The Anti-Fraud Law has left a significant mark in several respects. Especially under the fight against tax fraud and tax evasion. In that sense, we will explain you why ISD and ITP-AJD are among the taxes most impacted by the Anti-Fraud Law. In addition to how these modifications may affect taxpayers, read the details!

Anti-Fraud Law: Impact in ISD and ITP

In July 2021, the Anti-Fraud Law, also known as the law against Tax Fraud, was passed. This legislation brought modifications to both the Inheritance and Gift Tax (ISD) and the Transfer Tax (ITP).

Until now, the calculation of the taxable base for both rates, ITP and ISD, was based on the consideration of the real value of the assets involved. However, a transcendental change has been introduced thanks to this new law.

As of the year 2022, inheriting or transferring property acquires a more onerous character. That is, an act or contract in which one of the parties obtains an advantage or benefit. Always in exchange for making a performance or giving something of value to the other party.

The Anti-Fraud Law entails a crucial modification. Specifically in the way in which the taxable base is established for ISD and ITP taxes. The primary distinction lies in the difference between what is recognized as real value and value for tax purposes.

Having said this, we will proceed to examine the novelties that this law introduces in the ISD and ITP mechanisms.

You may also be interested in: Types of taxation in Spain: direct and indirect taxes

Modifications in the Inheritance and Gift Tax (ISD) due to the Anti-Fraud Law

Within the ISD, the reform impacts Article 9 of the law which regulates the tax base of the tax. The Anti-Fraud Law introduces the following novelties:

- First, they eliminate the use of the concept of real value, which had been used until now.

- Second, they establish the following guidelines for determining value:

- The assets will be valued based on their market value. This is the most likely price at which they would be sold between independent parties, without any encumbrances.

- The market value will be the ISD taxable base according to the Anti-Fraud Law. Unless the taxpayers declare a higher value.

- In the case of real estate, the value will be calculated according to the regulations of the Real Estate Cadastre. Considering the date on which the ISD is accrued. If there is no reference value fixed by the Cadastre, the taxable base will be the higher amount between the value declared by the interested parties and the market value. Although a tax inspection can be carried out to verify the values.

- The value used to calculate the tax base may be challenged. In such a case, the tax authority will make the decision based on a report from the General Directorate of Cadastre. It will consider the documentation submitted by the parties involved.

All these provisions of the Anti-Fraud Law mean that the Treasury cannot review the value of real estate. Taxpayers have used as reference the value established by the Cadastre or have declared a higher value than this.

Check the summary below:

You may also be interested in: What is the new Insolvency Law about?

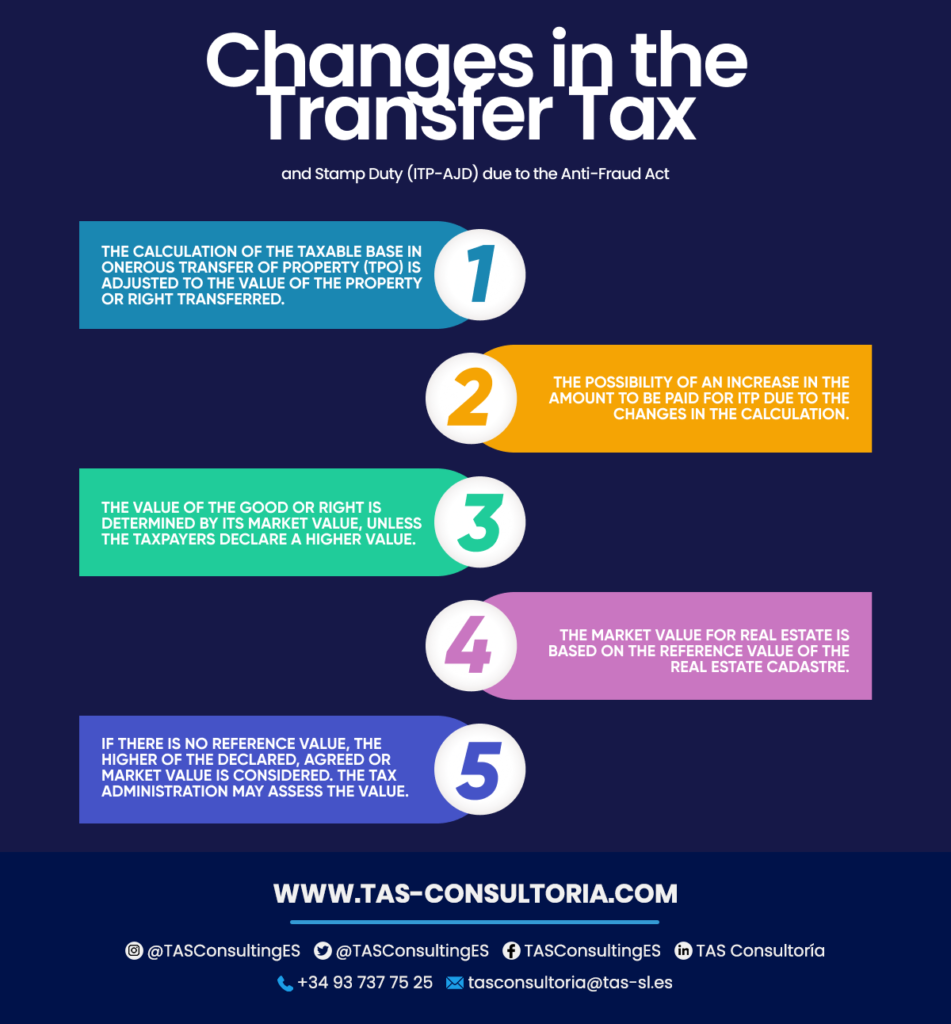

Changes in the Transfer Tax and Stamp Duty (ITP-AJD) due to the Anti-Fraud Law

In the category of Transfer Tax (TPO) within the ITP, there is also an alteration. Likewise in the way of calculating the taxable base of the tax. The taxable base will now correspond to the value of the property, right transferred, constituted or assigned.

These changes introduced by the Anti-Fraud Law may result in an increase in the amount payable for ITP.

The value of the property or right, therefore, will be determined according to its market value. Unless the taxpayers declare a higher value.

In the ITP the market value refers to the most probable price at which an asset could be sold. Or an unencumbered right between independent parties. For real estate properties, the reference value will be used; that is to say, the one established by the Real Estate Cadastre.

If there is no reference value, the higher of the following values will be applied: the value declared by the parties, the agreed price or the market value. In this case, the Tax Administration may carry out an appraisal of the value.

Modifications to the Real Estate Cadastre Law

In line with the above of the Anti-Fraud Law, other regulations have also been reviewed. The one related to the reference value in the Real Estate Cadastre Law. For real estate, the reference value will be calculated based on the prices provided by Notaries in real estate transactions.

The Anti-Fraud Law introduces significant changes in the calculation of the ISD and ITP taxable base. This has a direct impact on the final amount that taxpayers must pay.

Therefore, it is a measure that requires careful analysis in order to be in compliance with current tax regulations. And, at the same time, to avoid possible value assessments by the tax authorities or tax inspections.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

These transformations have a direct impact on taxpayers and their wealth transactions. Make sure you comply with all regulations and take full advantage of the tax benefits available. In view of this, we recommend you seek specialized legal and tax advice.

Our team of experts is here to provide you with the necessary guidance on all tax aspects of your assets. Do not hesitate to contact us at tasconsultoria@tas-sl.es to enjoy a personalized consultancy. Ensure that your tax processes are in order and aligned with the Anti-Fraud Law and other current regulations.

Your email address will not be published .

Required fields are marked with *