You probably declared and paid VAT on invoices issued to a delinquent customer, if you are self-employed or entrepreneur. Well, surely you didn’t know before about the rectifying invoices as a useful element to recover the VAT. Do you want to regularize your fiscal and accounting situation? Then, this article is for you, because we will tell you how rectifying invoices work and how they help you to recover VAT from invoices issued to delinquent customers. Come on!

What to do with the VAT recovered when a delinquent customer finally pays his invoice?

When a client does not pay his invoices and you must declare and pay the VAT on the invoices issued, it means an economic perjury and lack of liquidity for your business. You advance the tax without collecting the service or product sold, because of this.

In such cases, you need to recover the VAT on the unpaid invoice. But, in order to do so, you need to meet certain requirements established by law, these are:

You may also be interested in: How to obtain a loan in Spain?

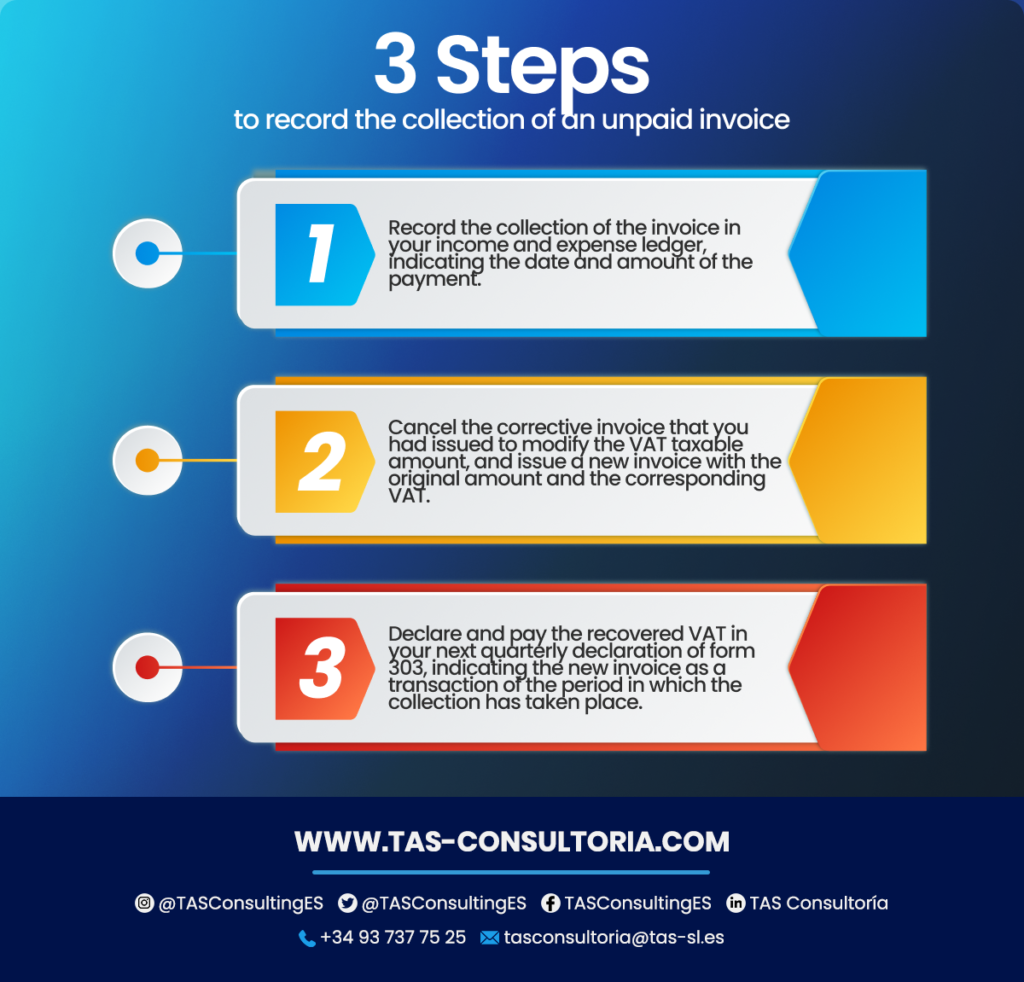

3 steps to account for the collection of an unpaid invoice

If you meet the above requirements and you have recovered the VAT on your unpaid invoices, you must now account for this collection. To do so, you must follow these steps:

By following these steps, you will be able to regularize your tax and accounting situation with respect to VAT on unpaid invoices and invoices subsequently collected. Remember that it is important to keep a rigorous control of your invoices and collections, as well as to comply with the deadlines and legal requirements to avoid penalties or surcharges by the Tax Authorities.

