Entities risk forgetting less frequent adjustments when calculating corporate income tax, which can cause problems when filing. As a consequence, there can be problems when it comes to their declaration. Do you want to know more about these extra-accounting adjustments? Here we tell you more about them and how to deal with them, come on!

What is Corporate Income Tax?

Corporate income tax is a tax levied on the profits obtained by companies and other legal entities. This is a direct tax, since it is levied on the income generated by the economic activity of the entities.

This is calculated by applying a tax rate to the taxable income, which is the result of subtracting deductible expenses from the income obtained. The general tax rate is 25%. However, there are some reduced rates for certain entities, such as SMEs, cooperatives or non-profit entities.

Corporate income tax is declared and paid annually, by means of Form 200, which is filed in July of the year following the fiscal year.

This being so, entities must make installment payments on account of IS in the months of April, October and December. All this by means of form 202. Thus, these installment payments are calculated according to the profit obtained in the previous year or the current quarter, depending on the method chosen by the entity.

You may also be interested in: VAT rates in Spain: updates 2022

How is corporate income tax calculated?

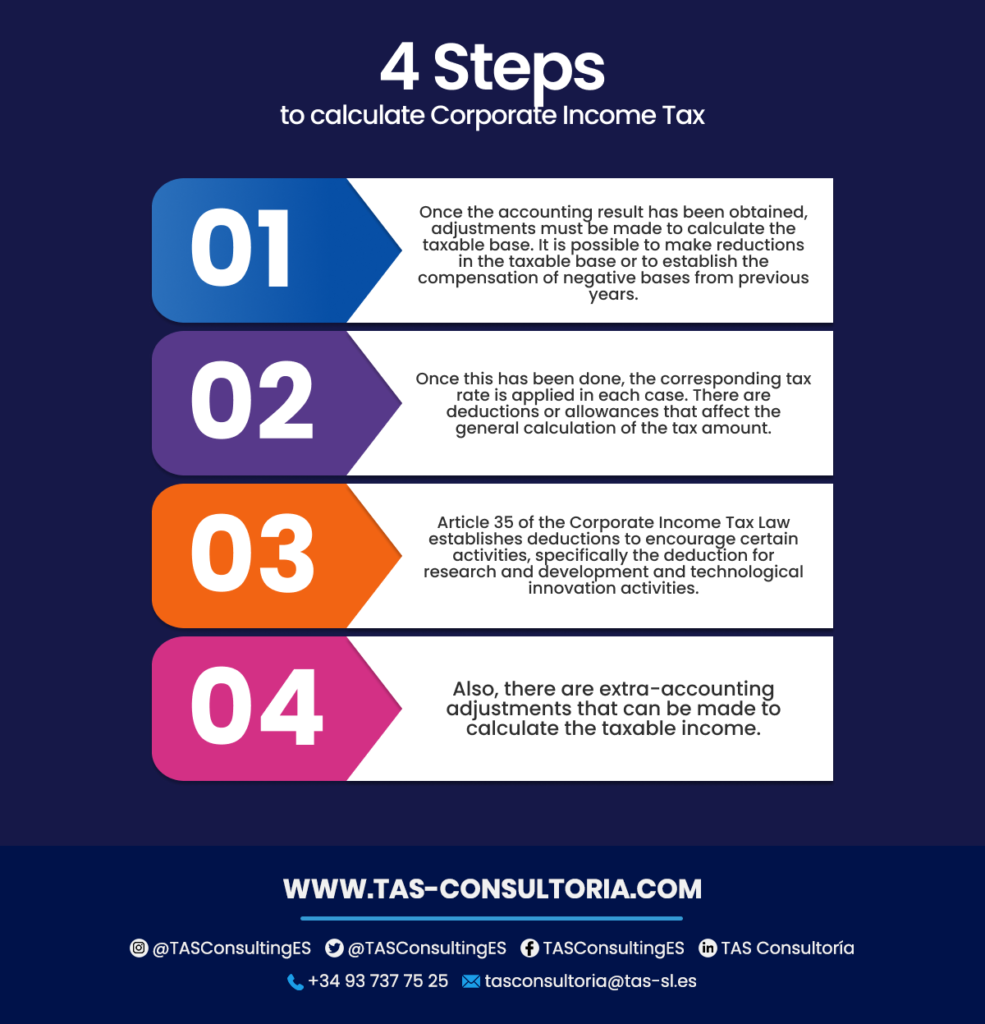

To calculate the tax, you must apply the following process:

How is the corporate income tax base calculated?

