With the steady growth of self-employed professionals in Spain in recent years, entrepreneurship has become one of the best employment options for many workers. However, many of the entrepreneurs have expanded their hiring range without assuming the responsibility that this entails. In this article we want to tell you about the risk you run as a freelancer by not registering your employees, Join us!

Why should you, as a self-employed person, cancel your membership in the Special Regime for Self-Employed Workers?

As a self-employed worker, it is important that you comply with the obligation to register with the Special Regime for Self-Employed Workers (RETA). It is important that you do so within 30 days from the start of your activity.

If a self-employed worker starts working without register with the Treasury, he/she would be committing a very serious infraction, which can result in a fine of between 300 and 3,000 euros.

Register with the Social Security Treasury.

This is a necessary step that every self-employed person must take, as it is the only way that he/she can receive social benefits. In addition, you will also have to pay the self-employment fee according to your income.

In case of late payment, such payment will have a surcharge of 20% and the accumulated interests of the previously contracted debt will be added. Also, it is very important to register your workers, as this can result in multiple penalties, which we will talk about later on.

You may also be interested in: Tax obligations for the self-employed in Spain 2022

What is the penalty for the self-employed for not register their workers?

Failure to register an employee, constitutes a crime, as shown in Article 311 of the Penal Code and the Royal Legislative Decree 5/2000, of August 4. The amount of the fine ranges from 9,750 euros, up to 12,000 euros.

If the Labor Inspectorate is the one who discovers the problem, it will be almost impossible for you as a self-employed entrepreneur to solve your situation positively and quickly. If so, the allegations are dismissed in their entirety if that is the case.

How does the Labor Inspection work?

When your company, being self-employed, has unregistered employees, you may receive an unexpected visit from a labor inspector. As part of his work, he will ask you to verify the data of all the workers in your charge.

If there are any irregularities, a report will be issued notifying the company that it is not complying with the laws and regulations. Subsequently, the company will be given a period of time to present the allegations and regularization of its workers.

Problems you may encounter as a self-employed person if you do not register your employees

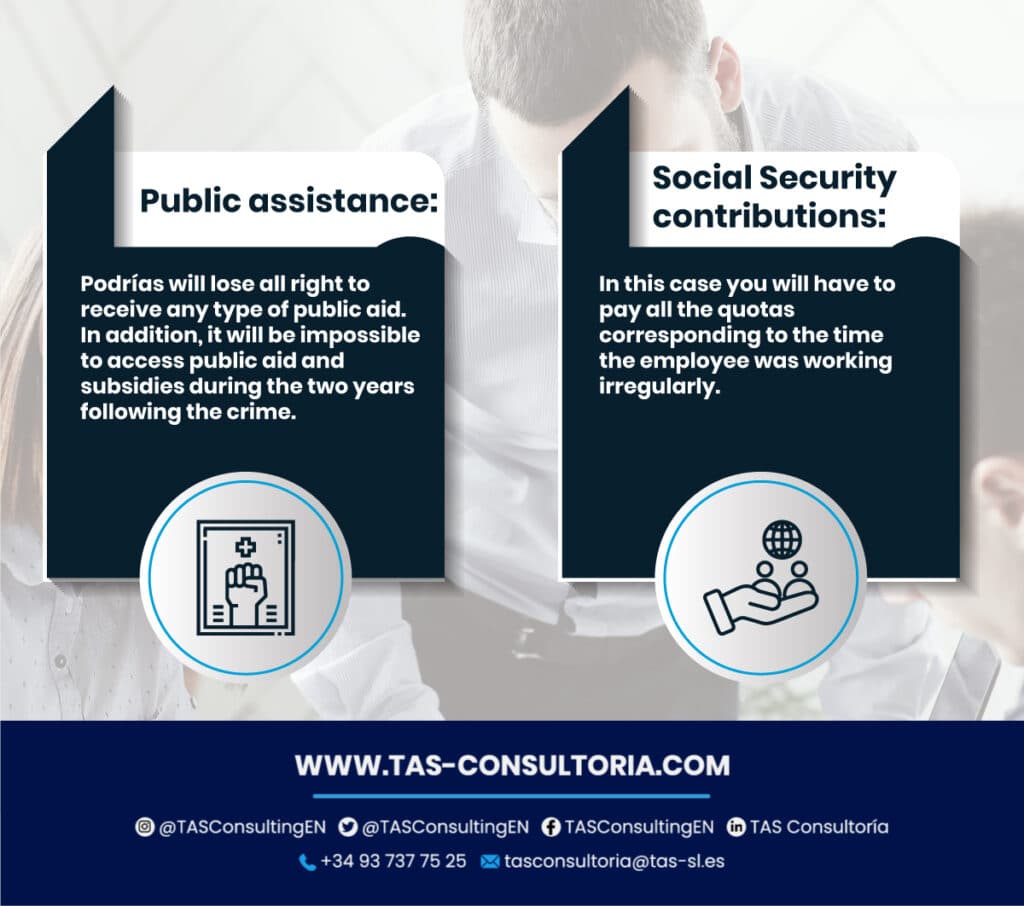

If you are self-employed and your employees are not register, you may encounter two major difficulties that we will explain below:

You may also be interested in: Form 036 and 037: registering with the Tax Authorities

What are the penalties for companies that do not register their employees with Social Security?

