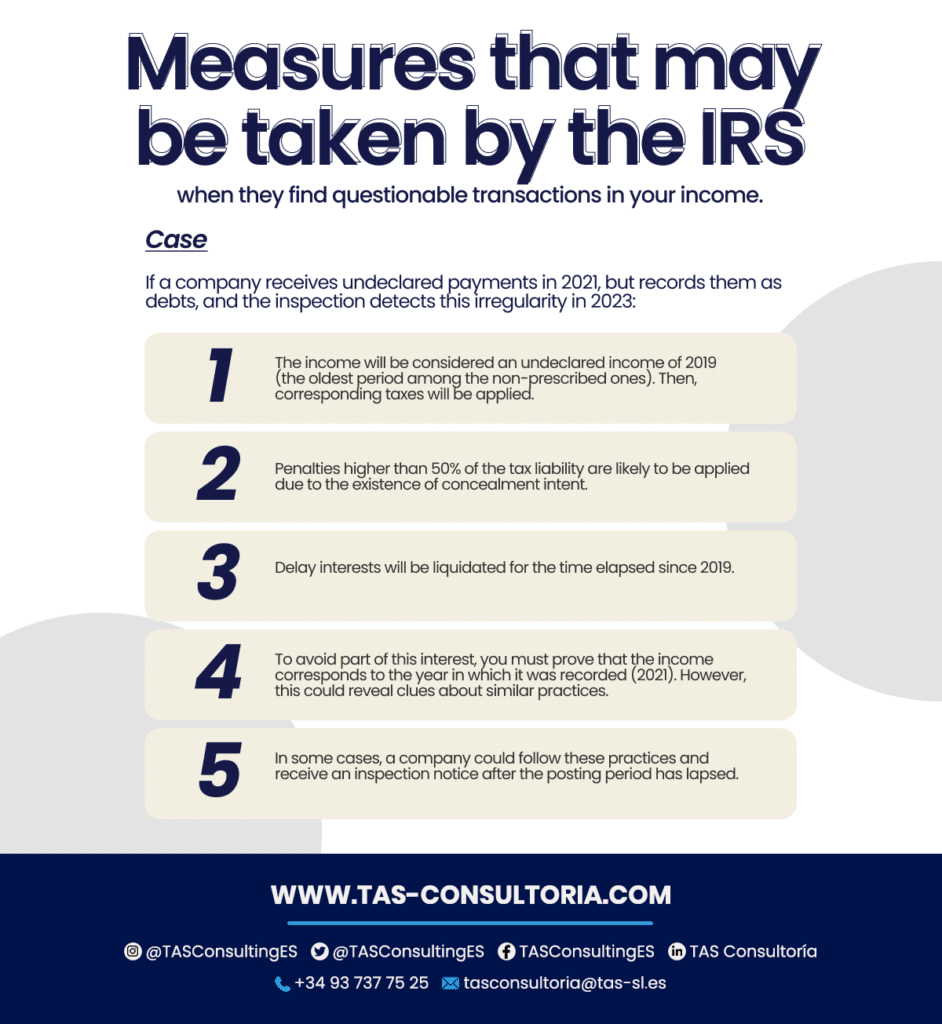

These practices in accounting income are regulated by the Corporate Income Tax (IS) law. When the inspection discovers that the accounting reflects a non-existent debt, it is presumed that it is an undeclared income. It is then imputed to the oldest tax period among the non-prescribed ones. For example:

In such a case, if the tax authorities detect the debt and intend to charge it to a prescribed year, the company can prove through the exhibition of the accounting records that the income corresponds to a prescribed year. In this way, the payment of the quota, penalties and late payment interest can be avoided.

Maintaining transparent accounting is essential to your company’s financial success. Avoiding unnecessary risks and ensuring compliance with tax regulations is critical.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

Would you like to get advice on good accounting practices and make sure your income is managed efficiently and legally? Don’t hesitate to contact us!

Our experts are here to help you make informed decisions and prevent potential penalties or tax problems. Don’t leave your accounting income in inexperienced hands — contact us today to ensure a solid financial future!

Your email address will not be published .

Required fields are marked with *