If you are self-employed or have a company, you will know that Hacienda can send you electronic notifications about your tax obligations. These notifications are sent through the DEHú, which you access with your digital certificate or PIN code. However, vacations are sacred and no one wants to be on the lookout for tax liabilities. Find out here how to choose the 30 days of courtesy from Hacienda to not receive notifications, let’s go!

What are the electronic notifications sent by the Internal Revenue Service?

Electronic notifications from the Internal Revenue Service are messages that the Tax Administration sends to taxpayers by electronic means. This is to inform them of any process or procedure related to their tax obligations.

In order to receive electronic notifications from the Tax Authorities, it is necessary to register in the DEH system. This is a free and voluntary service offered by the Tax Agency.

By doing so, you obtain a unique and personalized e-mail address, which receives all communications from the Tax Administration. In addition, you can choose the preferred means of receiving notification notices: e-mail, SMS or mobile application.

There are several advantages of electronic notifications from the Tax Authorities, see below:

- Streamlines communication between the taxpayer and the Tax Administration.

- They avoid possible postal mail misplacements or delays.

- Facilitates access to notifications from anywhere and at any time.

- Contributes to saving paper and protecting the environment.

You may also be interested in: How does the equivalence surcharge work in Spain?

What is the Single Enabled Electronic Address (DEHú)?

The Single Enabled Electronic Address (DEHú) allows citizens and companies to receive electronic notifications from public administrations. It is a way to simplify and speed up administrative procedures, save paper and guarantee the security and confidentiality of communications.

To access the DEHú, you need to have a digital certificate or an electronic ID, and register on the portal [060.es]. Once registered, you can choose an email address or cell phone number to receive notifications.

You can also check the status of notifications, download attachments and access other related services.

What are the 30 days of courtesy without electronic notifications?

There is a way to avoid receiving these notifications during some days of the year. This is the option of “days on which electronic notifications will not be made available to the taxpayer” that you can configure at the Tax Agency’s electronic headquarters.

This option allows you to choose up to 30 calendar days per year in which you do not want to receive electronic notifications. These days can be consecutive or not, and you can modify them up to 7 times a year.

You may also be interested in: How to defer the payment of taxes in Spain?

Why request the 30-day courtesy period?

The 30 courtesy days are recommended, because electronic notifications have a term of 10 calendar days to be consulted from the time they are made available in the electronic mailbox. If this is not done within this period, they are understood as notified and the computation of deadlines to respond or appeal begins.

This can be a problem if you are on vacation, traveling, sick or simply do not have Internet access on those days. Therefore, it is advisable to choose the days on which you do not want to receive electronic notifications to avoid unpleasant surprises.

How to choose the best days not to receive electronic notifications?

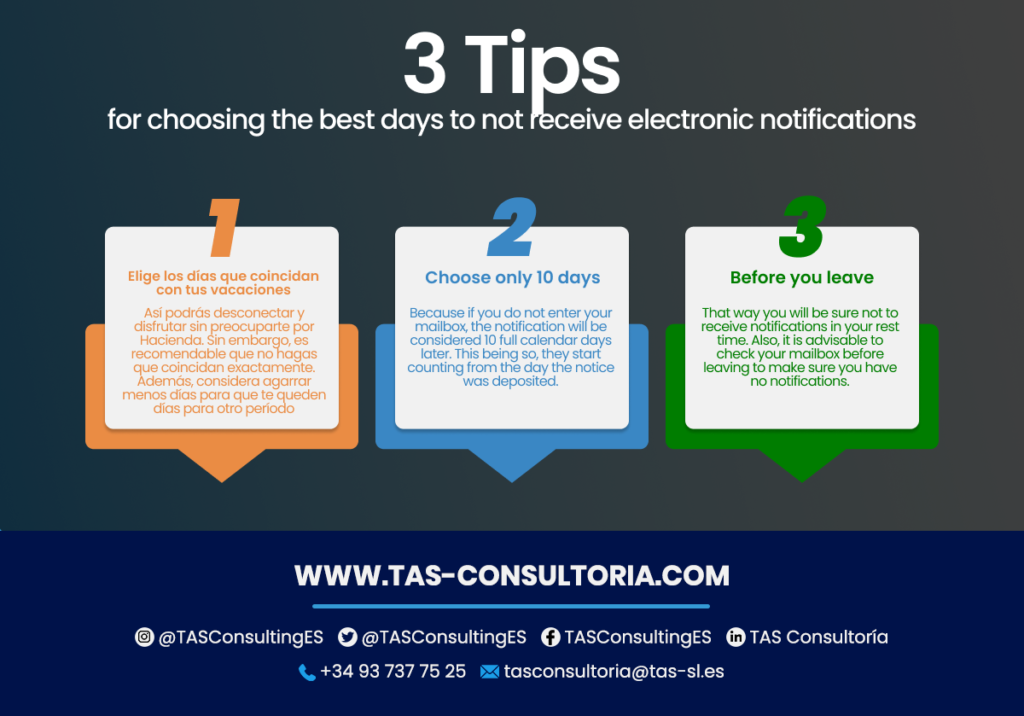

If you are still confused and don’t know at what point to request the 30 days of courtesy without notifications. Here are some tips that may help you make your decision:

In addition, you must remember that you can change the chosen days up to 7 times a year, as long as you do it before the 15th day of the month prior to the one you want to change.

How can I request courtesy days for the sending of electronic notifications?

Courtesy days can be requested for a maximum of 30 calendar days per year, provided that they do not coincide with the deadline for filing tax returns or self-assessments. To request them, you must access the Tax Agency portal and enter the Electronic Notifications section.

To request courtesy days for the sending of electronic notifications, you must follow the following steps:

Remember that requesting courtesy days is a right as a taxpayer, but also a responsibility. You should not abuse this service or use it as an excuse to evade your tax obligations.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

Do you want to be up-to-date with your tax responsibilities and choose correctly the 30 days of courtesy without electronic notifications? Contact us at tasconsultoria@tas-sl.es! Our team of experts is ready to provide you with the help you need.

Schedule with us your personalized advice and meet your needs with the best service in the market.

Your email address will not be published .

Required fields are marked with *