Are you wondering which assets with impairment losses you can deduct from corporate income tax in Spain? The tax legislation on deductions is key to optimize your company’s taxation. We will explore the possibilities you have in this area, read on to learn more!

Are there any impairments that are still deductible?

In recent years, a significant change in tax regulations has been observed. Specifically, that related to the deduction of assets with impairment losses in corporate income tax.

The general trend has been the non-deductibility of most of these impairments. However, it is important to note that there are still some exceptions for this corporate tax. We share with you the types of assets:

You may also be interested in: Form 036 and 037: registering with the Tax Authorities

1. Credits

In the event of default on payments, the following occurs: your company will have to reflect in its accounting records the respective impairment of the corresponding receivables.

This impairment loss may be considered tax deductible. Except in specific circumstances, such as related-party transactions or loans backed by guarantees. These types of IS deductible expenses will be valid at year-end under the following conditions:

- That the debtor has been declared bankrupt or is being prosecuted for asset stripping.

- Your company has initiated a legal or arbitration action against the debtor.

- Or, at least six months have elapsed since the maturity date of the loan.

In addition, in the case of small companies, there is the possibility of recording impairment charges of 1%. The Company has the possibility of recording impairment charges of 1% on balances receivable at year-end, even if they have not reached their due date.

It is important to mention that the basis for calculating this 1% is the balance of debtors. Always adjusted by the balances corresponding to debts that meet certain conditions, such as:

- Those that have experienced an individual impairment loss. Due to the passage of more than six months since maturity or because they are debts of companies in insolvency proceedings.

- Those whose impairment is not deductible according to the law. That is, those owed by related parties. Unless they are in bankruptcy liquidation or balances owed or guaranteed by public law entities.

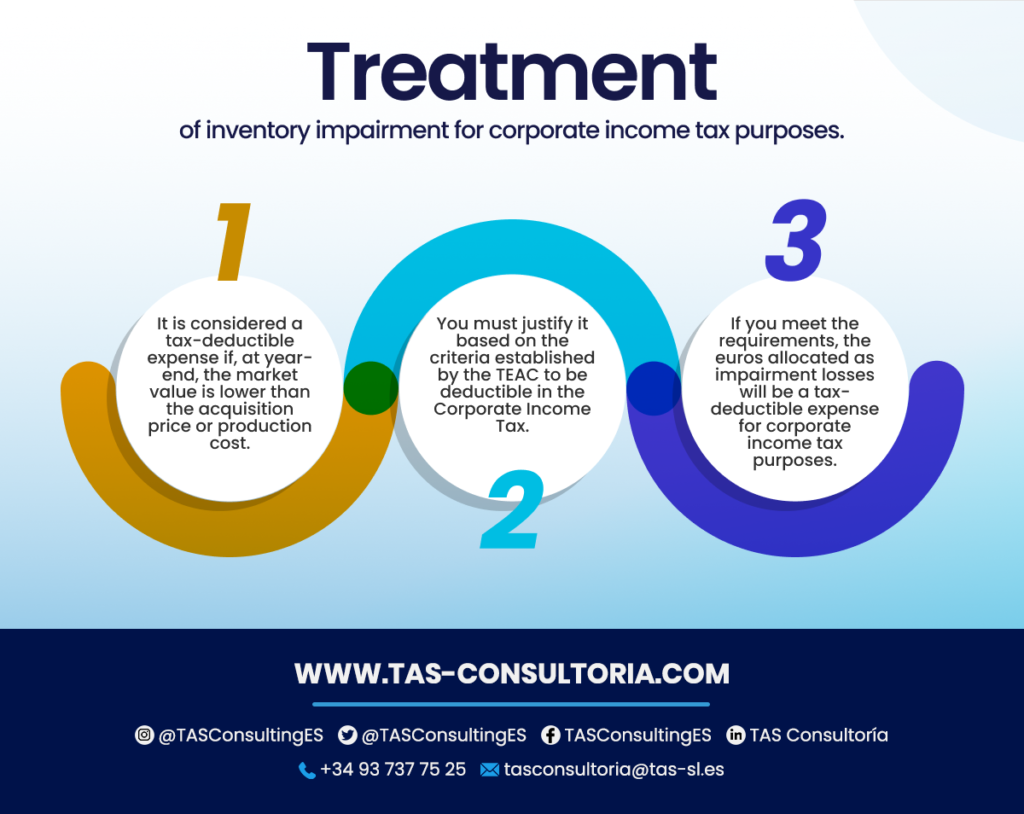

2. Stocks

There is a possibility that there are products in your company’s inventory that have experienced a real impairment loss. That is, a decline in value over the last few years and are not currently being sold.

In this scenario, when performing the inventory valuation, your company can record the following. A detailed description of the expense and its impairment loss. In this way it will be deductible for corporate income tax purposes.

However, it is essential to bear in mind that the calculation of impairment cannot be based on statistical methods. Nor can it be based on the consideration of inventory turnover.

This being the case, the most reliable way to determine the realizable value, if applicable, would be through an expert’s report. Or, in the absence of such a report, the price will be applied at the first sale made after the end of the fiscal year.

Another scenario is that your products have lost so much value that they can no longer be sold, even as a balance. In this case, your company may choose to destroy them. This will allow you to book an impairment loss equal to their book value. This will manifest itself through the difference between the beginning inventory and the ending inventory.

If you opt for this route, you must keep proof and evidence to support the destruction process. Otherwise, there is a risk that the Treasury may interpret this decrease in inventories as undeclared sales. Learn about the treatment of these deductible expenses in the Corporate Income Tax:

3. Trading portfolio

As we have explained in the accounting and tax area, the treatment of impairment of investments varies according to specific conditions.

A scenario that allows deduction due to impairment loss are those that are accounted for under the category of “trading portfolio”. It is relevant to note that this deduction privilege does not apply to the rest of the holdings.

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

What is considered a trading portfolio?

A “trading portfolio” are those participations that do not grant the right to the double taxation exemption for dividends. In other words, they are investments that represent less than 5% of the investee company’s capital. Or that will be held for a period of less than one year.

In the case of participations in non-resident companies, certain additional requirements must be met in order for the loss in value to be considered deductible. It is necessary that the country where the companies are located has a tax similar to the IS. In addition, this tax must have a nominal rate of at least 10%.

It is important to note that a deduction is still allowed for impairment losses on receivables and inventories. We recommend that you verify that your company correctly accounts for these aspects when closing the accounting books at the end of the fiscal year. In this way, you ensure the proper application of accounting and tax regulations.

You may also be interested in: Double taxation in Spain

Need personalized, expert advice on navigating this issue? Make sure you’re taking full advantage of these impairment loss deduction possibilities.

So, don’t hesitate to contact our experts! We are here to provide the guidance you need to optimize your tax burden and ensure a solid financial future. Request your expert advice now and take control of your tax situation!

Your email address will not be published .

Required fields are marked with *