The IRPF reduction for those who lower the rent is a measure that seeks to encourage the supply of rental housing in Spain. It aims to favor both owners and tenants, providing tax benefits and facilitating access to affordable housing. Do you want to know how you can benefit from the personal income tax reduction? Then you’ve come to the right place, follow us to the end!

Tax benefits of the reduction in housing rent: How much can you save in personal income tax?

The approval of the new Housing Law is expected soon. This important legislative milestone will bring with it a series of significant changes in the real estate sector, such as the personal income tax reduction. One of them is the introduction of tax reductions for homeowners who decide to reduce the rental price.

The main objective of this legislation is to promote stability and balance in the real estate market. This to the extent that it provides affordable options for those seeking rental housing.

The latter by offering tax incentives for owners who choose to lower their prices. This is expected to have a positive impact on both supply and demand.

This being so, in case of adjusting downwards the amount of the rent of the house, you will be able to benefit from a great saving. Specifically, in the payment of the Personal Income Tax (IRPF).

In addition to the personal income tax reduction, the Housing Law includes other provisions aimed at improving the regulation of rentals. Some of these include the protection of tenants’ rights and the prevention of abusive practices by landlords. As well as the promotion of transparent and fair rental contracts.

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

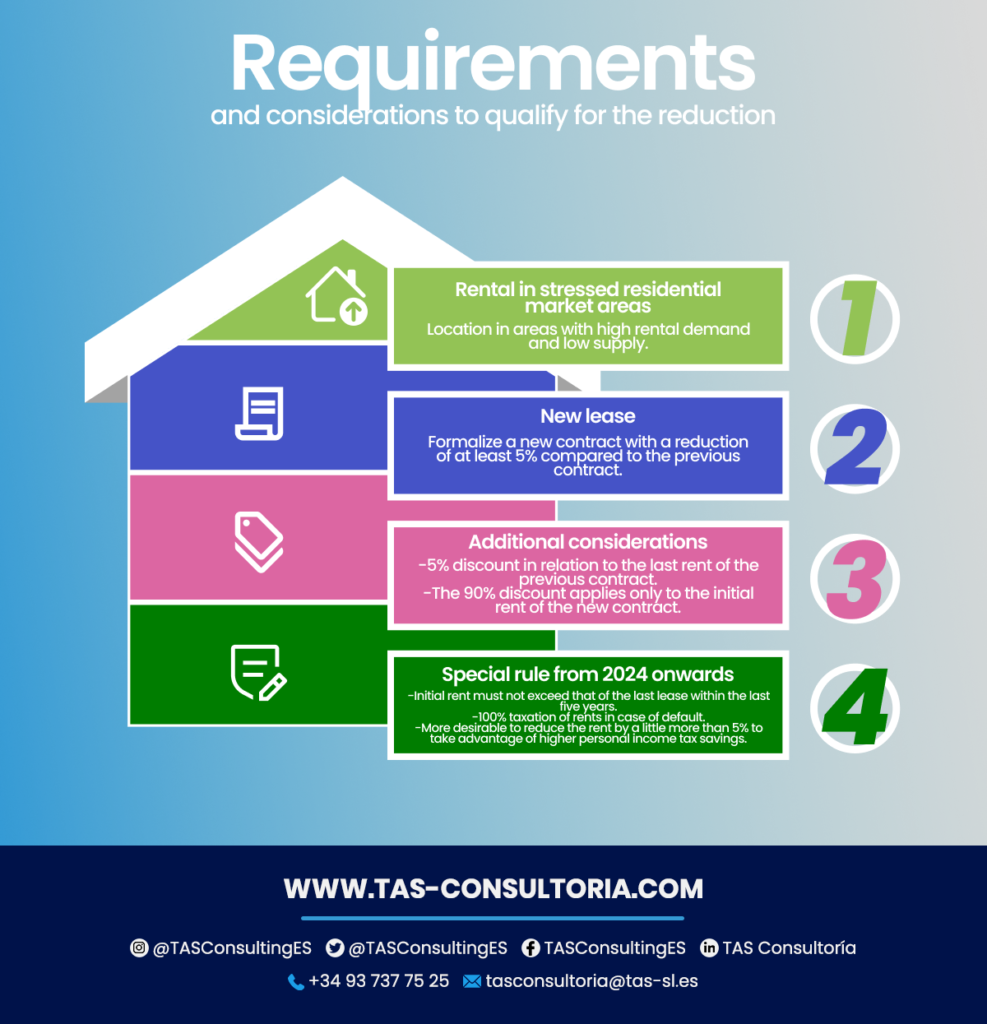

Requirements and considerations to qualify for personal income tax reduction

If you are thinking about reducing the rent on your home, there are some important requirements and considerations to keep in mind. These are as follows:

Stressed residential market areas

To qualify for the personal income tax reduction, the property must be located in areas where rental demand exceeds supply. In this way, you generate a situation of tension in the residential market.

