Are you part of a company and your incorporation involved contributing a share premium? If so, it is vital to understand how this situation influences the taxation of the dividends you might receive. In this article, we will explain the key aspects you need to know in order to optimize your tax burden. Read on and make informed decisions for a better financial performance!

What are share premium?

Share premiums play a crucial role in capital increase transactions in the financial context. When a company decides to increase its capital, it does so by issuing new shares at a price higher than their par value. This difference between the nominal value and the price at which the new shares are issued is known as the share premium.

This practice has a significant strategic purpose: to compensate existing shareholders. New shareholders contribute to the capital gains accumulated by the company up to that point. Since they pay more for the shares than their nominal value indicates.

This additional capital contribution, which generates a share premium, strengthens the company’s reserves. This in turn avoids dilution of existing shares. This ensures that the entry of new shareholders does not harm the proportion of participation and the rights of the original shareholders.

Thus, the share premium strategy also serves to maintain a balance in the market value of the shares. Contributing to the sustained growth of the company in the long term.

This is a practice commonly used in the financial world to support the development and expansion of organizations. At the same time ensuring equity and stability in the shareholding.

You may also be interested in: What is the Financial Transaction Tax?

What are dividends and their relevance to shareholders?

Dividends are the earnings in the form of money that a company delivers to its shareholders. Depending on the amount of shares they own (share premium).

These payments are essential for shareholders, as they represent a vital part of their earnings from owning the company. Dividends convert retained earnings into real benefits for shareholders. They provide them with a reward for their investment and affect how they view the company’s long-term profitability.

In this way, they become a way for the company to share its profits with its stakeholders.

Opt for additional paid-in capital before dividends

If you became a partner in a company through a capital increase, it is likely that you contributed a share premium. This reserve is created when a partner acquires shares after the incorporation of the company.

Generally, this is done by paying a nominal value and an additional premium. This is to compensate the existing partners for the increase in value of the company since its inception.

Take advantage of the tax benefit

If you are in this situation, when the time comes to distribute earnings, we recommend that you distribute the share premium first. This can lead to significant savings in your personal income tax return. You will only be taxed on the part that exceeds the acquisition value of your shares.

You may also be interested in: Keys to carry out a capital increase in your company

How does taxation of additional paid-in capital work?

When the share premium is distributed, part of it is treated as a dividend. It is taxed according to the equity of the company minus the acquisition value for each partner. However, if the acquisition value is higher than that of the senior partners: it is likely that a large part of the premium will not be taxed as a dividend for you.

It is essential to bear in mind that these processes may vary depending on the specific tax legislation of each country. Therefore, it is highly advisable to have the advice of a tax expert to fully understand the implications. We explain a case under Spanish taxation.

An illustrative example

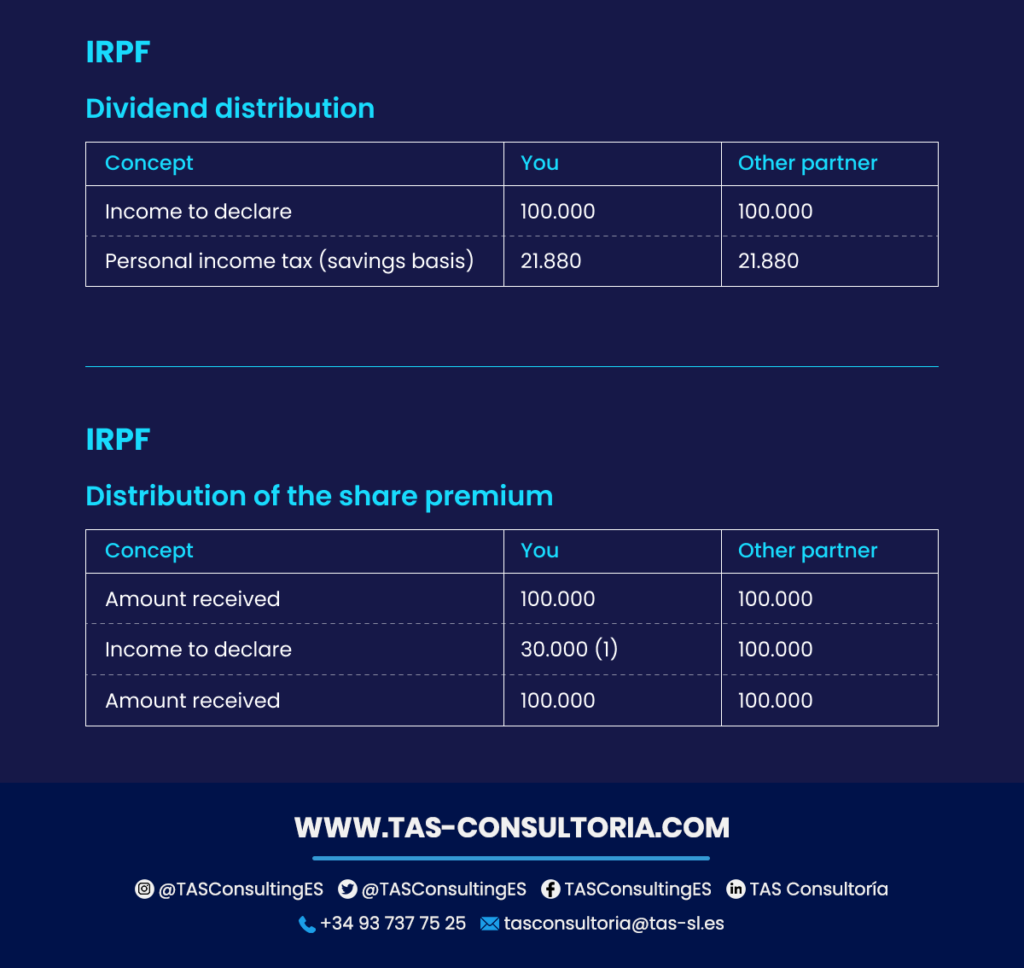

Let’s assume that your limited liability company has a capital of 20,000 euros. Together with a share premium reserve of 264,000 euros. If you decide to distribute 100,000 euros, receiving the premium instead of dividends can save you significant taxes. Let’s see how this compares to traditional dividend taxation:

This approach can provide you with significant tax benefits and will not increase the tax burden for your fellow partners. Additional paid-in capital is not taxed in the same way as dividends. This is because it is an amount that is added to the company’s capital stock.

Reasons behind corporate dividend payouts

Companies choose to distribute dividends for tax and transactional reasons. This practice provides assurance of the veracity of accounting reports and serves as a test of managers’ diligence in financial management. It also helps reduce agency costs by aligning shareholders’ interests with the dividend policy.

In addition, the regular and increasing distribution of dividends acts as proof of the company’s financial soundness. It generates shareholder confidence and attracts potential investors.

However, the determination to pay dividends is not always straightforward. In fact, it may vary according to economic conditions, the company’s strategic objectives and shareholders’ preferences.

You may also be interested in: What are Temporary Joint Ventures?

If you’re interested in exploring the bonus issue option and need tax or legal advice, don’t hesitate to contact us! We are here to help you navigate your work situation and get the maximum benefits. Contact us at tasconsultoria@tas-sl.es and schedule a personalized consultation with our professionals, they will help you enhance your business.

Your email address will not be published .

Required fields are marked with *