So, what are corrective invoices?

One issues corrective invoices to correct errors or modify data in an original invoice. One uses them when there is some kind of incident or non-conformity with the service or product invoiced. For example: returns, discounts, among others.

Being so, these invoices must comply with the same legal requirements as ordinary invoices. But, in addition, they must clearly indicate that it is a rectifying invoice and make reference to the original invoice that it modifies. In this way, you will avoid confusion and tax control will be easier.

Either the issuer of the original invoice or the receiver can issue corrective invoices, in this sense. Of course, as long as there is an agreement between the parties and they comply with the conditions established by the regulations in force.

One must communicate the rectifying invoices to the Tax Agency, in any case. All within four years from the date of issue of the original invoice.

In addition, these invoices have tax effects for VAT, personal income tax and corporate income tax purposes. Therefore, it is important to keep a proper record of these invoices and reflect them correctly in the corresponding tax returns.

How to make a rectifying invoice?

To issue a rectifying invoice, you must follow the same steps as for issuing a normal invoice, but with some particularities:

- You must clearly indicate that it is a corrected invoice and refer to the original invoice.

- Show the difference between the original invoice amount and the corrected amount, either positive or negative.

- Use a specific serial number for corrective invoices, or add a code that identifies them as such.

This being so, the term to issue a rectifying invoice depends on the reason that originates it. If it is due to a material, arithmetic or factual error, you have a period of four years from the date of issue of the original invoice.

It may also be due to a return of goods or a change in the agreed price. In this case, the term is one year from the date on which the event giving rise to the rectification occurred.

One should note that the amendment invoice has tax effects for both the issuer and the receiver. The issuer must declare the amendment invoice in the VAT form 303 corresponding to the period in which it is issued. But also, it must adjust the amount of the accrued or deductible installments as appropriate.

On the other hand, the receiver must accept the amendment invoice and modify its accounting and tax returns accordingly.

You may also be interested in: How to defer the payment of taxes in Spain?

What are the requirements for an amendment invoice?

A rectifying invoice must meet the same requirements as an ordinary invoice, with some particularities:

- Its condition of rectification and the description of the cause that motivates the rectification must be stated.

- You must identify the data of the rectified invoice(s) (number and date).

- You must indicate the rectification made, either directly indicating the amount of the rectification (positive or negative) or indicating how the taxable base and the tax liability are after the rectification.

In some cases, it will not be necessary to issue a corrective invoice. You will be able to practice the rectification in the invoice that you issue for a later operation and has the same recipient and the same tax rate, instead.

This occurs when the change in the tax base is due to the return of goods or containers and packaging.

When should you notify the tax authorities that you have issued a corrective invoice?

If you have issued a rectifying invoice in Spain, you should know that you have to communicate it to the Tax Authorities. This must be done within a maximum period of one month from the date of issuance of the corrective invoice.

To do this, you must file form 952 VAT, this is the communication of the modification of the taxable base in cases of bankruptcy and uncollectible credit. It indicates the amount and the reason for the rectification.

In addition, you must keep a copy of all your corrective invoices and the originals. This must be done during the tax pre-registration period, which is four years.

You may also be interested in: Collaborative accounting: what is it and what does it consist of?

Do you need a complete tax advice on the treatment of your corrective invoices? Contact our consultancy through tasconsultoria@tas-sl.es and our experts will be pleased to assist you. Write us your problem and schedule a personalized consultancy.

Your email address will not be published .

Required fields are marked with *