The contribution system for the self-employed in Spain has undergone significant changes in recent years. This being the case, the Spanish Government has implemented a series of modifications to improve the conditions of self-employed workers and adapt to the evolution of the labor market. However, even the self-employed are still evaluating whether this new contribution system for self-employed workers is really beneficial for them. Find out more here!

What is new in the new contribution system for self-employed workers?

The main new feature of the new self-employed contribution system is the increase in the minimum and maximum contribution base. Specifically, the minimum base was increased by 1.25%, from 944.40 euros to 968.60 euros per month. For its part, the maximum base has increased by 0.9%, from 4,070.10 euros to 4,070.40 euros per month.

This series of increases implies an increase in the monthly contribution to be paid by the self-employed. This increase in the contribution base also has implications for the pension that the self-employed will receive once they retire. As they will have a higher contribution base, the pension they will receive will also be higher.

Another fundamental change is the elimination of the flat rate of 60 euros for new self-employed workers. From now on, the new self-employed will have a bonus of 80% during the first month of activity, 50% during the following five months and 30% during the following six months.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

What are the changes in the new contribution system for self-employed workers?

The new contribution system for self-employed workers consists of a progressive contribution model that is deployed over 3 years. Over the course of these 3 years, those self-employed workers who generate less income will have their contribution reduced, while those who earn more will see their contribution increased.

The new system establishes 15 contribution brackets in which the self-employed will have to be inserted according to their income forecast, which should be communicated to the Social Security.

How does the new self-employed contribution system affect social protection?

With the new contribution system, the social protection of the self-employed is generating concern among members of the Special Regime for Self-Employed Workers (RETA). This is because they are constantly wondering whether it is beneficial for them or not.

However, it is a measure that will not directly affect all the self-employed in the same way and where the real important point lies in the change in the form of coverage that this aid will have.

Of course, the real judge of this discussion will be time. In the meantime, the change in the form of hedging is something that cannot be lost sight of.

You may also be interested in: What are the penalties imposed by the Tax Agency?

What is social protection coverage?

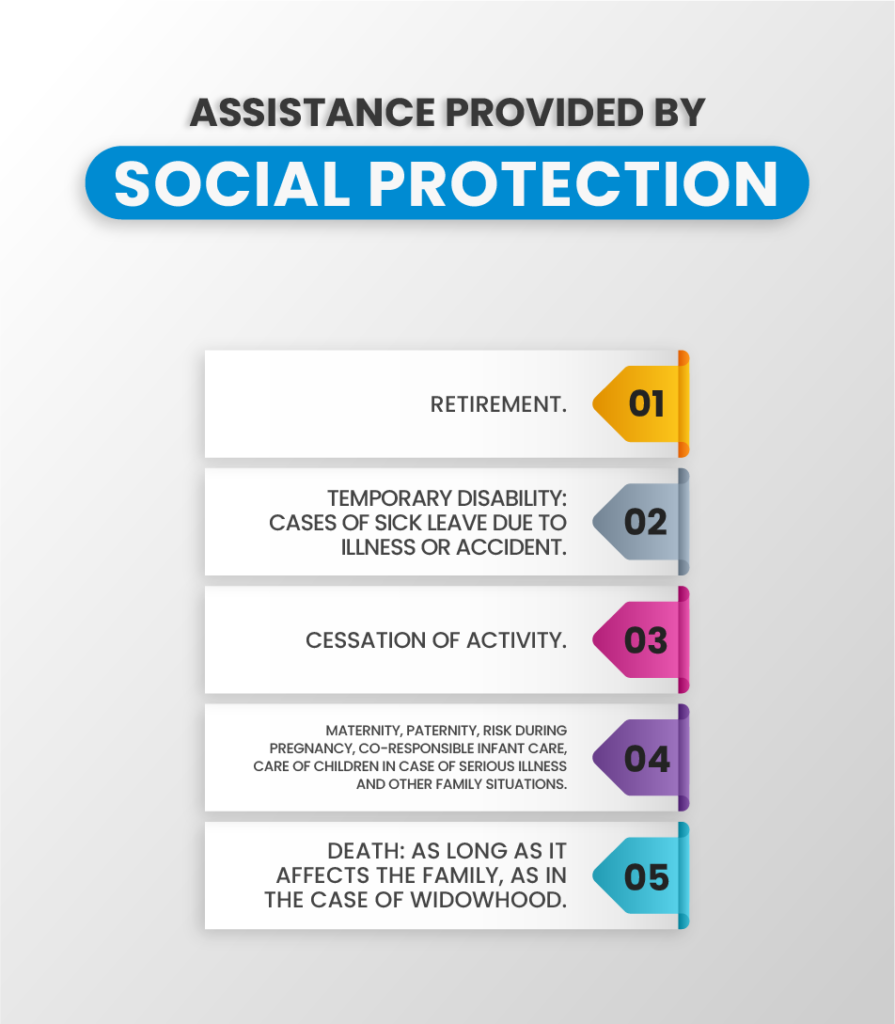

Basically, social protection coverage is the different mechanisms that offer the self-employed benefits, generally monetary, in the event that they are unable to work or need a break. Among the most important benefits you can find:

Main social protection systems for the self-employed

Social protection for the self-employed is made up of different systems that may be affected by the new contribution system for the self-employed. The three most noteworthy are:

RETA protection

Social Security is based on very strong principles to protect self-employed workers affiliated to the RETA system. These principles are usually:

- It is a mandatory program where contributions must be paid each month.

- You can only collect it if the covered contingencies occur.

- The amounts and the collection of each benefit will depend on the regulation at the time the contingency occurs.

Private social security systems

These are systems based on different contracts linked to the self-employed, either with financial institutions or insurance companies. These include pension plans and different types of insurance.

The latter usually cover benefits similar to those of Social Security, but have different characteristics:

- They are a complement to the mandatory Social Security system.

- The contracts are based on a financial balance between benefits collected and contributions paid.

Other means of personal savings

Despite having the systems we talked about before, as a freelancer you can use any measure to save. You can do it with the idea in mind of having savings in the future. Some of those savings alternatives can be:

- Endowment of your own funds for your business.

- Acquisition of financial assets.

- Real estate investments.

- Obtaining other types of physical or intangible assets.

Changes to social protection under the new self-employed contribution system

The new contribution system for the self-employed aims to give greater importance to Social Security in the social protection of the self-employed. However, this may have advantages as well as disadvantages:

You may also be interested in: Learn about the new quotas for the self-employed 2023-2031

If you would like to know more about the new developments in the self-employed contribution system and how it affects social protection benefits, I invite you to contact us by e-mail at tasconsultoria@tas-sl.es. We have an excellent team of professionals who will be able to guide you through all these changes in legislation.

Don’t miss the opportunity to stay informed about all these new tax issues. Don’t wait any longer and contact us and get your free advice.

Your email address will not be published .

Required fields are marked with *