Do you find it complicated to manage your Treasury notifications due to the decentralized management of your digital certificates? Worry no more! With GD Notifications, you will be able to simplify this process and have a greater control of your Treasury notifications. Make your tax life easier and respond effectively to any notification without penalties or inconveniences, read on for more information!

Before the digital certificate, notifications from the Tax Authorities were received by physical means. For example, they were sent by mail or delivered in person at the Administration offices. However, this old practice had several disadvantages, among them:

- Delays in communication between the Administration and citizens or companies.

- Generation of costs and inconvenience due to travel and waiting.

- Limitation of access to notifications in terms of time and location.

- Use of paper and natural resources.

- Exposure of personal data to possible loss, theft or manipulation.

The transformation in the way in which Treasury notifications are received by tax offices is evident. Previously, client communications were received on paper. However, Law 39/2015 imposes on companies the obligation to establish electronic communication with the Public Administrations.

This has brought about a radical change in the way we work. We now find ourselves receiving more notifications from the tax authorities than ever before, even on non-working days.

In addition to this, you must manage different proxies in different public administrations. That way, you will be able to manage and use your company’s certificates correctly.

The responsibility of being the recipient of these notifications involves constantly checking the administrations’ mailboxes. All this requires investing more hours and resources without being able to bill them to the client. In addition, you must archive and manage all these notifications manually in an electronic file.

This makes it obvious that you need a more efficient solution so that no notification is lost. Especially those companies that handle dozens of digital certificates.

You may also be interested in: What is the NIF in Spain and how to obtain it?

How to receive electronic notifications from the Internal Revenue Service with your digital certificates?

Receiving a notification from the IRS through your digital certificates is a simple and secure process. Here’s how it works:

- Obtain a digital certificate or use an electronic identification system such as Cl@ve to access notifications confidentially.

- Apply for a unique enabled electronic address (DEHú) through the Electronic Notifications and Enabled Electronic Address (SNE-DEH) service of the Tax Authorities.

- Select the agencies and administrative procedures from which you wish to receive electronic notifications. Personalize your mailbox in the SNE-DEH.

- When you receive a notification from the tax authorities, you will receive a notice by e-mail and on your mobile device. Access the notifications from your Citizen Folder or the corresponding electronic offices.

- Access the content of the notification using your digital certificate or Cl@ve, and download or print it according to your preference. Remember that you have 10 calendar days to access the notification before it is considered rejected.

