If you are self-employed and you have to file your VAT return, there is news you should know: in 2023 important changes have been introduced in the way of filing the 303 and 322 forms and the most outstanding thing is that paper is eliminated. This is a great advantage to manage taxes in a simpler and faster way. In this article, we tell you everything you need to know about the self-employed VAT return. Don’t miss the details!

What are the new implications following the elimination of the physical VAT return?

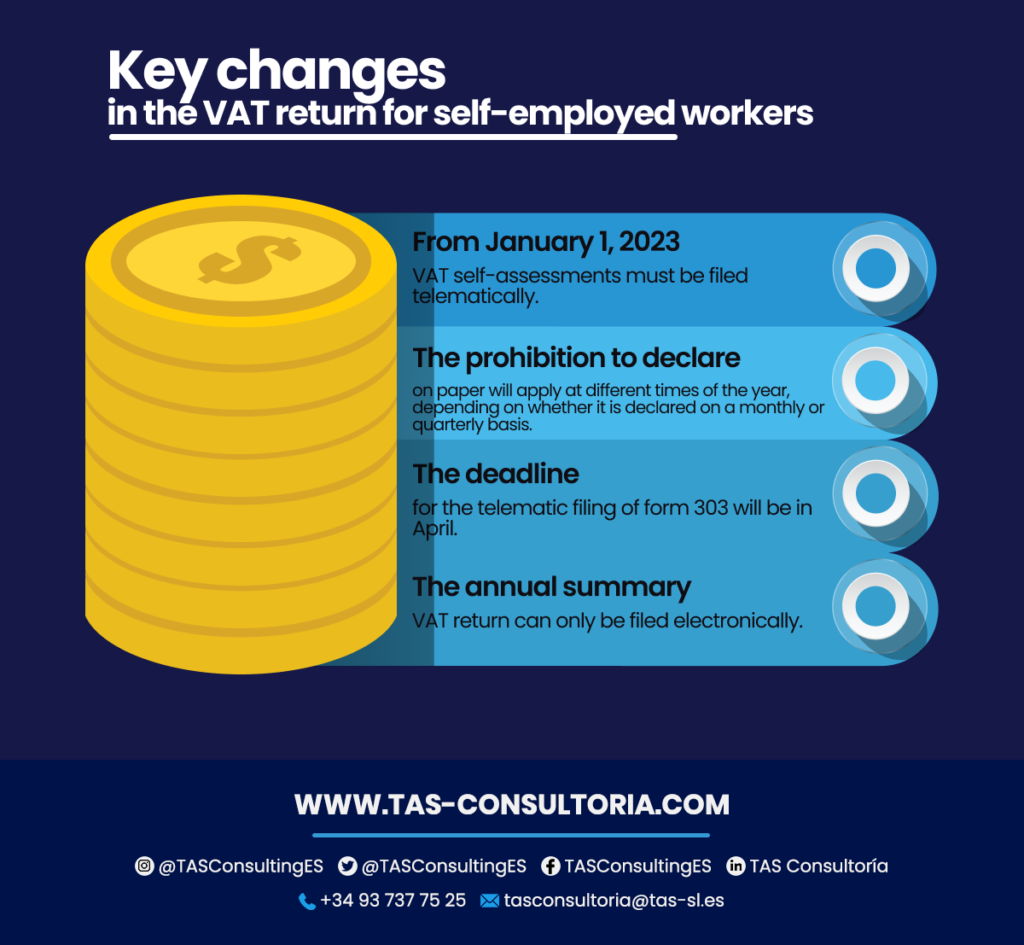

As of this year, the possibility of filing the self-employed VAT return on paper was eliminated, as indicated in Order HAP/2194/2013. This constitutes another step towards the consolidation of the digitalization of tax obligations.

This measure is part of a series of events aimed at transforming tax relations towards a more technological and modern environment. Thus, among the most important measures are:

You may also be interested in: Taxes in Spain for Foreigners

How do self-assessments work within the self-employed VAT return?

We are gradually moving towards a reduced use of paper, and this is important both for environmental reasons and for information security.

Paper is vulnerable to loss, deterioration or even theft, while the digital version offers greater protection and ease of access. In the case of self-employed VAT returns, taxpayers can request copies of their filed returns to ensure their availability in case of need.

What are self-assessments?

When a self-employed person makes a sale or provides a service, he/she must apply and collect the corresponding VAT, which he/she must subsequently pay to the Tax Agency through the VAT self-assessment. This is key in the self-employed VAT declaration.

It is important to bear in mind that this extra money does not remain in the hands of the self-employed, but acts as an intermediary between his clients and the Administration, since he must return it to the Treasury and settle accounts. In short, the self-employed person plays a fundamental role as a tax collector for the State.

Electronic filing is mandatory for several of the most relevant self-assessments of small and medium-sized companies (SMEs) and self-employed workers.

In the case of settlements, there are models where the same user performs several operations at the same time:

- You transmit to the Tax Agency the data required to settle the corresponding tax.

- You make a legal assessment of the facts, analyzing whether they should be reflected in some specific way in the corresponding boxes of the self-assessment form.

- You carry out the mathematical and quantification operations essential to calculate the amount to be paid, refunded or offset in subsequent self-assessments.

Which self-assessments can continue to be filed in paper format?

After the elimination of the paper form 303, this will be the only alternative available for the most important forms that can still be filed on paper:

- Form 111 and Form 115, used for withholdings.

- Form 122, which is used for specific personal income tax deductions.

- Forms 130 and 131, used for fractioned payments of Personal Income Tax according to direct or objective estimation.

- Form 136, required for the special taxation of certain lotteries and bets.

- Form 309, corresponding to the non-periodic VAT return-settlement.

You may also be interested in: VAT exempt activities: in which cases does it apply?

Self-assessments that can be filed online by means of electronic certificate

There are certain subjects that are obliged to file their forms by means of an electronic certificate, such as entities belonging to the public sector and taxpayers that are part of the Register of Large Companies. This includes those whose volume of operations exceeded 6,010,121.04 euros during the immediately preceding calendar year.

On the other hand, there are certain forms that must be filed by means of an electronic certificate. For example, taxpayers who must file their monthly VAT self-assessments are subject to the Immediate Supply of Information (SII) and must file them using it.

And to file the declaration-settlement form for the Tax on Insurance Premiums (form 430), it is mandatory to use the electronic certificate.

However, as an exception, the orders of each model may establish other means of electronic filing that do not imply the use of the electronic certificate.

On the other hand, in the case of self-assessments filed by individuals, there are the following options:

You may also be interested in: Tax benefits for the self-employed in Spain

In order to adapt to these changes, it is important to have good advice and efficient management of our self-employed VAT return.

In this sense, we offer a comprehensive service that includes the management of the self-employed VAT return in 2023, as well as the management of the digital certificate. Do not hesitate to contact us at tasconsultoria@tas-sl.es to help you in this process so you can focus on what really matters: your business.

Your email address will not be published .

Required fields are marked with *