Learn about an essential concept for financing SMEs and startups in Spain: “participative loans”. What exactly does it mean and how can it transform your company? Discover its financial keys and how it can boost your project. Read on for crucial information – here we go!

What are participative loans?

Participative loans are a form of corporate financing in which the lender is actively involved in the profits generated by the financed company. This is in addition to receiving a fixed interest rate.

You should know that this type of financing is somewhere in between the company’s own funds and external resources. Therefore, it is a long-term loan that is granted as the objectives stipulated in the business plan are achieved.

Historically, participative loans have been used to provide public subsidies or grants by lenders with public capital. For example, Empresa Nacional de Innovación, S.A. (ENISA).

However, it can also be used by private entities or investors to support the launch of a startup. In this case, there is the possibility of becoming a partner in the company. The contract establishes a period in which the investor can choose to request the repayment of the loan. But he can also transform it into a percentage of participation in the company’s capital.

Thus, if the company does not achieve the expected results, the investor has the option of requesting repayment of the loan. Thus, if the company does not achieve the expected results, the investor has the option to request the repayment of the loan.

You may also be interested in: Expansion and Diversification Strategies

Key features of participative loans

1. Interest, both fixed and variable, linked to a business indicator.

The variable interest rate is linked to a business indicator, which is why they are called participative loans. This indicator varies depending on the case. It can refer to aspects such as sales, turnover, completion of a product, reaching a certain number of customers, among others.

In general, it is usually based on profit or turnover. It is therefore common for this variable interest rate to be capped. However, you can also fix a fixed interest rate on participating loans.

It is usually symbolic and is intended to cover inflation or opportunity cost. This is because the main idea of this type of loan is that the lender “participates” in the borrower’s results.

2. Limitation of early redemption

The regulations only allow the early cancellation of the loan if it is offset by an equivalent increase in the company’s capital. This prevents the company from being undercapitalized and prejudicing other creditors. In some cases, there may be a penalty clause agreed by both parties in the event of early repayment.

Subordination to other financial obligations

Participating loans rank junior to any other receivable or obligation of the recipient company. This implies that the lender ranks after the common creditors in the event of bankruptcy proceedings. Therefore, it will only be paid before the company’s shareholders. This provision leads the lender to assume a risk similar to that of the owners.

As a result, it is common to require that the company’s own funds exceed the loan, thus ensuring that the lender does not assume a greater risk in the project than the company itself.

4. Treatment as equity

Participative loans are considered part of the company’s equity in the context of a capital reduction. Also in the liquidation of companies contemplated in the commercial legislation.

This classification is significant in unfavorable economic times. Thus, it makes it possible to delay liquidation and provide the company with more opportunities for recovery.

5. Interest deductible for corporate income tax purposes.

The interest generated, both fixed and variable, is deductible for corporate income tax purposes for the borrower.

You may also be interested in: Frequent mistakes when setting business goals

What do you need to apply for a participation loan?

Participatory loans are used to promote business progress and encourage entrepreneurship. To access this type of loan, your startup must have a viable operating model and meet certain criteria.

As a result, financial institutions usually require a detailed business plan for the entrepreneurial project. Instead of requesting personal or mortgage guarantees. If historical data exists, it can improve the company’s rating, which translates into lower operating costs.

