Since March, the Impot@SS portal has brought numerous new features for users. With them, it is intended to facilitate the self-employed all the Social Security procedures and the transition to the new contribution system. Here we will tell you about all the new features of the Import@SS portal and how to benefit from them if you are self-employed. Join us!

What is the Import@SS portal?

The Impprt@SS portal is more than just a website of the Social Security Treasury, it is the new model of attention to citizens. You should know that all the services offered by the Treasury have been redesigned, organized and presented in a way that makes them simpler, clearer and more intuitive.

That said, through this new portal you will be able to consult your Social Security number or request it if you do not have one. Also, you will be able to download your work life report, process registrations, cancellations and employment modifications. Whether from home or self-employment.

Likewise, you will be able to modify your contact and address data or access your contribution, working day and salary data. You will also be able to consult any relevant information in case you are a domestic employee.

You can also access Import@SS by accessing the Treasury’s website. But you can also do it from the app for Social Security mobile devices.

You may also be interested in: Tax obligations for the self-employed in Spain 2022

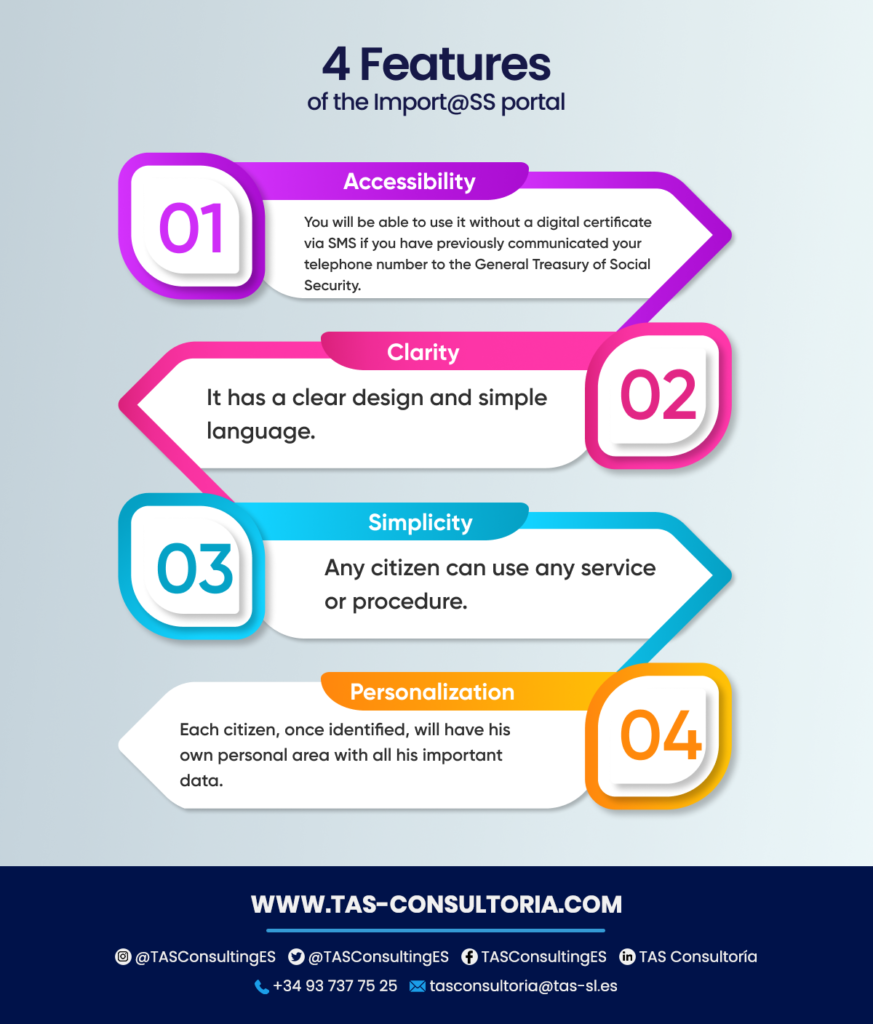

4 features of the Import@SS portal

The Import@SS portal aims to enable citizens to be more active with their responsibilities. In addition, it is important that you know the key features of this new portal, check them out below!

How is the Import@SS portal organized?

The portal of the General Treasury of the Social Security is divided into two clearly differentiated areas, these are:

Public area

Where they offer everything you need to carry out any procedure or management, organized in four main categories:

- Work life and reports. You will be able to consult and download reports on your Social Security situation, your contributions and other supporting documents.

- Registrations, cancellations and modifications. You will be able to request your NUSS and process registrations, cancellations and modifications in home and self-employment.

- Consultation of payments and debts. Consult pending payments and proceed with their payment.

- Personal data. You will be able to check your personal data and modify your address or contact details.