New lease agreement

You must formalize a new rental contract to obtain the personal income tax reduction. It can be with the previous tenant or with a new one.

In this new contract, the initial rent must be reduced by more than 5% compared to the last one for the same dwelling.

Additional considerations

When determining the amount of the new rent to access the 90% IRPF reduction, it is important to consider the following:

- 5% discount in relation to the last rent

The 5% discount is calculated based on the last rent of the previous lease of the same property. Once the annual update clause of the previous contract has been applied, if any.

- Discount due on initial rent

As established by law, the 90% IRPF reduction only applies to the initial rent of the new lease.

Important: if in the following years the rent is updated according to the corresponding index, there is no problem. If the discount no longer exceeds 5%, it is understood that the 90% reduction will be maintained.

From 2024, a special rule is established for new leases in stressed areas

For the personal income tax reduction, it will be necessary that the initial rent does not exceed that of the last rental contract formalized in the last five years. Except in certain exceptional cases, such as improvement works carried out or rental contracts of at least 10 years.

You may also be interested in: Taxes in Spain for Foreigners

In case of non-compliance with this rule, you will be taxed on 100% of the income obtained. This limitation of increase is key to consider the option to reduce the rent and obtain greater savings.

Examples of savings by reducing the cost of rent

The Registro de Asesores Fiscales (REAF) of the General Council of Economists has provided examples of how a landlord could “win” by reducing rent by 6%. So, how would your IRPF reduction be calculated? Like this:

Purchase price of the property: 300,000 euros.

It has a rent of 1,000 euros per month or 12,000 euros per year.

- With the 6% reduction, the annual rent would be 11,280 euros. This means that the owner would receive 720 euros less per year.

- This loss would be mitigated by the tax credit to which the owner would be entitled in his income tax return.

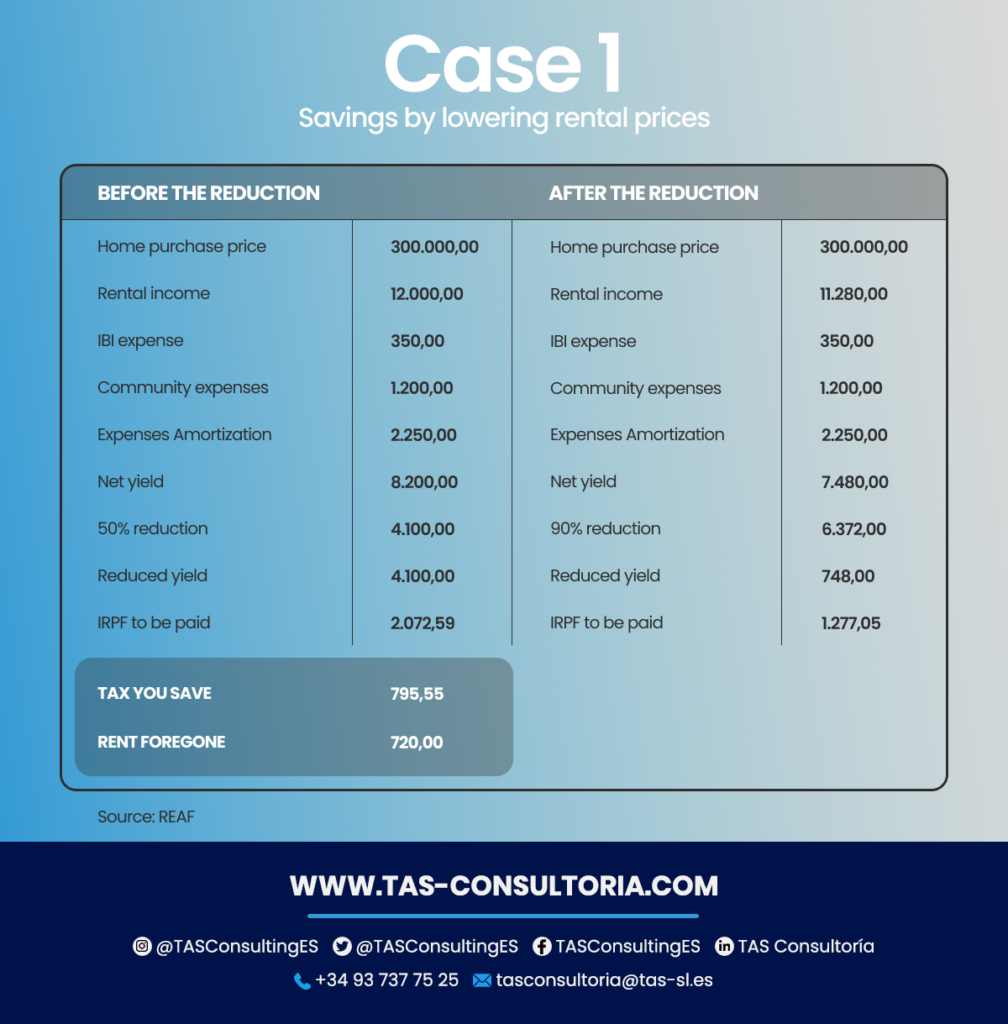

Example 1 of the personal income tax reduction:

- Let’s look at the case of a single owner, under 65 years of age and without offspring. With a total income of 18,000 euros, he could save 795.55 euros in the IRPF. This amount exceeds by 75.55 euros the loss suffered in the rent, which means that the owner would obtain a positive net balance.

