The importance of complying with tax deadlines should not be overlooked. In case you forget to file a tax return or are late in filing it, the Tax Agency could penalize you, depending on whether you pay voluntarily and how late you file. This fine will depend on whether you pay voluntarily and how long you file late. Do you want to know what could happen if you’re late filing? Here is what you need to know.

Alternatives for paying a tax to the Internal Revenue Service after the due date

Tax returns can be overwhelming. For this reason, you need to be aware of the consequences of making late returns or payments.

First, you must make the payment of a tax filed after the deadline as if no delay had occurred. To do so, go in person to the AEAT offices or to the bank. We recommend that you make the payment as soon as possible, since the penalty increases with the passage of time.

When you go to the bank to make the payment, they will provide you with an NRC Code that will serve as proof of payment. Afterwards, you must return to the electronic office and, in the Declaration Type section, select the “Total Income” option. Subsequently, you must enter the amount paid and the NRC code.

You may also be interested in: Tax obligations for the self-employed in Spain 2022

How to deal with the late filing of your taxes without a prior request?

A key point: when filing late, pay before the tax authorities take action. This will help you avoid penalties for late filing. However, you will be charged interest due to the late filing.

In the declaration process, the Administration will define a previous requirement in which the Treasury will notify you of any irregularity. In this case, the delay in your tax return.

This means that if you correct the situation on your own, without receiving any notification from the IRS, the penalty will be less.

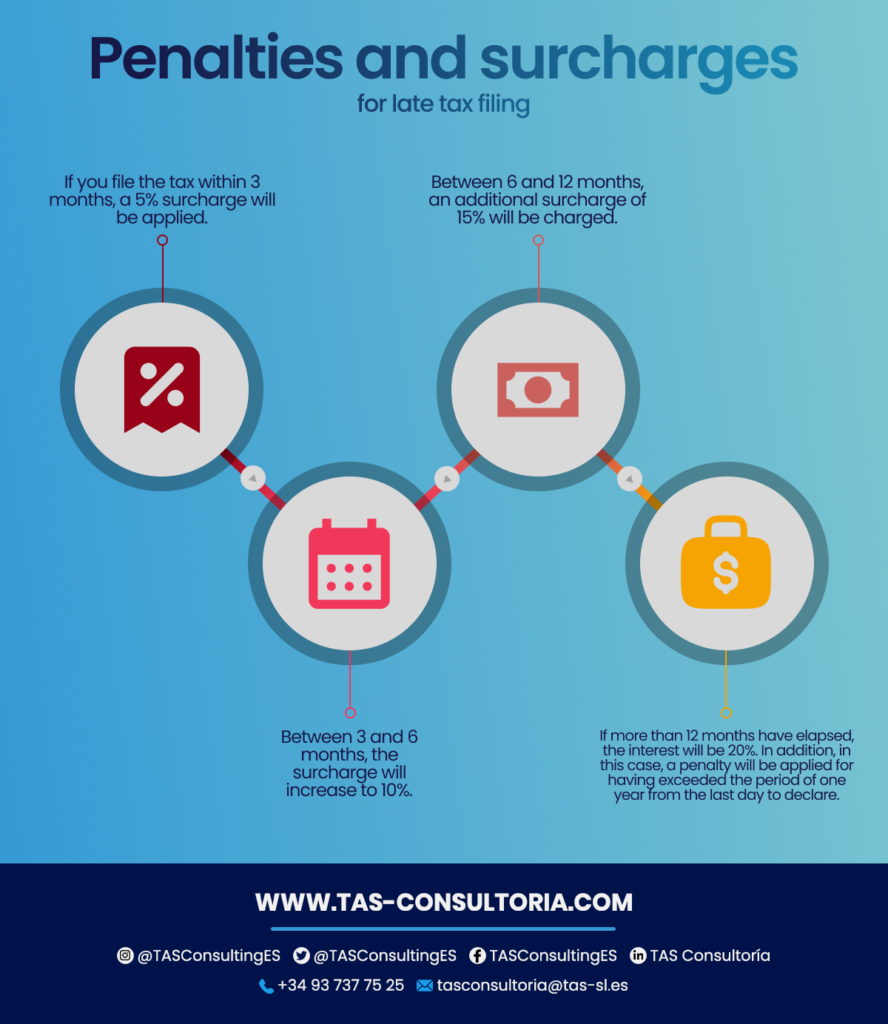

What are the penalties and surcharges for late filing?

The penalty for filing late tax returns will depend on the time elapsed since you became aware of the situation. This being so, the amount of the penalty will vary according to the period of delay. To give you more details, below we share with you the most important AEAT 2022 late filing surcharges:

It is crucial that you keep in mind that these surcharges will be calculated according to the amount you must initially pay. They only apply to late payment of taxes. However, penalties will vary if the deadline for requested deferrals or installments is not met.

That said, a late rent payment is not necessarily a serious penalty.

You may also be interested in: How to defer the payment of taxes in Spain?

Non-payment with prior notice: consequences and penalties

As you have already found out, if you missed the deadline to declare and you have received a notification from Hacienda before paying, the fine will be higher. Therefore, we recommend you to make the payment voluntarily before Hacienda notifies you.

In case the Tax Agency has to call your attention, surcharges will be applied on the amount to be paid. In addition, there will be a financial penalty for the delay.

Now, in case you do not agree with the fine, for any reason, you have the right to complain within 10 days after receiving it.

We also recommend that you bear in mind that the penalties for late filing vary according to the corresponding tax. For example, if you are late in the payment of VAT, the penalties can reach a surcharge of up to 100%.

In this case, you may have to pay double the original amount due to a few days of delay. If you find yourself in this situation, it is advisable to review the possible reductions of the penalty. This is because they could mean a saving of up to 50%.

Late Filing: return, zero or informative return

When filing your tax return after the deadline, if the result is negative or zero, the Administration can penalize you with 200 euros. This, of course, if you have been previously notified of your delay.

In the case of informative declarations, you will be asked for 20 euros for each piece of information or set of information referring to the same person or entity. All this with a minimum of 300 euros and a maximum of 20,000 euros.

In addition, it is essential that you keep in mind that in both situations, if you file taxes before receiving a claim from the IRS, the penalties and limits will be reduced by half. As we have told you throughout the article.

In other words, the penalties would be 100 euros for negative and zero returns. And €10 for each data or set of data in informative declarations, with limits between €150 and €10,000.

For a better understanding, you can see the summary below:

You may also be interested in: Types of taxes in Spain: direct and indirect taxes

It is crucial that you understand the consequences of late filing. Not only the financial penalty you may receive, but also the legal and tax complications you may face.

For us, it is essential that you avoid as many risks as possible. Therefore, we put at your disposal our experts in Spanish taxation. Contact us through our email tasconsultoria@tas-sl.es and schedule your free advice. Guarantee with us the correct fulfillment of your tax obligations, what are you waiting for?

Your email address will not be published .

Required fields are marked with *