With the growing demand for new solutions and business models, start-ups have become crucially important in the Spanish business landscape. In this article, we will focus on defining what start-ups are and explore the tax advantages they enjoy this year, such as reductions in Corporate Tax. Do not hesitate to read the complete information!

What are emerging companies in Spain?

The Law for the Promotion of the Emerging Companies Ecosystem, also known as the Startup Law, is the regulation that defines the parameters of the Spanish entrepreneurial world.

The law indicates that a start-up company is any new company with a maximum of five years of life, or seven years in the case of biotechnology, energy or industrial companies. By years of life we refer to the period of time since the company’s registration in the Commercial Registry.

Generally, companies pay corporate income tax (IS) at a rate of 25%. However, this is not the case for emerging companies.

On the one hand, as of 2023, companies generating revenues of less than one million euros per year will be taxed at a rate of 23%. On the other hand, and this is the aspect that interests us, “start-up companies” are taxed at a reduced rate of 15% in the first year if their taxable income is positive and then continue in the following three years.

You may also be interested in: 10 steps to start your own company

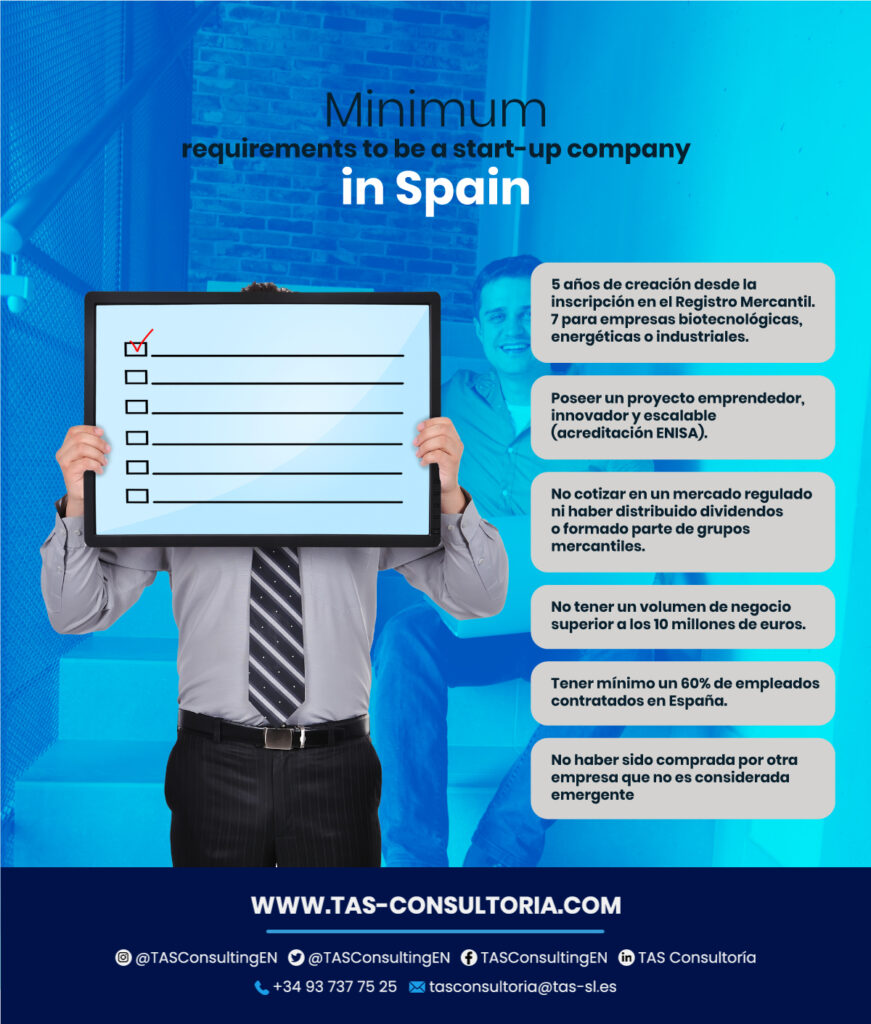

Minimum requirements to be an emerging company

In addition to the years of life that start-ups must have, it is also necessary for them to have a head office in Spain or a majority of employees with contracts in the country.

In addition, in order to access tax benefits, start-ups are required to be accredited by the National Innovation Company (ENISA). This is a public entity that issues the accreditation valid before public administrations.

This certification is a recognition granted by the National Innovation Agency of Spain to companies that demonstrate a high potential for innovation and growth. In other words, they contribute to the economic and technological development of the country.

This accreditation gives emerging companies access to financing and innovation support programs, as well as a series of tax and administrative incentives to foster their growth.

If you wish, you can access the procedures manual from their website to begin the analysis or audit process of your start-up company.

In summary, we show you all the necessary requirements for emerging companies to access tax benefits:

You may also be interested in: Spanish companies and ICO guarantees

Tax advantages for emerging companies

As we have explained above, after being accredited as an emerging company, a reduction in the corporate income tax rate to 15% will be included. Now, how does the process of the four tax years included in this reduction work?

The Emerging Enterprises Act dictates that:

- For a maximum of 4 years, i.e. the next 4 fiscal years, emerging companies will benefit from a reduction in the corporate income tax rate and the permanent non-resident income tax rate.

- Emerging companies will be entitled to a deferral in the payment of the tax debt corresponding to the first two tax periods with a positive taxable base.

The State Tax Administration will grant the deferral without the need for guarantees for 12 and 6 months, respectively. In this way, the emerging company will have to make the payment without interest for late payment within 1 month after the expiration of each of the installments.

- Emerging companies will not be required to make installment payments during the first 2 tax periods with positive taxable income if they maintain their status as an emerging company.

- In addition, emerging companies will not be required to obtain the NIE for non-resident foreign investors.

- They will also benefit from a three-year bonus on social security contributions for self-employed entrepreneurs working under contract.

- In terms of investments in newly created companies, these companies will also have an increase in the deduction for investment and an increase in the rate up to 50%, with a maximum limit of 100,000 euros. They will be given facilities to make installment payments in case of receiving subsidies.

Some labor migration measures to support start-up companies

The law on emerging companies includes immigration measures to facilitate the entry and residence of highly qualified professionals, entrepreneurship and investment. Some of them are:

- Bonus of 100% of the minimum base for self-employed workers of emerging companies who directly or indirectly control the company and simultaneously work as employees during the first 3 years.

- New visa category and residence authorization for “digital nomads” who work remotely for companies outside the country.

- International telecommuting visa allows entry and residence in Spain for one year.

- Residence permit for regular foreigners in Spain for a maximum period of 3 years, renewable for 2 years, and with the possibility of obtaining permanent residence after 5 years.

Important note: the visa holder can only work for companies outside the country if it is an employment activity. If it is a professional activity, it is only allowed to work in Spain if the work does not exceed 20% of the total.

The telework visa or authorization is available for qualified professionals with a university degree, professional training or professional experience of 3 years.

You may also be interested in: Frequent mistakes when setting business goals

Ultimately, the law for emerging companies tells us that they are a key enabler of economic growth and innovation. With the right support in areas such as tax planning and resource management, these companies can thrive and contribute to market success.

However, to achieve this prosperity, it is crucial to have the advice of experienced professionals in the field. At TAS Consulting, we offer a wide range of tax consulting services for emerging businesses, providing comprehensive solutions that fit your unique needs.

If you need comprehensive tax advice, do not hesitate to contact us at tasconsultoria@tas-sl.es and make an appointment with our certified advisors.

Your email address will not be published .

Required fields are marked with *