When you rent a place, it is normal that it is not everything you need or that it does not suit your aesthetics. However, if you want to change or reform it, you should know that any work you do is under the regulations of the Treasury. Do you want to know what the Treasury dictates regarding the works in renting of premises? Stay until the end and find out!

What happens if you make changes to your leased premises?

In Spain, if you make alterations to renting of premises, you must first obtain the landlord’s permission before doing so. If the landlord allows it, you will be able to carry out the necessary renovations for your business as a tenant.

But what happens if the landlord does not allow the renovations and you carry them out anyway? In that case, the landlord will be able to terminate the lease and claim compensation for the damage caused.

In addition, if you make alterations to the renting of premises, you will be responsible for maintaining and repairing them during the term of the lease. It is advisable that you inform yourself well about the regulations imposed by the tax authorities in this particular case.

You may also be interested in: The lease contract for commercial premises in Spain

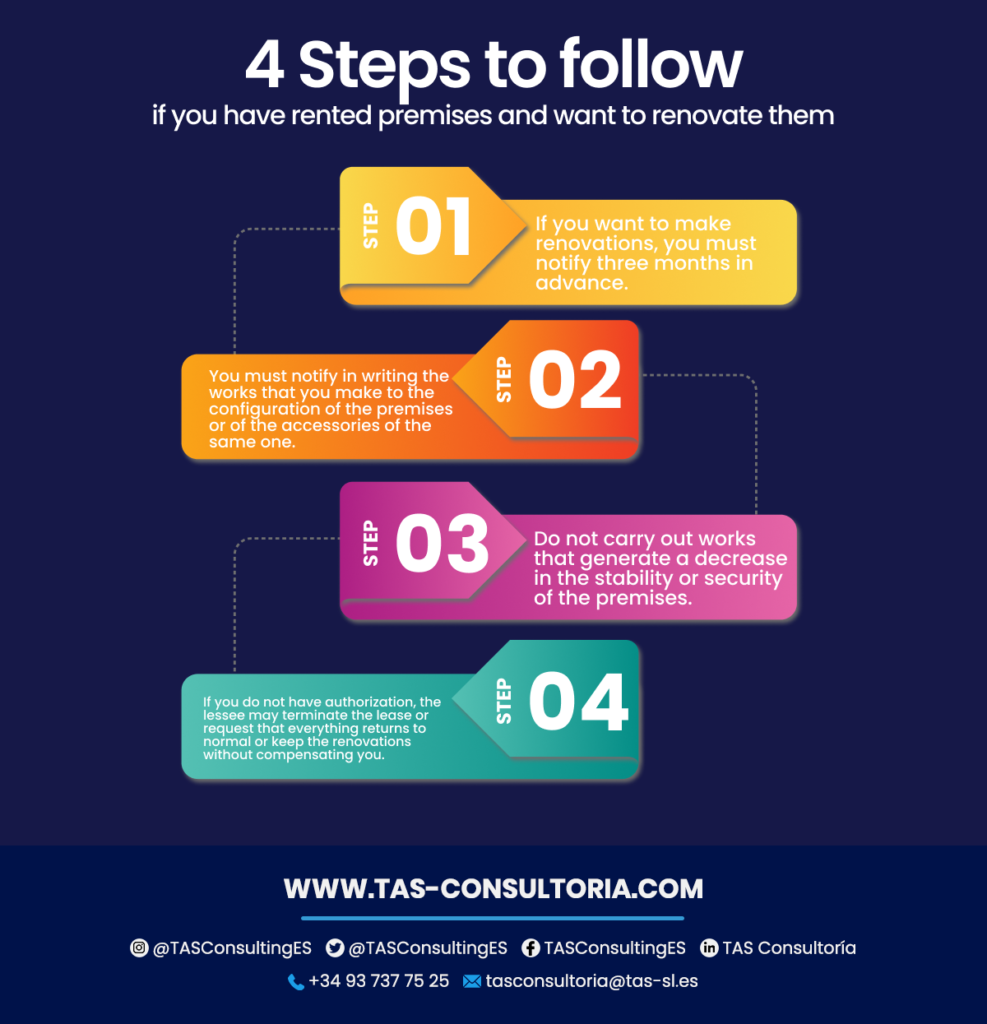

4 steps to follow if you have renting of premises and want to refurbish them

Have you renting of premises and want to carry out works to adapt it to your business and its aesthetics? Then these are the steps you should follow:

3 points to be considered by the tax authorities when you carry out works on your renting of premises

In Spain, when you renting of premises and renovate them, there are tax regulations established by the tax authorities that determine how the corresponding taxes and deductions are to be applied.

Here are the main points highlighted by the Treasury on this issue:

It is important to keep in mind that tax regulations and requirements may change over time. Therefore, it is advisable to consult a tax advisor or review the current regulations at the time of making changes to the renting of premises.

In addition, it is essential to keep a correct documentation of all the expenses and investments made. That is to say, keep the corresponding invoices and receipts to comply with tax obligations and enjoy the corresponding deductions according to current regulations.

You may also be interested in: Hiring a real estate agency: what should you know?

What is the Tax on the Increase in Value of Urban Land (IIVTNU)?

The Tax on the Increase in Value of Urban Land (IIVTNU) is levied in Spain when urban land is transferred.

The main objective of this tax is to tax the increase in value of urban land when it is transferred. This can be through sale, inheritance, donation or any other form of transmission.

The IIVTNU is based on the idea that the value of urban land increases over time. The more development and growth the area has, the more benefits the land will offer. As a consequence, its economic value increases.

In this sense, when urban land is transferred, it is assumed that its value has increased. This being so, its increase must be taxed.

How is the IIVTNU calculated?

The calculation of the IIVTNU is based on several factors. For example, the cadastral value of the land, the time elapsed since the previous acquisition. Also, the tax rate established by the corresponding town hall and other elements that influence the valuation of the land.

It is also important to note that the IIVTNU has been the subject of controversy and debate in recent years. But why? In 2017, the Spanish Constitutional Court declared the tax unconstitutional. This applies in cases where there is no real increase in value in the transfer of the land. This ruling led to some legislative amendments and a review of the valuation criteria used by local councils.

How can I reduce my IRPF renovation expenses in Spain as a tenant?

If you completed the lease of premises and made renovations to it, you can deduct them from your IRPF payment. Of course, as long as the renovations made reduce the consumption of non-renewable primary energy. But not only that, you must also adapt the premises to current health and safety regulations.

In the case of energy consumption, this must be reduced by at least 30% or at least improve the energy rating of the building to obtain an energy class of “A” or “B” on the same rating scale. This being the case, these works are eligible for a deduction.

In addition, renovation costs may be deductible as long as they are incurred to improve the lessee’s business. In this case, the lessee may deduct the costs of the renovations as a business expense on its tax return.

You may also be interested in: How to register a trade name in Spain?

Do you need tax or real estate advice on the reforms that you can carry out when renting premises? Get advice from our experts at TAS Consulting. Just contact us at tasconsultoria@tas-sl.es.

Our team of professionals can provide you with the help you need to grow your business. Contact us and ask for your free advice.

Your email address will not be published .

Required fields are marked with *