Discover the new changes to operating profit margin calculation in Spain! Want to know how they will impact your business and how you can adapt to them? We will explore the latest updates in the way to calculate the profit margin and how they can affect your profitability. Don’t miss this opportunity to optimize your commercial strategies. Read on to learn the key points.

Understanding the concept of operating profit and profit margin

Operating profit represents the difference between the total revenue from a sale and the costs related to that sale. However, this term is only applied when the resulting value is positive. This is because when the value of sales does not exceed costs, a loss is incurred.

Although a basic and essential concept, profit provides a basis for calculating the operating profit margin. This margin is determined as a percentage of the bottom line, either positive or negative, to total revenues.

It is important to use percentage calculations rather than absolute figures. Calculating the operating profit margin provides a true test of the company’s financial health. It allows you to compare results between large and small companies.

You may also be interested in: VAT rates in Spain: updates 2022

Calculating the profit margin: how to do it without errors?

To determine the profit or loss of a business, it is sufficient to examine the difference between expenses and revenues.

However, this difference alone does not provide an accurate assessment of the benefit obtained. For it does not consider the magnitudes at stake. For example:

- A gain of Є1,000 may be considerable if costs are Є500, but would be negligible if the associated costs amount to Є950.

Therefore, it is more important to calculate the operating profit margin. This margin will give you an answer in the form of a percentage, which will provide a better overall perspective.

To do this, you must first subtract all costs from total revenues. The result you divide by the revenue and multiply by 100 to get the percentage that represents the margin.

Changes in calculating operating profit margin

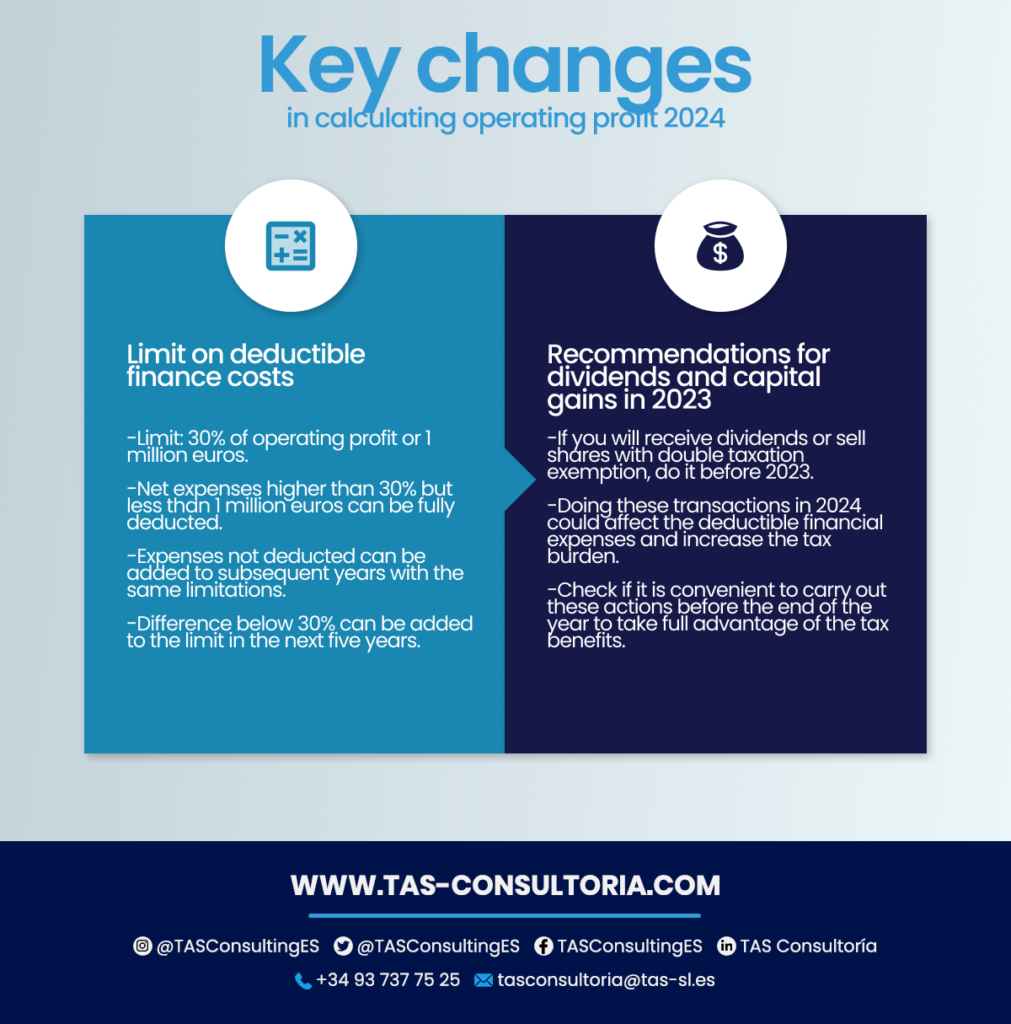

Is your company affected by the rule that establishes a 30% limit for deductible financial expenses with respect to operating profit? You need to be alert. Starting in 2024, there will be changes in the way operating profit margin is calculated. We share with you the key points:

Limit on deductible financial expenses

This implies that: if the net financial expenses exceed the 30% limit, as long as they do not exceed one million euros, they can be deducted in their entirety.

