Treasury management is a fundamental element in ensuring the financial health of any company. In Spain’s economic climate, mastering these keys becomes even more vital. Discover how to optimize cash management and boost your business accounting success. Ready to boost your business? Read on and discover the essential keys – we’re on the road to financial success together!

What does cash management involve?

In short, treasury management in a company is an integral accounting process. It focuses on optimizing liquidity and ensuring the availability of funds, which are necessary to meet the company’s payment commitments. We do this in the right currency and at the right time.

As such, treasurers play a crucial role in this task. They implement strategies to ensure the financing of the company’s operations when necessary. This involves close coordination with financial institutions and efficient management of available financial resources.

A point of special attention for cash management managers is the value date of transactions. Accurate date management is crucial to avoid unexpected expenses. This avoids possible overdrafts caused by discrepancies between the accounting date and the value date.

You may also be interested in: Pros and Cons of Venture Capital Fund Financing

Main drawbacks in treasury management: delay in payments or immediate requests

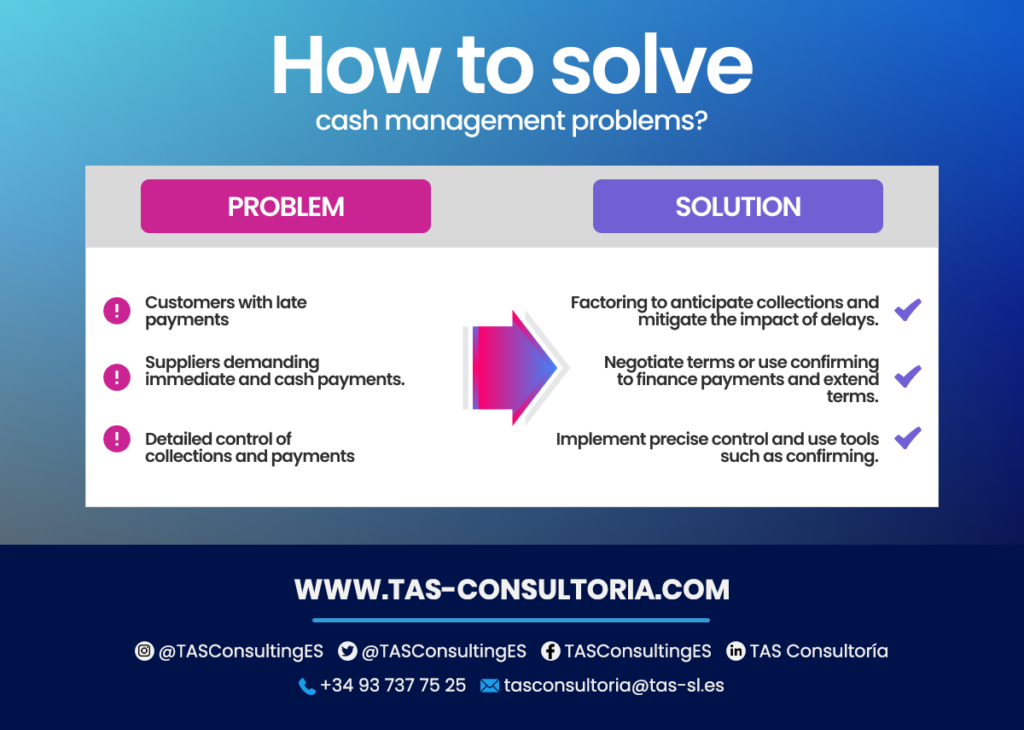

As we have mentioned, effective treasury management maintains detailed control over collections and payments. It seeks to receive payments early and seeks financing options with suppliers. However, this task presents considerable challenges, for the following reasons:

- Some customers, especially if they are significant for the company, may extend payment terms. Although always within the maximum legal limit of 60 days. To mitigate the impact of delays in collections, the company can resort to factoring to anticipate the collection of its invoices.

However, another drawback arises in cash management. Only if credit advances remitted by the company are returned. One solution to this problem is to opt for non-recourse factoring. In this way, the company releases the assignor from liability in the event of non-payment by the customer.

- As for suppliers, they may set short payment terms or even demand immediate payment.

To address this situation, it is possible to negotiate with suppliers to finance payments through confirming.

This option facilitates the negotiation of longer payment terms. This allows the supplier to be paid at the time the confirming is accepted. Although with the payment of interest for the anticipation of the collection.

That said, it is essential to maintain precise control over collections and payments. Confirming is a viable option for financing payments over longer terms. Review a summary of the key points:

You may also be interested in: Collaborative accounting: what is it and what does it consist of?

How can you optimize your company’s cash management?

Rigorous monitoring of revenues is essential for the smooth operation of cash management. In particular, monitoring outstanding trade receivables and making timely claims against delinquent customers.

In addition, receivables can be advanced through factoring. Larger companies, this monitoring is usually the responsibility of the accounts receivable manager. Here are some other important factors:

Administration of payments

Obtaining financing from suppliers is often one of the most economical and common ways to secure financing. However, when the agreed due date arrives, you must meet your payment commitments to suppliers.

Failure to make these payments can interrupt supplies or suspend credit, leading to demands for advance payments. Efficient treasury management with payments is supported by the figure of the accounts payable manager. Commonly present in the accounting department of a large company.

Bank negotiation and information to financial institutions

If the company requires financing for its operations, the treasurer or CFO must negotiate terms with lenders. In addition, provide the information about the company requested by the lenders in order to carry out the corresponding risk analysis.

Ensure compliance with agreements with financial entities

Treasury management must ensure that the terms agreed with the banks are complied with. Sometimes the agreed terms may change over time or standard terms may apply.

Situations may also arise in which certain conditions apply if certain requirements are met. There may even be errors in bank settlements, among other things.

Preparation of cash flow forecasts and budgets

Anticipating the company’s future liquidity needs is fundamental to cash management. This is why you should prepare a specific budget.

This makes it possible to determine whether the company’s daily activity is sufficient to cover all expenses and investments. Or, if it is necessary to finance certain investments or the company’s working capital.

Currency and interest rate hedging management

It is paramount that treasurers maintain effective control over abrupt fluctuations in foreign exchange rates. Clearly, those used by the company along with interest rates. This can have a significant impact on the company’s finances.

Daily operations and accounting record of transactions

All treasury operations must have an accounting counterpart that requires accurate and adequate recording. This process ensures that transactions are properly documented and accounted for in the company’s accounting records.

You may also be interested in: Keys to carry out a capital increase in your company

Now you know the vital keys to successful treasury management in the Spanish business context. You are ready to take a step forward in the financial control of your business.

If you want a personalized accounting consultancy and to boost your financial management, do not hesitate to contact us at tasconsultoria@tas-sl.es! We are here to help you achieve excellence in your business accounting, contact us now and give a decisive boost to your company!

Your email address will not be published .

Required fields are marked with *