This can be seen in more detail in the following table:

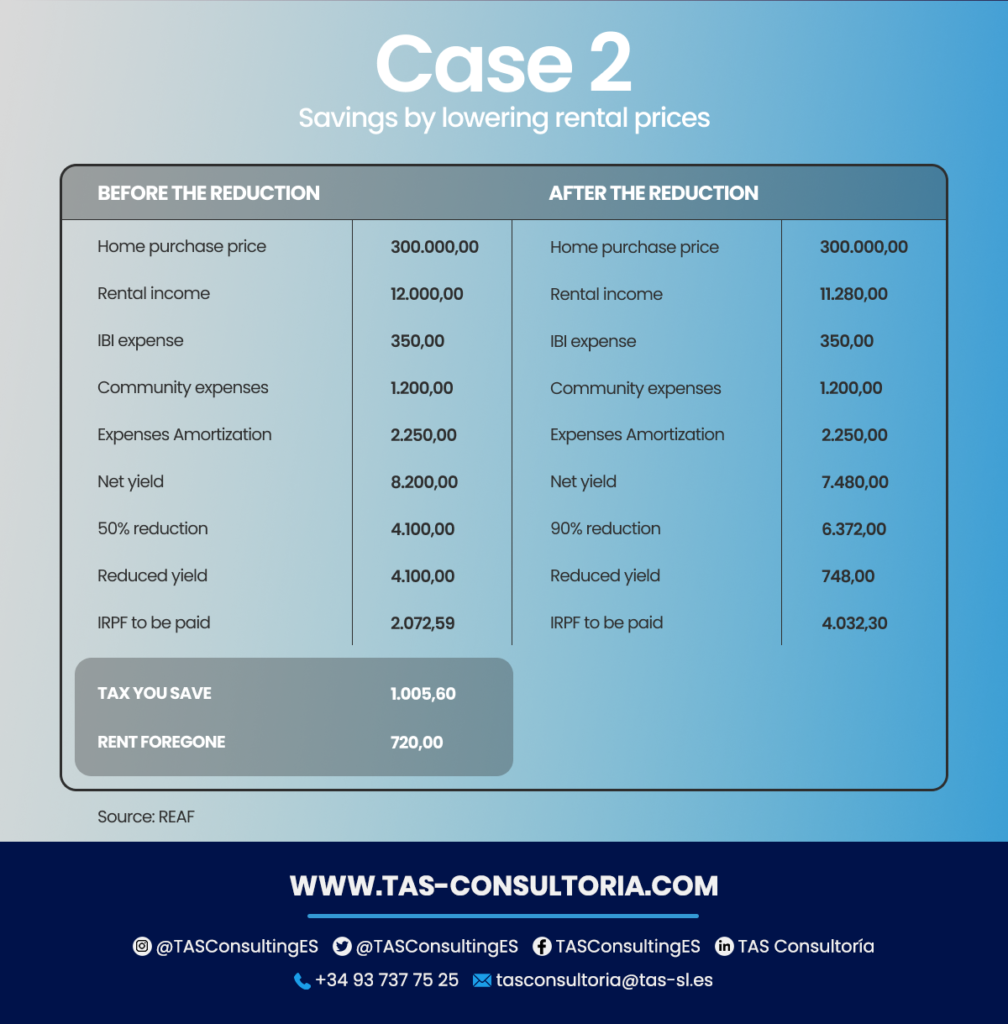

Example 2 of the personal income tax reduction:

- A single owner, without children and under 65 years of age, with an annual income of 26,000 euros. Without the rent reduction, he would have to pay 5,037.9 euros in his personal income tax return. With the reduction, the amount would decrease to 4,032.3 euros, which means a saving of 1,005.6 euros.

- This amount is 285.6 euros more than the loss caused by the rent reduction. This is the positive net balance that the owner would obtain.

In the same way, know in more detail how the tax structure of this example would be:

You may also be interested in: Hiring a real estate agency: what should you know?

The personal income tax reduction for those who reduce their rent offers significant advantages to both owners and tenants. If you are a landlord and you are interested in taking full advantage of this tax reduction, it is important to have the right advice and management.

In our company, we have experts in tax services that can help you understand how the IRPF reduction works and how to apply it effectively. Contact us at tasconsultoria@tas-sl.es and schedule your free consultation!

Your email address will not be published .

Required fields are marked with *