The Anti-Fraud Law 2024 has revolutionized the business landscape in Spain. It imposes stricter regulations and requirements that all companies must comply with. Complying with it is not only an obligation, but also an opportunity to strengthen the integrity and trust in your business. In this article, we will reveal the essential keys to optimize your internal processes and ensure compliance with the Anti-Fraud Law. Read on!

What is the essence of the Anti-Fraud Law 2024?

The Anti-Fraud Act 2024 establishes new responsibilities for companies in the prevention and detection of both economic and financial violations. It applies to all businesses, of any sector or size.

That said, its most relevant aspects include:

Establishment of a registry of beneficial owners

The Anti-Fraud Law 2024 introduces the obligation to register beneficial owners. That is, the natural persons who effectively control the company. This registration is aimed at preventing and detecting money laundering and other criminal activities.

New accounting requirements

The new law implements a series of accounting obligations. For example, keeping a record of invoices issued and received, and retaining the documents that support operations for 10 years.

Obligation to report relevant transactions

It establishes the obligation to report to a special commission. Specifically to the Executive Service of the Commission for the Prevention of Money Laundering and Monetary Offenses (SEPBLAC). This being so, you must inform them of all transactions considered relevant due to their amount, nature or complexity.

Measures to prevent tax fraud

The regulation introduces measures to prevent tax fraud. Some of these include the prohibition of using software that allows hiding operations or manipulating accounting data.

You may also be interested in: What is the NIF in Spain and how to obtain it?

What is the impact of the Anti-Fraud Law 2024?

The Anti-Fraud Law brings with it new responsibilities and requirements for companies in their fight against financial violations. This regulation applies to companies in all economic sectors and brings with it a number of significant changes:

Increased administrative burden

Companies face an increased administrative burden due to the need to comply with new accounting obligations. Especially when maintaining the records of the beneficial owners. This can result in additional costs, especially for those with limited resources.

Increased responsibility

It imposes greater responsibility on companies. By requiring them to take effective measures to prevent and detect tax fraud and other crimes, discipline must be increased. In addition, they are expected to cooperate with the authorities when requested to do so.

Penalties for noncompliance

In case of noncompliance with the established obligations, the Anti-Fraud Law 2024 provides for penalties that may be of an economic, administrative or criminal nature, depending on the seriousness of the noncompliance.

You may also be interested in: Basic guide to bookkeeping as a freelancer

How can you comply with the regulation from your internal management?

To ensure compliance with the Anti-Fraud Act 2024, companies should familiarize themselves with the regulations. In particular, recognize and reduce the risks of fraud, establish internal policies, controls, and follow other measures described below:

Knows and understands the Anti-Fraud Law 2024

The first step is to thoroughly familiarize yourself with the new Anti-Fraud Act 2024. Companies need to understand the new features introduced and ensure that their processes are compliant. In this regard, having specialized legal advice can be beneficial.

Identifies risks in advance

It is crucial that your company identifies the fraud and corruption risks it may face. A risk assessment will allow you to detect vulnerable areas and develop strategies to prevent and detect potential violations.