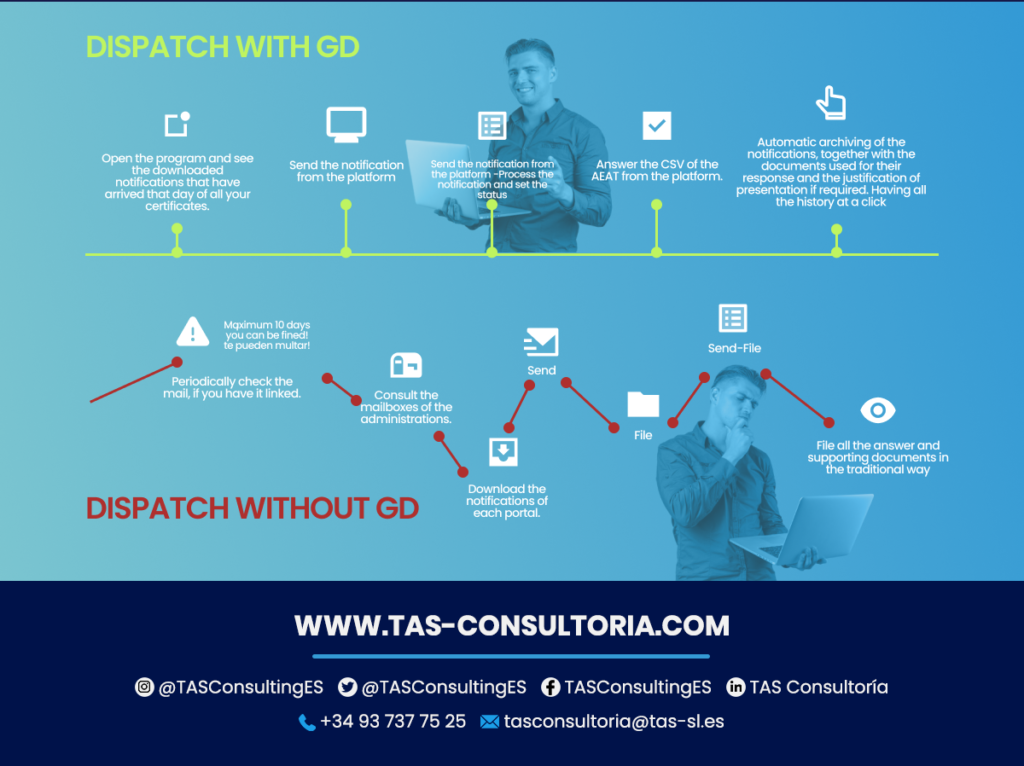

How does an office with GD Notifications perform compared to one that does not use this tool?

GD Notifications software will transform your work dynamics, providing ease in your daily routine, improved legal guarantees and agility in work processes.

With this powerful tool, you will experience a significant improvement in your productivity and efficiency. The next Treasury notifications you receive will be no problem. Where would you like to be? You can see it below:

You may also be interested in: Form 036 and 037: registering with the Tax Authorities

Who can use GD Notifications?

In the field of digitalization of procedures and communications, GD Notifications is presented as a versatile and efficient solution. But who can benefit from this platform to manage a Treasury notifications? Both individuals and entities that are obliged to receive communications and notifications by electronic means.

Everyone can make use of GD Notifications to simplify and streamline their administrative processes. Specifically:

- Legal entities.

- Entities without legal personality.

- Any person who exercises a professional activity that requires mandatory membership in a professional association.

- Persons exercising a professional activity that requires mandatory membership in a professional association.

- Employees of Public Administrations.

- Taxpayers registered in the Registry of Large Companies.

- Taxpayers in the Corporate Income Tax Consolidation Regime.

- Taxpayers registered in the Special Regime of the VAT Group of Entities.

- Those who pay taxes in the VAT Monthly Return Register (REDEME).

Key features and tools to manage your tax notifications

The centralized administration of digital certificates and the efficient management of tax notifications are key aspects to optimize work processes. There are two important aspects related to the digitization of procedures and receipt of any notification from the Treasury:

1. Centralized administration of digital certificates

Effective control of digital certificates is essential to speed up procedures and ensure the security of information. Especially the data of a Treasury notifications.

With our platform, you can easily centralize and manage all your digital certificates. This will allow you to access them from any device.

In addition, you’ll have alerts for expiration control and manage user access permissions. With secure storage and support for a variety of qualified service providers, you’ll enjoy greater peace of mind.

2. Centralized reception, management and resolution of notifications.

The process of receiving and managing Treasury notifications from multiple administrations can be tedious and time-consuming. A notice from the IRS can arrive at any time.

Therefore, our platform automates the download of notifications from more than 9000 public administrations. Thus, you avoid the need to check emails or download manually from different portals.

You will be able to filter and view Treasury notifications in a personalized way. You will also be able to manage their status visually, receive alerts and respond to requirements or requests directly from the platform.

Here are the most important benefits:

You may also be interested in: What are the penalties imposed by the Tax Agency?

GD Notifications is the comprehensive solution to efficiently manage and respond to your Treasury notifications. Forget about the inconveniences of traditional management and discover the comfort and security offered by our platform.

Don’t waste any more time and contact us today to request a free trial of our digital solutions. Write us at gestiondirect@gd.eu or call us at +34937377525. Simplify your paperwork with GD Notifications and experience the peace of mind of being up-to-date with your tax obligations.

Your email address will not be published .

Required fields are marked with *