Are you aware of the recent changes in the models for presenting consolidated financial statements in Spain? Accounting regulations are constantly evolving. Therefore, it is crucial to stay informed in order to comply with tax and regulatory obligations. Below, we share with you the most important changes according to the Resolution of May 18, 2023. Keep reading and stay up to date with accounting regulations!

When should you file the consolidated financial statements for 2023?

The corresponding Commercial Registry requires all companies to annually file their accounts. These accounts provide an overview of the company’s financial situation during the fiscal year. Companies must file their accounts within six months of the end of the accounting year.

Normally, this coincides with the fiscal year. This may be the standard period from January to December or any other selected by the company. As such, it is essential to comply with these legal deadlines to avoid possible penalties.

The specific dates for the filing of consolidated financial statements in Spain may vary depending on the company and its particular situation.

For fiscal year 2023, let us consider a year-end of December 31. Companies should file their consolidated financial statements by April 30, 2024. It is important to mention that this date may change if the company requests an extension or if there are exceptional circumstances.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

What are the general developments for consolidated financial statements?

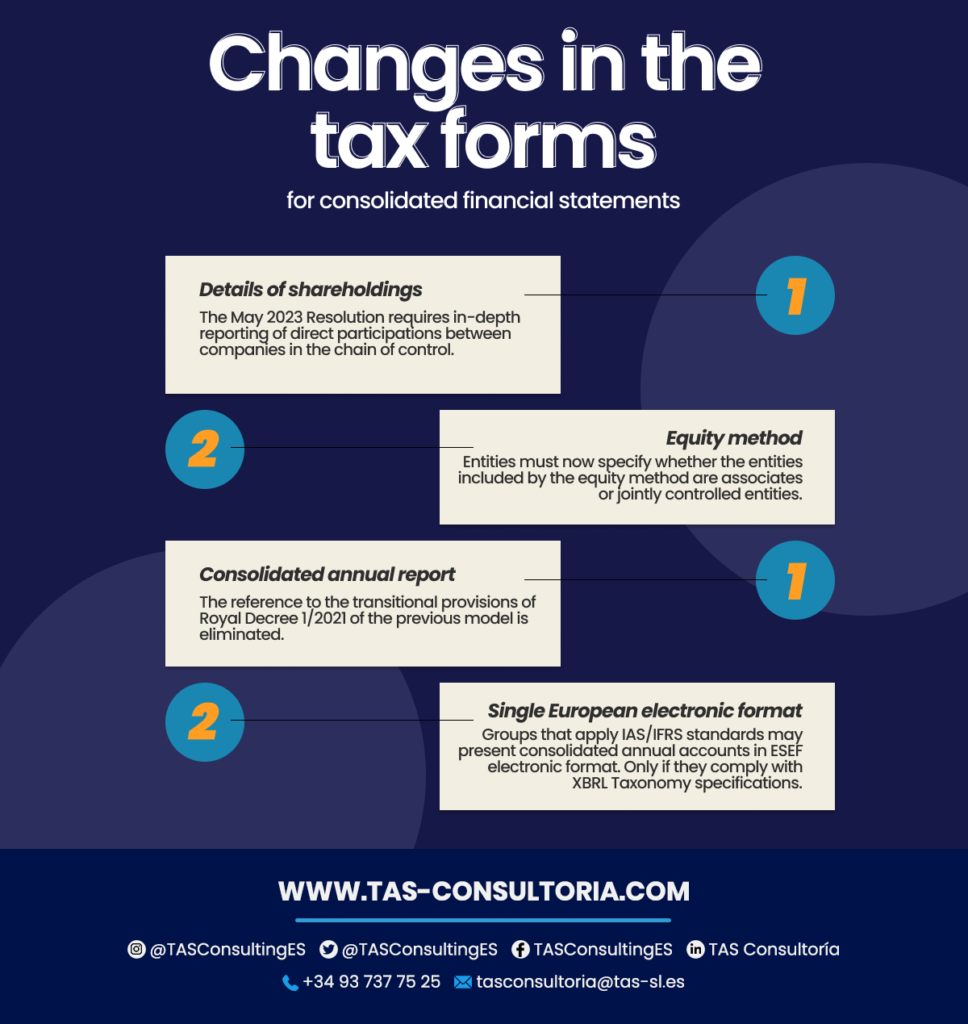

Consolidated financial statements undergo significant changes with the Resolution of May 18, 2023. These changes not only represent an evolution in accounting regulations, but also mark a crucial milestone for companies operating in the financial sector.

The resolution has introduced significant changes that directly impact the presentation and analysis of consolidated financial statements. It provides a renewed framework for transparency and understanding of the financial health of companies.

Among the main modifications, the following stand out:

They also allow groups applying IAS/IFRS international accounting standards to present their consolidated financial statements. Only in single European electronic format if they comply with the XBRL Taxonomy specifications of the ESEF format.

How many types of consolidated financial statements are there?

From the most detailed reports to the most simplified formats: each of these approaches aims to provide a specialized experience. Your organization tailors the presentation of consolidated financial statements to its specific needs.

That said, you can find three types of formats for the presentation of annual accounts. Remember that the choice depends on the size of your company:

1. Normal format

Applies to large organizations with significant revenues. Requires a thorough and detailed presentation of financial information for the presentation of consolidated financial statements.

Abbreviated format