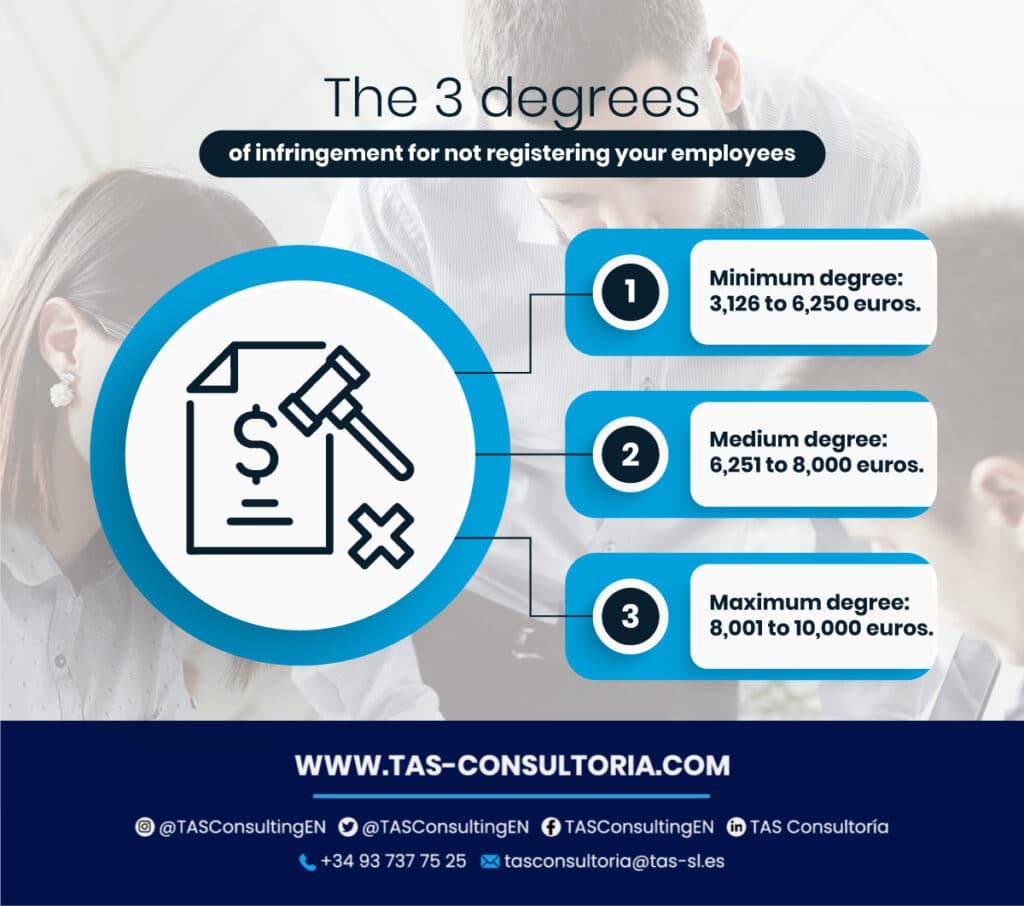

Failure to register workers with the Social Security will have serious consequences for companies, and may result in a fine of between 3,126 and 10,000 euros. The amount of the fine will depend on the degree of the infraction committed:

It is the labor inspector who chooses the degree of infraction of the company. Sanctions are applied for each worker that the company has in an irregular manner.

When is a freelancer at risk of imprisonment?

The crime of having unregister workers could carry a prison sentence, if there is more than one worker in the same irregular situation. Depending on the seriousness of the offense, the penalty may vary from six months to six years of imprisonment.

However, it is important to always bear in mind that failure to register employees is a serious violation of the law.

What are the consequences of not being register?

The consequences not only apply to the self-employed for not registering their employees, but the workers themselves will be seriously affected by the problem.

In this case, the worker will be deprived of the right to unemployment benefits and retirement pensions, in addition to not having any coverage for contingencies such as illnesses or accidents at work.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

To learn more about these penalties that your company can suffer by not registering your employees and how you can prevent them. I invite you to contact us through our email tasconsultoria@tas-sl.es and request your free trial. We have the best professionals ready to advise you on everything you need, do not miss this opportunity and contact us!

Your email address will not be published .

Required fields are marked with *