If you own an SME in Spain and you have considered how to take the leap to become a large company, you are in the right place. Here we share with you the conditions you must meet to take that important step and become part of the big companies. Discover how to grow your business and reach a new level of business success. Are you ready to know the details? Keep reading!

What obligations do you have when making the transition from SME to large company?

Changing status from a small or medium-sized enterprise (SME) to a large company brings with it a number of tax and accounting obligations. Understanding the new obligations when making this transition is essential to ensure proper compliance.

In this transformation process, the guidance of an expert advisor plays a key role. For, being part of large companies implies more responsibilities.

The variation is manifested in several aspects such as: the frequency of tax filing and the required model of annual accounts. These adjustments are linked to specific turnover thresholds and the number of employees in the company. Once these thresholds are exceeded within a defined period, new liabilities arise that need to be addressed.

You should not underestimate the complexity of this transition. It requires detailed planning and a thorough knowledge of the tax and accounting regulations that affect large companies.

Ensuring a successful transition involves seeking specialized advice. One that allows your company to comply with these new obligations efficiently and effectively.

You may also be interested in: How to turn your company into a franchise?

When does a small or medium-sized company become a large company?

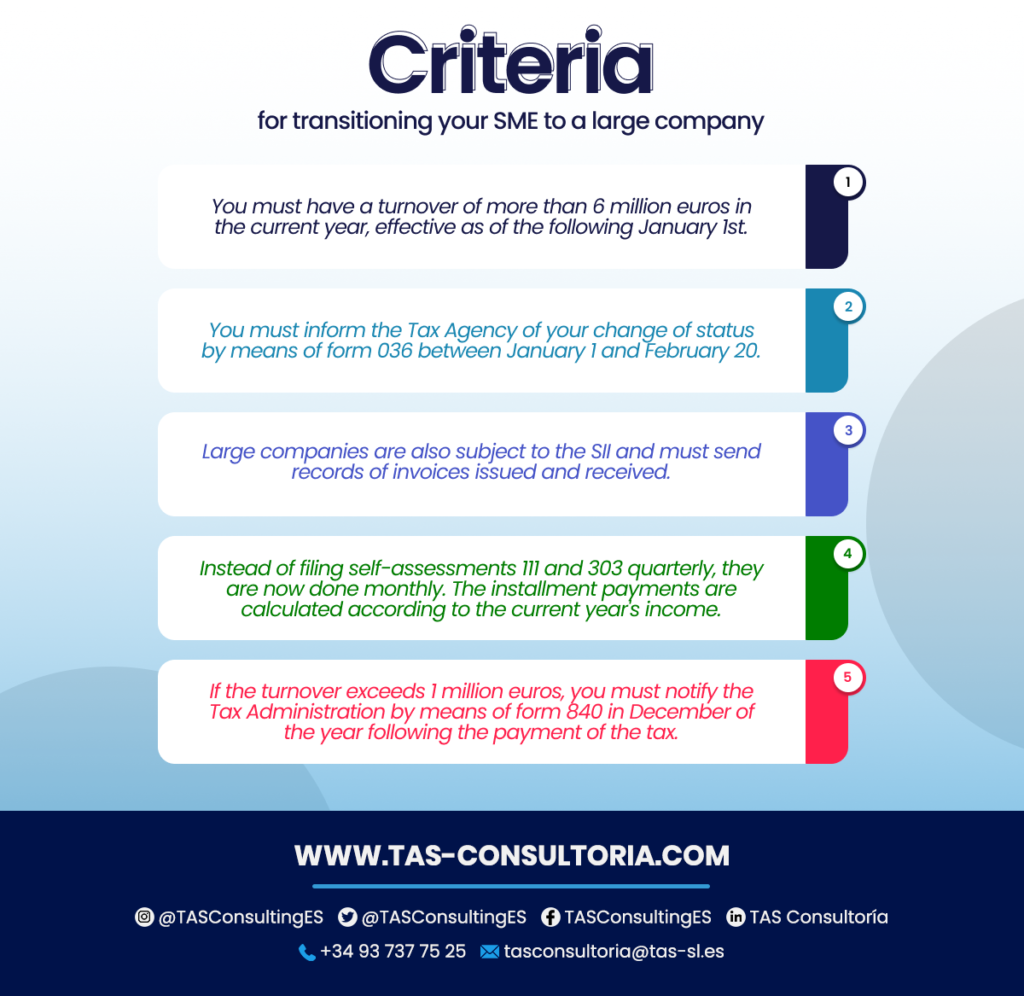

The moment when an SME makes the leap to become a large company comes with a number of important implications. Generally, this change of status occurs when the company reaches a specific turnover: one that exceeds €6 million during the current year. This transition takes effect as of January 1 of the following year.

One of the first responsibilities that fall on the new large companies is to communicate this change to the Tax Agency. This procedure is carried out by filing form 036.

This procedure must be carried out between January 1 and February 20. Likewise, as of 2017, large companies are also subject to the Immediate Information Supply (SII). As a result, they must send the records of invoices issued and received.

That said, the transition to a large company entails several implications. Including the need to file the 111 and 303 self-assessments on a monthly basis instead of quarterly. In addition, installment payments must be calculated on the basis of the current year’s income. Not in relation to previous installments.

Likewise, the new regulation also establishes that if the turnover exceeds one million euros, you must notify the tax authorities by means of form 840. This notification is made in the month of December of the year following the year to which the tax payment corresponds.

Want to refer to this information in the future? Here is a summary of these key points below:

You may also be interested in: What are Temporary Joint Ventures?

Obligations and classification of large companies

The transit of large companies is required to submit their annual accounts to an audit process.

This obligation is triggered if the company meets at least two of the following three requirements during two consecutive fiscal years, as of the close of each fiscal year:

- If total assets exceed 2,850,000 euros.

- If the net turnover exceeds 5,700,000 euros.

- If the volume of workers during the fiscal year exceeds 50.

In addition, since 2016, the limits for the formulation of Abbreviated Annual Accounts are established as follows:

- If total assets do not exceed 4,000,000 euros.

- If the net amount of the annual turnover does not exceed 8,000,000 euros.

- If the average number of employees employed during the fiscal year does not exceed 50.

Classification of companies

To better understand the differences between these types of companies, it is useful to classify them according to their turnover and number of employees.

- Microenterprises, for example, have up to ten workers. They have a turnover between 0 and 2 million euros, sharing the same category as SMEs.

- Small companies, on the other hand, are characterized by having more than 10, but less than 50 employees and a turnover between 2 and 10 million euros.

- Medium-sized companies have between 51 and 250 employees. They have a turnover of more than 10 million euros, but not less than 50 million euros.

- Finally, large companies have more than 250 employees and a turnover of more than 50 million euros. These distinctions are essential in determining the obligations and regulatory framework to which each company must adhere. Especially as it grows and develops in the market.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

The road from SMEs to large companies can be an exciting challenge full of opportunities. Are you determined to take your business to the next level and become a large company in Spain? Do not hesitate to contact us at tasconsultoria@tas-sl.es.

Our experts are ready to help you draw up a specific action plan for your company, tailored to your needs and goals. Don’t wait any longer! Consult with us and start your journey to business success. We are here to support you every step of the way.

Your email address will not be published .

Required fields are marked with *