Suitable for businesses with revenues of less than 5.7 million euros and assets not exceeding 2.85 million euros. In addition to a number of employees not exceeding 50. Allows for simplified presentation of financial information.

3. SME format

Small and medium-sized companies that have selected the SME Plan should use this format. It provides a simplified format, adapted to the needs of these companies. It allows a more concise and simplified presentation of the financial statements when presenting the consolidated annual accounts.

You may also be interested in: Everything you need to know about the new tax reform 2023

More specific changes by model or format type

The rigorous regulatory update not only seeks to establish general guidelines, but also delves into the specificity of each model. Accountants carefully consider the different forms of accounting presentation for consolidated financial statements.

This detailed approach aims not only to maintain consistency in the application of the rules. It also seeks to adapt to the diversity of business structures present in Spain’s economic fabric.

Changes in the normal model

- In the balance sheet, the caption A. VII: Non-current trade accounts receivable is changed to A. VII Non-current trade accounts receivable.

- In the standard notes to the financial statements, references to transitional provisions of previous years have been eliminated. In addition, they update the categories of financial liabilities in note 9-Financial instruments-a.2 financial liabilities.

- In the model M9.17 of the standardized report, certain strikethroughs are eliminated for when you file your consolidated annual accounts. Specifically, in the concept of lines of credit in the columns of limit granted and drawn down.

- In model M24-c) Auditor’s fees, adjustments are made to reflect more accurately the fees for additional services.

- The bug tests are modified to adapt to the latest updates and exclude those related to the pandemic.

Adjustments in the abbreviated model

- In the abridged notes to the financial statements, references to transitional provisions from previous years have been eliminated.

- The actual tenure sheet error tests are adjusted and those related to the pandemic are removed.

Changes in the SME model

- In the balance sheet, number 15 is eliminated in the accounts corresponding to caption B. VII of equity and liabilities.

It is key that you do not underestimate the importance of keeping your consolidated financial statements up to date and complying with current regulations. These changes in presentation models require a precise and professional approach.

You may also be interested in: All about the tax on large fortunes in Spain

Do you want more details or need advice on how to adapt to the new guidelines? Do not hesitate to contact our tax and accounting experts.

We are here to help you complete your consolidated financial statements successfully and smoothly. Schedule a consultation now through tasconsultoria@tas-sl.es and ensure your company’s peace of mind in the tax and accounting area!

Your email address will not be published .

Required fields are marked with *