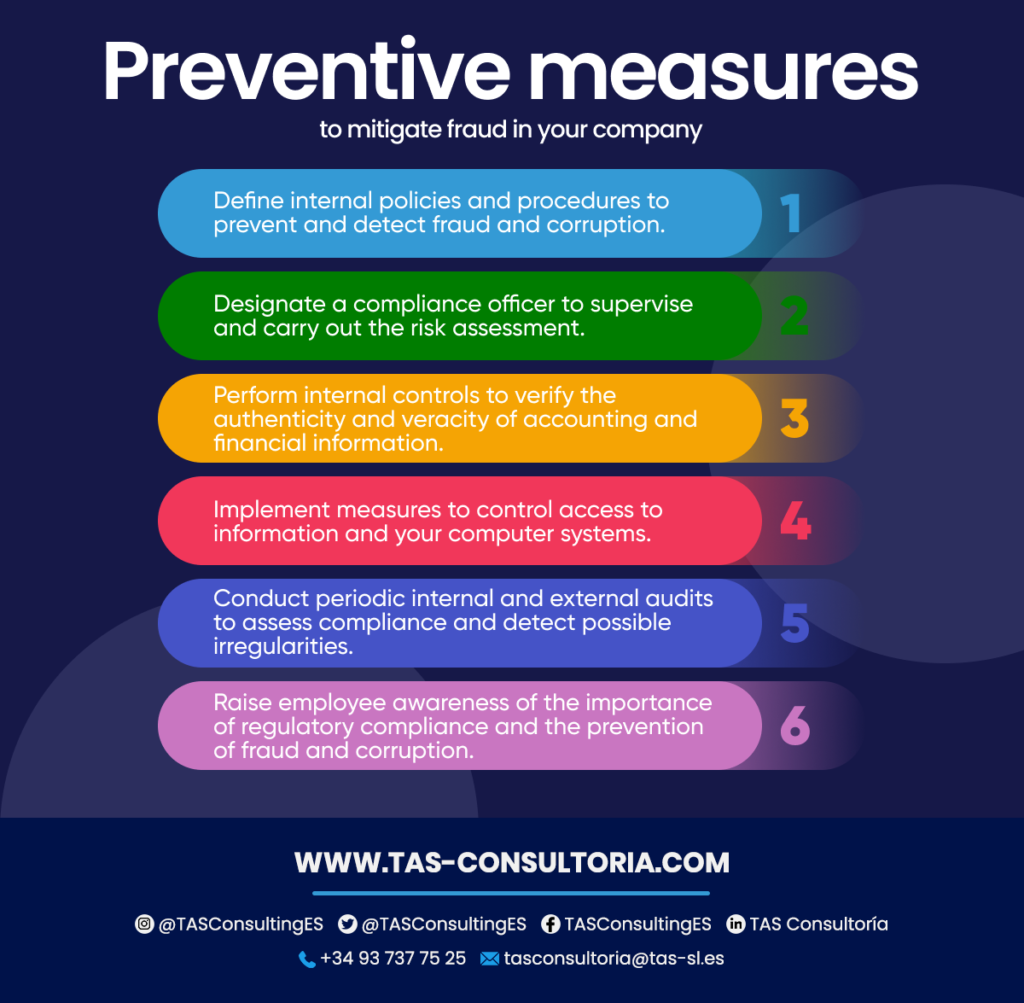

Implements preventive and screening measures

You must implement both preventive and detective actions to ensure compliance with the new Anti-Fraud Act 2024 regulations. Some of these measures include:

Prioritize the registration of beneficial owners

The Anti-Fraud Law 2024 imposes the obligation to identify and document the beneficial owners, as mentioned above. All natural persons who effectively control the company must be included. This information must be properly recorded and kept up to date in the appropriate file.

Communication of relevant transactions

According to the Anti-Fraud Law 2024, companies must report to SEPBLAC those transactions considered significant due to their:

- Amount

- Nature

- Complexity

That said, you can establish internal procedures to identify and report these operations, as well as designate a person responsible for this task.

Employee training

All employees share the responsibility to comply with the Anti-Fraud Act 2024. Therefore, it is essential to provide training on the new legislation.

For a precise and customized adaptation to your business structure, we invite you to request a specialized legal consultation.

What are the penalties provided for in the Anti-Fraud Law 2024?

These regulations impose significant penalties that may result from noncompliance with the requirements relating to computer programs and systems. The main ones are:

- Failure to comply with legal requirements related to computer programs or systems carries penalties of between €50,000 and €150,000.

- Companies owning non-certified programs or altering certified programs may face fines of €50,000 per fiscal year.

- Software manufacturers and marketers could be fined up to €150,000 per fiscal year in case of infringement. In addition, those who are required to certify software and fail to do so may face penalties of €1,000 for each system or program marketed without the corresponding certificate.

You may also be interested in: What is the Financial Transaction Tax?

It is essential to comply with the certification requirements of the Anti-Fraud Act 2024 to avoid penalties and ensure regulatory compliance.

Our team is ready to help you navigate this challenging, but essential path to compliance and growth. Don’t miss this opportunity and secure a solid financial future for your company! Contact us at tasconsultoria@tas-sl.es for an assessment of your accounting processes and make sure everything is in order.

Your email address will not be published .

Required fields are marked with *