Corporate insolvency is a challenge that can stalk companies of any size in Spain. In an ever-changing economic environment, it is essential to have sound strategies in place to manage and prevent bankruptcy. In this article, we will explore key strategies that can help you protect and strengthen your business. Read on to find out how to face insolvency with confidence.

What is insolvency risk?

Insolvency risk in Spain refers to the possibility that an entity may not be able to meet its payment obligations. Whether it is, for example, a bank, a company or a government.

This risk is evaluated mainly through the entity’s credit rating. In addition, it is influenced by factors such as its financial stability, its capacity to generate income, its level of indebtedness, among others.

In the case of banks, the bankruptcy risk is slightly different. It refers to the bank’s ability to repay its customers’ deposits. It also refers to meeting its payment obligations in the event of financial difficulties.

Spanish banks are regulated and supervised by the Bank of Spain and the European Banking Authority. In order to ensure their solvency and stability.

You may also be interested in: Pros and Cons of Venture Capital Fund Financing

What is the Bankruptcy Law about?

Last year, a significant reform of the Insolvency Law was introduced to optimize insolvency procedures. This update redefines management practices, placing a strong emphasis on the early detection of financial difficulties.

Specifically, Law 16/2022, enacted on September 5, has incorporated substantial improvements to the previous text of the Bankruptcy Law. It has a clear focus on strengthening restructuring plans.

Although, so far, the approval of such plans has been limited. Their results are remarkable in recovering companies in critical situations. These legal amendments provide a new basis for dealing with insolvency more efficiently and effectively.

That said, the new Insolvency Law establishes bankruptcy systems with the following objectives:

- Facilitate the efficient reallocation of productive resources in distressed companies, particularly those with economic viability but financial difficulties.

These procedures seek to promote debt restructurings that protect creditors’ rights and ensure business continuity.

- Another fundamental aspect of the new Insolvency Law is the provision on the exoneration of debts. When the insolvent debtor is an individual, the bankruptcy proceeding is more flexible. It seeks to identify those debtors in good faith and offer them a partial discharge of their outstanding liabilities.

This aims to provide them with a second chance. Avoiding that they are forced to work in the underground economy or face situations of marginalization.

What strategies can you use to mitigate business insolvency risks?

To manage these risks, control delinquencies and ensure your company’s financial strength, you can implement the following strategies:

1. Assesses the risk of corporate insolvency

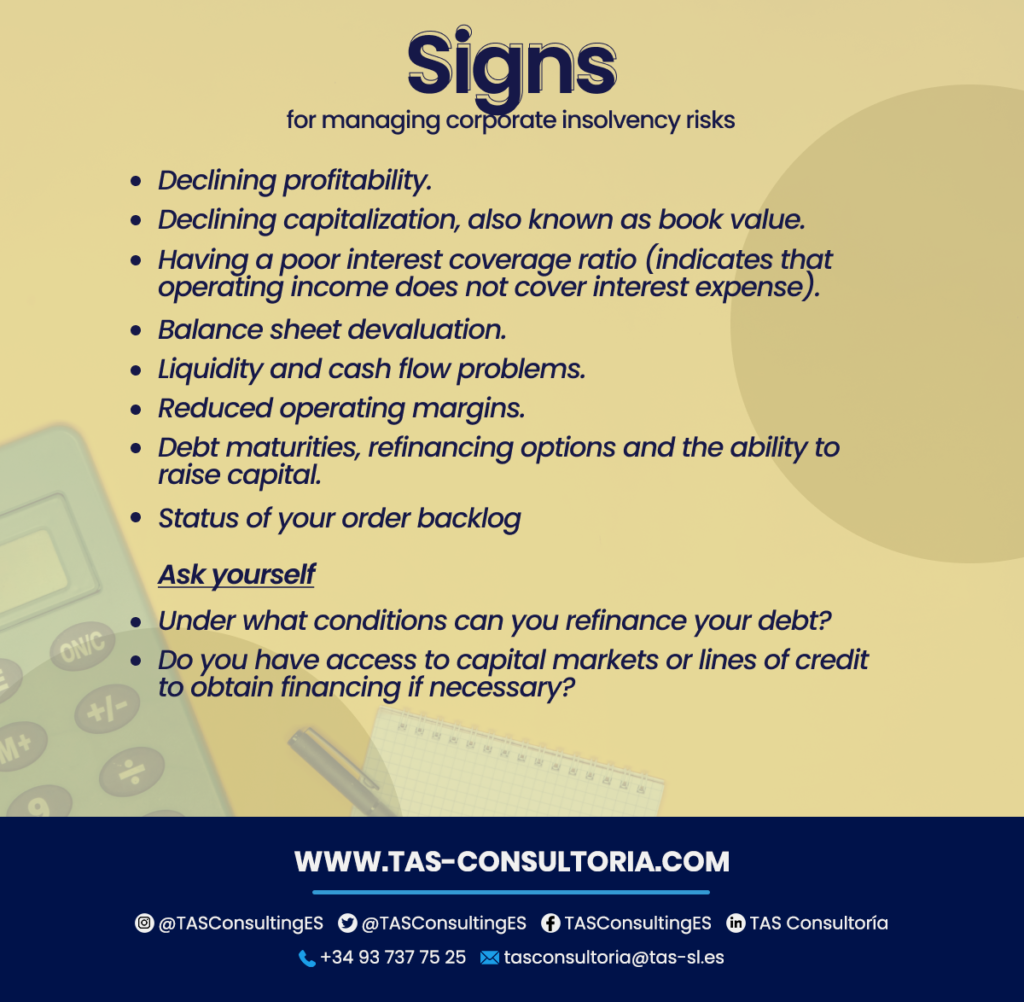

An accurate assessment of your company’s credit risk, as well as that of your customers and suppliers, is the first essential step in guarding against insolvency. Therefore, it is crucial to pay attention to certain warning signs, such as:

2. Ensures good asset management

To ensure effective management of your assets, it is essential to carry out the following actions:

- Verify that assets are properly registered and insured.

- Identifies any assets that are not being used.

- Performs periodic valuations of assets to avoid insolvency. Such as land, facilities and equipment. Keep a constant follow-up of any event that may influence their value.

3. Constantly optimize your stocks and warehouses

- Avoid accumulating stock and keeping overcrowded warehouses.

- Rely on online ordering and delivery systems to maintain a constant supply flow.

Maintain or transition to a digital business model

Take the step towards a digital business model by establishing online infrastructures for your marketing and sales strategies.

You may also be interested in: Keys to carry out a capital increase in your company

How to manage corporate insolvency in your company effectively?

When you are faced with a business insolvency situation, it is essential to know how to act correctly. The idea is to reduce the negative impacts and maximize the chances of recovery. Consider the following guidelines:

Resorts to the procedure established in the Insolvency Law.

This approach provides you with a legal framework to manage your company’s insolvency. By following the insolvency procedure, you will be able to address financial challenges in an organized manner. Especially protect creditors’ rights and work towards a viable solution.

Investing in data analysis and analysts

Data analytics technology is a powerful tool. But it is important to note that it cannot completely replace the need for accounting professionals and specialized advisors.

Accounting experts remain essential to identify and mitigate insolvency risks. This is despite advances in automation and technological solutions for data collection and analysis.

The interpretation of data is a task that requires a deep knowledge of the company and its particularities. This is where accounting and financial professionals are highly qualified to play this role.

In addition, their expertise in forward planning and budgeting is critical to mitigating insolvency risks.

Accounting firms have a holistic view and essential references for meaningful data analysis. Especially in the prevention of insolvency problems.

Attention to the deadlines for filing for insolvency proceedings

The Insolvency Law establishes specific deadlines for filing for insolvency proceedings. Failure to meet these deadlines can have serious legal and financial repercussions. It is crucial to stay informed about these deadlines and act accordingly.

Meticulously plan your business closing

In some cases, insolvency may lead to the need to close the business. However, it is essential that this decision be made in a thoughtful and well-planned manner. Making hasty decisions can lead to legal problems and limit your ability to manage other businesses in the future.

You may also be interested in: What is the new Insolvency Law about?

Now that you know the key strategies, you are better prepared to protect your business from financial threats. However, every business is unique, and a customized approach is critical.

Need help creating an insolvency-proof accounting and financial strategy that fits your business? Our experts are here to help. Don’t hesitate to get in touch at tasconsultoria@tas-sl.es and take the step towards a stronger and more secure financial future.

Your email address will not be published .

Required fields are marked with *