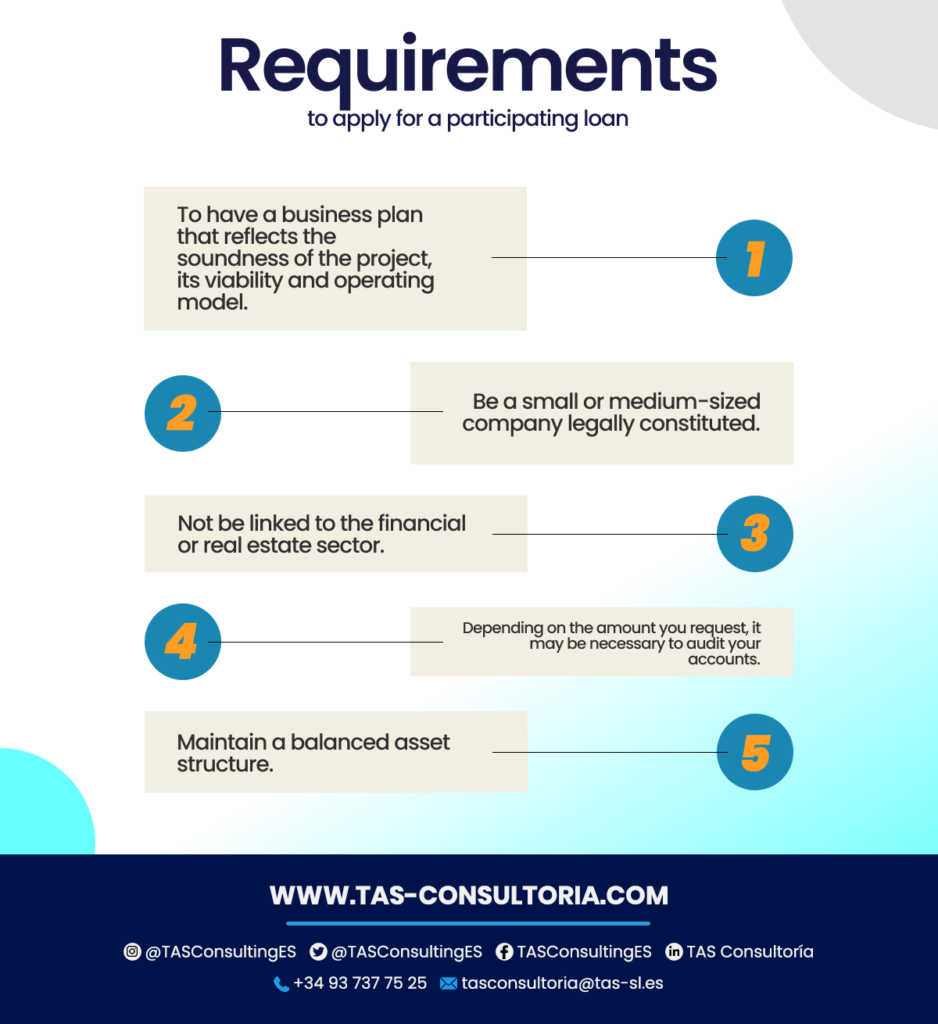

The following are the main requirements for obtaining a participation loan:

ENISA is currently providing this form of financing aimed at entrepreneurs. The amounts range from 25,000 to 75,000 euros for companies recently founded by young people. Also, from 25,000 to 300,000 euros for SMEs in their initial stages, with no age restriction for entrepreneurs.

Benefits of a participating loan

The main advantage of participative loans is that they do not require collateral. Although they require the presentation of a solid and quality business plan in order to obtain them.

The other advantages derive from its own characteristics:

- Interest payments according to the company’s profitability.

- Long loan repayment terms, as well as an extended grace period.

- The fact that participative loans are considered part of equity when reducing capital or liquidating a company implies that: in the event of losses, this money will be considered part of the company’s capital.

- Interest paid is deductible in the taxable income for corporate income tax purposes.

You may also be interested in: Foreign investments in Spain: associated regulations

Obtaining a participating loan in the current circumstances contributes to improving the perception of the company. Equity loans are not easily accessible and demonstrate the viability of a project. This can be attractive to new investors.

Are you ready to boost your project with the right financial advice? Don’t hesitate to contact us at tasconsultoria@tas-sl.es. Apply now for specialized advice for the creation and financial management of your startup (including equity loans). We are here to empower your path to financial success!

Your email address will not be published .

Required fields are marked with *