In addition, financial expenses not deducted due to the application of the above limits are not lost:

- They can be added to the financial expenses of the following years, being deductible with the same limitations.

- Additionally, if in a period the net financial expenses are below the limit, you have an additional opportunity. The difference until the limit is reached can be added to the limit applicable in the next five years. As a consequence, the maximum deductible limit is increased during that period. This being the case, calculating the operating profit margin for your Spanish company will be different next year.

Recommendations for dividends and capital gains in 2023

You can improve your financial opportunities now, especially by calculating your profit margin. If you plan to receive dividends or sell double tax-exempt units, consider doing so before the end of 2023.

Performing these operations in 2024 could reduce deductible financial expenses and increase your tax burden. Check whether it is in your best interest to take these actions before the end of the year to take full advantage of the tax benefits.

You may also be interested in: Taking out insurance for foreigners in Spain

How would the new operating profit calculation work?

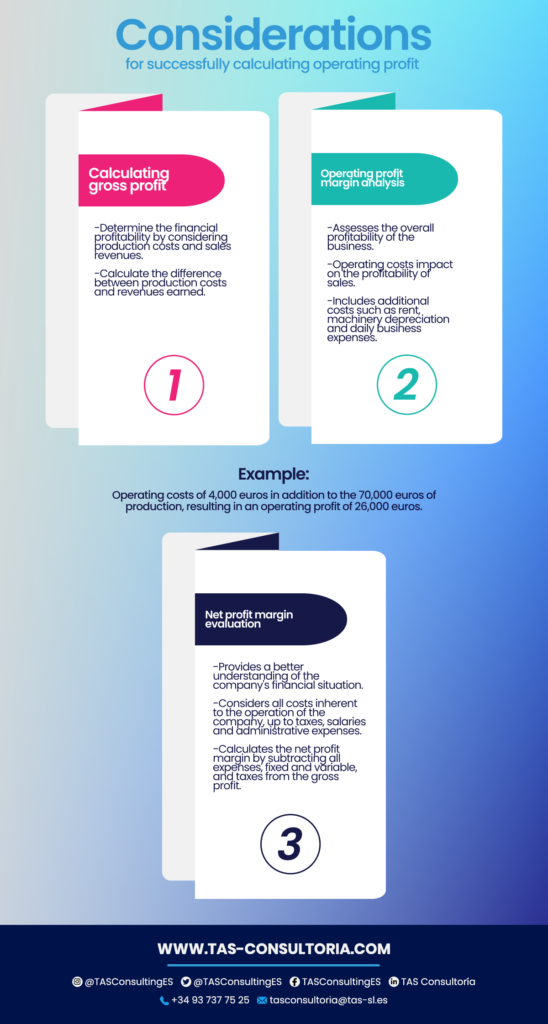

Until 2023, the operating profit margin is calculated on the basis of operating income. This represents the company’s profit without considering the financial result and exchange rate differences. From this amount, you can make the following adjustments:

- Deduct depreciation, grant allocations for non-financial assets and impairment losses or sales of fixed assets.

- Add dividends from companies in which the company participates, either directly or indirectly, with at least a 5% interest.

From 2024 onwards, to calculate the operating profit margin, you should not consider income, expenses or rents. Specifically those that are not included in the Corporate Income Tax (IS) taxable base. For example:

- If your company receives a penalty (non-deductible expense), it should not be subtracted when calculating the operating profit margin.

- Also do not consider 95% of dividends and capital gains from the sale of shares exempt from double taxation of dividends. Pay attention, as this is where some advantage can be gained.

Key factors to consider for successful operating profit calculation

Calculating operating profit margin is essential to assessing the financial health of your business. However, it is not simply a matter of subtracting production costs from revenue earned. There are several key factors to consider in order to obtain an accurate operating profit calculation. These are:

You may also be interested in: Double taxation in Spain

Now that you are aware of the new changes in calculating the operating profit margin in Spain, it is the perfect time to take action and optimize your financial strategy.

At TAS Consulting, we offer high quality and timely accounting management services. Our team of experts will be happy to help you calculate and maximize your profit margin. We will provide you with a coordinated and personalized follow-up.

Don’t waste any more time and contact us today at tasconsultoria@tas-sl.es to boost the profitability of your business! Calculating your operating profit margin may be easier than you think.

Your email address will not be published .

Required fields are marked with *