The taxable income is the amount of income obtained in the tax period, which usually coincides with the calendar year. To calculate it, you must start from the accounting result obtained from the difference between the income and expenses recorded in the company’s accounts.

However, you should bear in mind that the accounting result often coincides with the tax result. This is due to the fact that a series of adjustments or corrections must be applied as established in the tax law.

Therefore, these adjustments can be positive or negative. In other words, they increase or decrease according to the taxable income.

Thus, positive adjustments are those that increase the taxable base because they are income that has not been accounted for. But they can also be expenses that are not tax-deductible. Some examples of positive adjustments are:

- Dividends and shares in the profits of other entities, which are exempt from taxation but must be added to the taxable income.

- Accounting depreciation that exceed the limits established by tax law, which must be added to the taxable income.

- Non-deductible expenses, such as fines and penalties, gifts and gratuities.

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

What are the least frequent corporate income tax adjustments and their tax treatment?

Less frequent corporate income tax adjustments are those that do not occur regularly during the tax year. However, they can have a significant impact on the taxable income and the effective tax rate. Some examples of these adjustments are:

Intragroup sales at a loss

This occurs when a company sells to another company of the same group an interest in another company at a lower price than that at which it was purchased. As a result, there is an accounting loss. In Spain, the Corporate Income Tax Law establishes that these losses cannot be deducted in the same year in which they occur.

This being the case, the current regulations require the seller to defer these losses until the shares are transferred to third parties outside the group. Otherwise, until the intervening parties leave the group.

For this limitation to come into play, it is essential that the participants form part of a group of companies. This is in accordance with the criteria established in Article 42 of the Commercial Code. And, also, they must be independent of their residence and the formulation of annual accounts.

Accounting errors

They consist of omissions or inaccuracies in the annual accounts of previous years. This usually occurs when reliable information is not used and that the company could have obtained and taken into account in the formulation of such accounts.

To correct errors in income and expenses for fiscal years that were not recorded or were incorrectly recorded, an adjustment must be made in the fiscal year. These are detected by charging them directly to an equity item. Specifically, in a reserve account.

In this sense, the error must be accounted for when it is detected and will be recorded in a reserve account. According to the Income Tax Law, charges or credits to reserve items, recorded as a result of changes in accounting criteria, will be included in the taxable income for the tax period in which they are made.

Donations

If your company donated money or any asset, given that the loss or expense derived from the donation is not deductible, it must compute a passive adjustment of the same amount. As long as it is apart from the possible deductions in the IS quota to which it is entitled.

In the case of donations in kind, an additional positive adjustment must be computed. One that is for the difference between the market value of the donated good and its tax value.

Extraordinary income and expenses

These are those that do not derive from the ordinary activity of the company, but from abnormal or unforeseen events. For example, indemnities, donations, fines, etc. These income and expenses must be included in the tax base, unless they are exempt or non-deductible by law.

Related transactions

These are those between parties that have a relationship of dependence or control, such as partners, administrators, family members, companies of the same group, etc.

These transactions should be valued at market value. That is, the value that would have been agreed between independent parties under normal market conditions. If the valuation is not adjusted, an adjustment must be made to the tax base to avoid possible tax avoidance.

You may also be interested in: Taxes in Spain for Foreigners

Do you want to learn more and get advice on the tax treatment of the less frequent corporate income tax adjustments? Do you want your accounting management not to be messed up by unusual situations? Then, the first step to take is to contact us at tasconsultoria@tas-sl.es where our professional accounting experts are waiting to help you.

Schedule a personalized consultancy and we will attend your business according to your needs, we are waiting for you!

Your email address will not be published .

Required fields are marked with *