Personal area

This is a unique space for each user. It resembles the portals of telecommunication companies and banks. In it, you can immediately view your personal and contact information, employment status, SS work life and others.

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

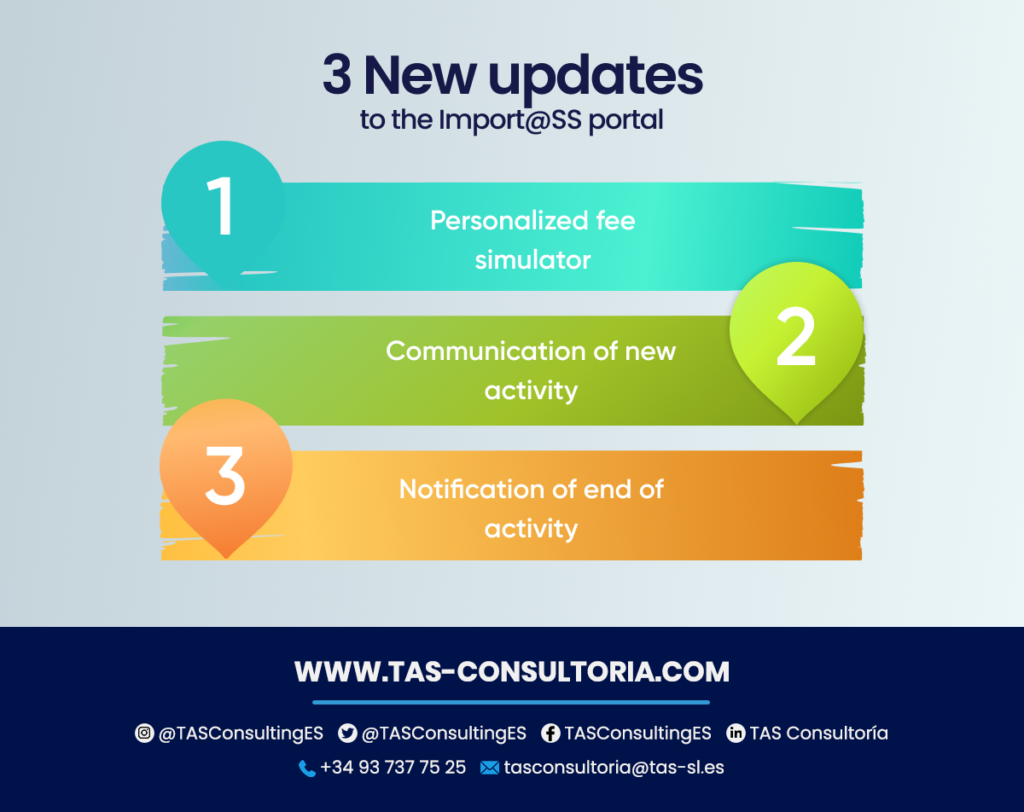

3 new Import@SS portal updates you should know about

Recently, in March, this portal included new updates to facilitate SS procedures for the self-employed. As well as the transaction to the new contribution system that came into force in 2023.

Three new active services were offered that will make it easier for users to perform certain tasks:

Personalized quota simulator

With this service, the self-employed can calculate their contribution taking into account their income, last year’s contributions and the last contribution paid. In addition, they will have the possibility of knowing at all times what they have to pay monthly. This way, you can avoid problems with the tax regularization at the end of the year.

Thus, you will be able to access this new tool immediately upon entering the portal. In it, you will have to indicate seven important data to the monthly net yield. You must also choose one of the 15 established monthly yield brackets and, finally, the simulator will show you what installment to pay.

Communication of new activity

In this case, a card was created for those who have registered in the platform and want to communicate a new professional activity. It is important to consider that before carrying out this process they must be registered in the Economic Activities Tax (IAE).

The steps to complete to register the new activity are very similar to the previous one. Enter the portal, enter your personal area, access your self-employed file. Then, confirm your address of the current activity, enter the start date of the same.

It is important that the latter coincides with the date stipulated in the IAE.

Communication of end of activity

In this new card you will be able to speed up the procedures to communicate the end of any of the activities.

Like the previous ones, the process is the same in which you will have to communicate the start of the new activity. The only change is that you will have to report the date on which the process was completed.

You will have the added convenience of being able to do so up to three days after the end of the business activity.

You may also be interested in: VAT exempt activities: in which cases does it apply?

To keep up to date with the news of the Import@SS portal and other portals of the public administration, contact us at TAS Consultancy. Write to us at tasconsultoria@tas-sl.es where our expert advisors will guide you in the tax area and Spanish documentation.

Remember that you can request your free advice. Don’t wait any longer and contact us.

Your email address will not be published .

Required fields are marked with *